By 2025, TVAM had established itself as a leading asset management firm, achieving an impressive profit margin of 17-20% across its funds, even without holding high-growth stocks. Looking ahead to 2026, Chief Investment Officer Nguyen Duy Quang forecasts steady, widespread, and high-quality market growth.

Chief Investment Officer of TVAM – Mr. Nguyen Duy Quang

|

Mr. Quang highlights that the primary drivers for the stock market will be the government’s commitment to achieving a 10% GDP growth target and the potential market upgrade, which will attract foreign investment. Additionally, robust credit growth and low-interest rates will support business operations. Public investment is also expected to reach a record high, with allocations of approximately 320 billion USD for 2026-2030, 2.5 times higher than the 2021-2025 period.

Furthermore, the real estate market is anticipated to recover, creating a ripple effect across related industries. Lastly, foreign investors’ net selling pressure, which peaked at 130 trillion VND in 2025, is expected to significantly ease.

As of December 16, 2025, the market was trading at a trailing P/E ratio of 15.7. Excluding the atypically high-valued Vingroup, this ratio drops to 12.6, notably lower than the 14.5 average of the past five years.

“This is particularly significant given the current macroeconomic conditions, which are far more favorable than those of the previous five years,” Mr. Quang notes.

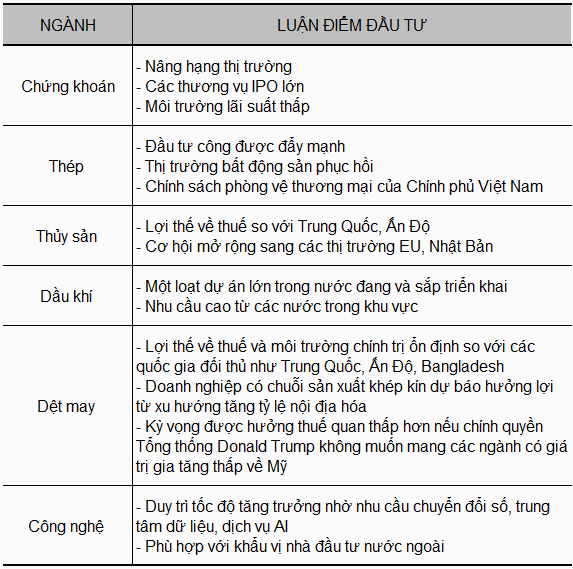

Which sectors are most attractive?

While optimistic about the overall outlook, TVAM’s Chief Investment Officer advises investors against chasing stocks in sectors that have already seen substantial growth over the past two years. Instead, focus should be on sectors with strong growth prospects and reasonable valuations, or those facing short-term challenges but poised for near-term recovery.

Most of Mr. Quang’s recommendations are in sectors that underperformed in 2025, such as energy, technology, and export-oriented industries like textiles and seafood.

|

Recommendations from TVAM’s Chief Investment Officer

Source: Compiled from TVAM representative interviews

|

However, investing is not without risks. According to Mr. Quang, interest rate and exchange rate volatility will be the most significant challenges for the stock market over the next two years. “These factors will directly impact corporate profits, the real estate market, and investment flows,” he explains.

To balance portfolio protection and opportunity, Mr. Quang suggests a strategic asset allocation: “I recommend allocating 60% to equities to capitalize on market upgrades and high GDP growth, 30% to real estate for value preservation, and 10% to cash deposits for liquidity and financial security.”

He adds that, due to concerns about currency depreciation and inflation, investors will continue to channel funds into real estate, particularly in areas with significant infrastructure development.

Shifting investment mindsets

A notable development this year is the Ministry of Finance’s approval of a plan to restructure investors and develop the securities investment fund industry, aimed at enhancing domestic investor participation. However, a significant challenge remains: individual investors’ preference for self-trading, despite limited knowledge and experience.

According to TVAM’s Chief Investment Officer, traditional financial habits, shaped over generations, still heavily influence Vietnamese investment behavior. This has prevented the personal asset management market from growing in line with the substantial increase in asset accumulation over the past decade.

TVAM’s 2025 survey on “The State and Needs of Vietnamese Personal Asset Management” reveals that while 88% of investors expect returns above 7% annually, and 42% aim for 15-30%, the average portfolio remains heavily concentrated in traditional assets like real estate (31%) and gold (14%), with only 7% allocated to stocks. Just 4% of investors have used professional asset management services, while 77% admit to struggling with self-investment.

This highlights a growing gap between investors’ profit expectations and their ability to manage risks effectively. In this context, Mr. Quang views the regulatory focus on sustainable, long-term market development as a positive step.

Over the next 5-10 years, investment behavior is expected to shift as younger generations begin managing assets accumulated by their predecessors.

“For this transition to be sustainable, investment thinking must evolve from individual decision-making to a disciplined, long-term approach supported by professional management. Asset management should not just be about seeking returns but about balancing growth and risk control at every stage,” Mr. Quang concludes.

– 10:00 14/01/2026

New Economic Growth Cycle Emerges as Capital Flows Shift Westward in the Capital

As Vietnam’s economy embarks on a new growth cycle, the real estate market is undergoing a transformative shift towards more selective and sustainable development. Capital is moving away from short-lived speculative trends, gravitating instead toward areas characterized by long-term planning, tangible infrastructure, and significant growth potential.

Banking Leaders and Economic Experts Convene at FChoice 2025

This morning, January 13th, Hanoi hosted the prestigious FChoice 2025 Awards Ceremony and the insightful seminar titled “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026.” The event brought together leading economic experts and prominent business representatives, fostering a dynamic exchange of ideas and strategies for the future.

Vietnam’s Economic Landscape in 2025 and Forecasts for 2026

With a strong foundation established in 2025, Vietnam’s economy is poised for a breakthrough in 2026. According to Dr. Can Van Luc and the BIDV Economic Research Institute, the collective determination of the political system, coupled with institutional reforms and an improved investment climate, will rejuvenate growth drivers and enhance their effectiveness. These factors collectively set the stage for Vietnam’s economy to surge ahead in the coming year.

FChoice Awards 2025: Celebrating Vietnam’s Pioneering Achievements in the Era of Ascendancy

Unveiling a fresh new look, FChoice 2025, hosted by CafeF, continues to solidify its position, celebrating the achievements of the economy. The event on the morning of January 13th is not merely a ceremonial awards ceremony but a strategic nexus where experts and businesses reshape the macroeconomic landscape for the upcoming phase of explosive growth.