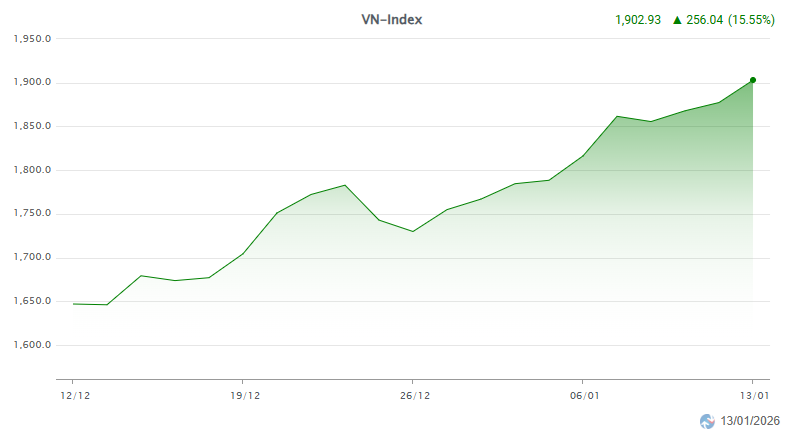

At the close of the session on January 13, 2026, the VN-Index surged by 25.6 points, marking a 1.36% increase to reach a historic high of 1,902.93. This milestone sets a new record in the history of Vietnam’s stock market.

|

VN-Index Continues to Break New Records

Source: VietstockFinance

|

Market liquidity remained robust, with 1.55 billion shares traded at a value exceeding VND 46 trillion. The VN-Index alone accounted for over VND 42 trillion. Amid this activity, foreign investors maintained high trading volumes but recorded a net sell-off of nearly VND 590 billion, ending a four-session buying streak.

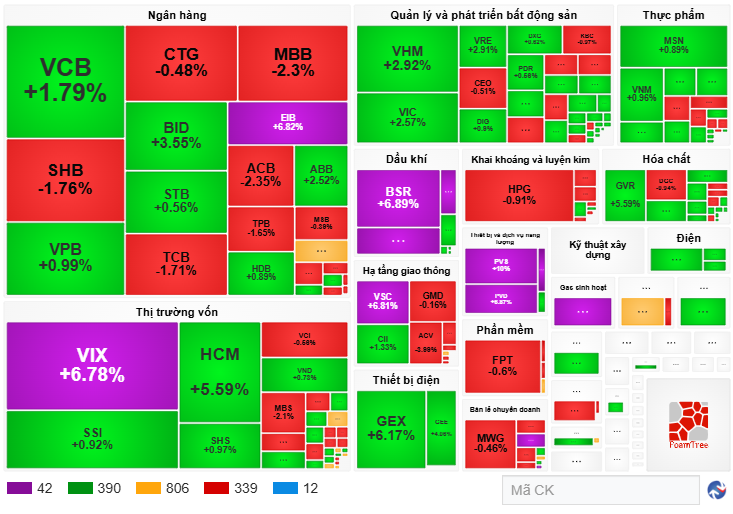

Across the market, 432 stocks gained, including 42 that hit their upper limit, outpacing the 351 declining stocks, of which 12 reached their lower limit. The top contributors to the VN-Index were VIC with 7.08 points, followed by GAS at 3.67 points, VHM at 3.41 points, BID at 2.7 points, and VCB at 2.35 points.

Sector-wise, the energy sector led the rally, with several stocks such as BSR, PLX, PVD, and GAS hitting their upper limits. The momentum extended to other sectors, notably large-cap industries like real estate (VIC, VHM, VRE, KDH…) and securities (VIX, HCM…), while the banking sector showed mixed performance.

|

Market Map for the Session on January 13, 2026

Source: VietstockFinance

|

Following a series of remarkable breakthroughs in 2025, Vietnam’s stock market swiftly achieved two more record highs in the early days of 2026. Just a week prior, on January 6, 2026, the VN-Index surpassed the 1,800 mark after a session gain of nearly 28 points.

The 2026 stock market is widely anticipated to perform positively, supported by forecasts of economic growth, improving corporate earnings, and long-term developments such as market upgrades, new product launches, and trading infrastructure enhancements. With these factors in play, the VN-Index is well-positioned to target even higher milestones.

– 15:45 13/01/2026

Vietstock Daily 14/01/2026: Breaking the 1,900-Point Barrier

The VN-Index surged decisively past the 1,900-point milestone, setting a new record high as trading volume remained above its 20-day average. Short-term momentum is further bolstered by the index closely tracking the Upper Band of the Bollinger Bands, while the MACD continues to widen its gap from the Signal line. However, caution is warranted as the Stochastic Oscillator shows signs of weakness in overbought territory, suggesting potential technical pullbacks in upcoming sessions.

2026 Capital Challenge: Achieving 15% Growth on High Debt Levels Without Capital Shortages for Businesses

Looking ahead to 2026, Ms. Nguyễn Thúy Hạnh, CEO of Standard Chartered Bank Vietnam, believes that a 15% credit growth rate, built upon the substantial outstanding loans of 2025, will be more than sufficient to support the economy. She emphasizes that this year’s strategy focuses on steady disbursement, prioritizing capital for production and real estate projects that meet genuine demand, thereby effectively managing bad debt risks.