On January 9, 2026, VNX approved Xuan Thien Securities JSC as a listed securities trading member. As a result, the company must comply with securities laws, stock market regulations, and VNX’s charter. This milestone marks a significant step forward for the company following substantial leadership changes, including a rebranding effort.

Formerly known as Golden Lotus Securities (GLS), the company’s name change was approved during the Annual General Meeting on June 27, 2025. This move was intended to leverage and inherit the brand value and internal strengths of the Xuan Thien Group. The meeting also highlighted ambitious plans to increase capital to 20,000 billion VND and aim for a top-3 market position in the future.

In terms of capital implementation, on November 7, 2025, Xuan Thien Securities announced the completion of a 135 million share offering to existing shareholders, with a notable contribution from Xuan Thien Group.

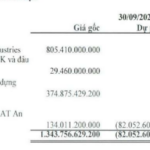

As a result, the company’s chartered capital increased to 1,485 billion VND, with 66 shareholders—a gain of 10 shareholders compared to pre-offering levels. Among them, four major shareholders include Mr. Nguyen Van Thien (24.6% ownership), Mr. Nguyen Tan Dung (20%), Ms. Thai Kieu Huong (9.9%), and XT Global Capital (6.7%). Additionally, eight shareholders hold more than 4% each.

Most notably, Mr. Nguyen Van Thien, a discreet tycoon from Ninh Binh, emerged as a key figure. He is widely recognized as the Chairman of Xuan Thien Group, a diversified conglomerate operating in energy, materials, and agriculture.

Mr. Nguyen Van Thien is the son of Mr. Nguyen Xuan Thanh, founder of Xuan Thanh Group (Ninh Binh), and the brother of Mr. Nguyen Duc Thuy, who recently transitioned from Chairman of LPBank’s Board of Directors to Acting CEO of Sacombank.

Mr. Nguyen Van Thien

|

In addition to the existing shareholder offering, the company previously approved a plan to issue 151.5 million private placement shares to raise 1,515 billion VND, but this has been temporarily suspended.

In 2025, Xuan Thien Securities set a revenue target of 179 billion VND and an after-tax profit of 70 billion VND, representing a 13-fold and 199-fold increase compared to 2024 results. The company anticipates commencing operations in Q4/2025, contingent on legal procedures for exchange connectivity and capital increases.

In Q3/2025, the company’s first quarter under its new name, it reported a net loss of over 4.1 billion VND, with a nine-month cumulative loss of nearly 3.6 billion VND.

– 10:45 AM, January 12, 2026

Historic Highs: Chuong Duong Plans to Issue Nearly 53 Million Shares at Half Market Price

Revised Introduction:

Chuong Duong JSC (HOSE: CDC) is set to launch its second public offering of shares to existing shareholders within just one year, amid its stock price reaching its highest level since listing.

SHB: Capital Increase Strategy and Foreign Investment Signals Set Stage for Major Capital Inflow

In 2026, bank stocks may witness significant divergence rather than a uniform industry-wide rally. Shares that combine strong fundamentals with compelling narratives—such as capital raises or foreign investment inflows—will likely attract prioritized capital allocation.