Decree No. 306/2025/NĐ-CP amends and supplements several articles of Decree No. 156/2020/NĐ-CP dated December 31, 2020, issued by the Government, which regulates administrative penalties in the field of securities and the securities market (as amended and supplemented by Decree No. 128/2021/NĐ-CP dated December 30, 2021). It also amends Decree No. 158/2020/NĐ-CP dated December 31, 2020, regarding derivative securities and the derivative securities market (Decree No. 306/2025/NĐ-CP).

Decree No. 306/2025/NĐ-CP will take effect from January 9, 2026. It includes amendments and supplements to several violations related to the operations of securities companies.

Addition of Multiple Violations

Decree No. 306/2025/NĐ-CP amends and supplements several clauses of Article 26 of Decree No. 156/2020/NĐ-CP, which addresses violations of regulations on the operations of securities companies and foreign securities company branches in Vietnam.

A new violation has been added for failing to establish a dedicated department responsible for customer communication and resolving customer inquiries and complaints, with a fine ranging from VND 50 to 70 million.

Another violation has been added for non-compliance with regulations on the safe investment ratio of securities companies, investment capital sources, and investment instruments when making indirect overseas investments, with a fine ranging from VND 70 to 100 million.

A violation has been added for non-compliance with regulations on determining the qualifications of professional securities investors participating in offerings and issuances, and for failing to retain documentation verifying the qualifications of professional securities investors as required by law, with a fine ranging from VND 70 to 100 million.

The violation related to the obligation to monitor transactions has been moved from clause 2(g) to clause 5b of Article 26, with the fine increased from VND 70-100 million to VND 300-400 million. This aims to enhance the responsibility of securities companies in monitoring customer transactions, in line with the obligations outlined in clauses 6 and 7 of Article 23 of Circular 95/2020/TT-BTC, which guides the monitoring of securities transactions on the securities market.

Amendments and Increased Fines for Various Violations

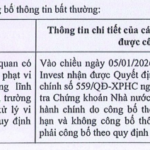

Decree No. 306/2025/NĐ-CP amends and supplements the description of violations, increasing the fine from VND 70-100 million to VND 300-400 million for securities companies that fail to monitor securities transactions as required, fail to report detected violations of securities laws, or fail to prepare and submit abnormal reports or reports requested by the State Securities Commission, the Vietnam Stock Exchange, and subsidiary companies related to securities transactions.

The decree amends and supplements clause 4 of Article 26 regarding margin trading violations, as follows:

The act of “securities eligible for margin trading” under point a has been removed as it overlaps with the act specified in point c of clause 4 (violations related to margin trading restrictions). According to clause 2 of Article 10 of the Regulation Guiding Margin Trading of Securities, issued under Decision No. 87/QĐ-UBCK, margin trading restrictions include cases related to securities eligible for margin trading.

The fine brackets under points a, b, and c of clause 4 have been increased to enhance deterrence. The act under point d has been moved to point c to ensure consistency in fines due to the similar nature of the violations.

Clause 5 of Article 26 has been amended and supplemented as follows: A new act has been added for failing to establish a segregated customer money management system where customers of the securities company directly open accounts at a commercial bank chosen by the securities company to manage securities trading funds. This aligns with the obligations of securities companies under clause 4 of Article 17 of Circular No. 121/2020/TT-BTC.

The phrase “foreign securities company branches in Vietnam” has been removed, as clause 7 of Article 86 of the 2019 Securities Law only mandates the separate management of customer assets and the separation of customer assets from the securities company’s assets.

A new clause 5a has been added after clause 5 of Article 26 to address violations of the obligation to review and verify information in the offering and issuance dossiers of consulting organizations involved in securities offerings and issuances, as per clause 4 of Article 1 of Law No. 56/2024/QH15 (which adds Article 11a to the 2019 Securities Law).

Decree No. 306/2025/NĐ-CP amends and supplements clause 7 of Article 26 regarding additional penalties, as follows:

A new penalty has been added for suspending the provision of margin lending services to customers for violations related to margin trading under point c of clause 4.

Additional penalties have been introduced for violations under clause 6, including a suspension of brokerage services for 1 to 3 months for acts involving the misuse of customer assets, as specified in clause 6 of Article 26.

The penalty of “revoking the securities practice certificate for 1 to 3 months for securities practitioners” under point b of clause 7 has been removed, as Article 26 pertains to penalties for securities company operations (organizations) and does not apply to individuals.

Clause 8 of Article 26 has been amended to include remedial measures corresponding to the act of failing to establish a segregated customer money management system at the securities company, as added under point a of clause 5.

Amendments to Violations of Securities Trading Regulations

Decree No. 306/2025/NĐ-CP amends and supplements Articles 33, 34, and 35 of Decree No. 156/2020/NĐ-CP, which address violations of securities trading regulations.

Article 32 has been amended and supplemented as follows: The fines for violations related to the management of employees and securities practitioners under clauses 1, 2, 4, and 5 of Article 32 have been increased. A new point c has been added after point b of clause 2 to address violations of the obligation to supervise securities practitioners by securities trading organizations.

Point b of clause 7 has been amended to remove the suspension of securities practice certificates for acts under point a of clause 6, as these acts are prohibited under Article 12 of the Securities Law and, according to point b of clause 3 of Article 97 of the Securities Law, will result in the revocation and non-reissuance of the securities practice certificate.

Article 33 has been amended and supplemented as follows: The violations under clauses 1, 2, 3, 4, 5, and 6 have been rearranged in ascending order of fines. The additional penalties under clause 7 have been amended to increase the suspension period for securities trading activities from 1-3 months and 3-5 months to 6-12 months and 18-24 months, respectively, for insider trading violations involving large transaction values, to enhance deterrence and prevent violations.

Article 34 has been amended and supplemented as follows: Clause 1 of Article 34 has been amended to increase the suspension period for securities trading activities from 6-12 months to 18-24 months for violations involving lending securities accounts to others or holding securities on behalf of others, leading to market manipulation.

Point b of clause 2 of Article 34 has been amended to include violations of the obligations of foreign-invested economic organizations as specified in Article 143 of Decree No. 155/2020/NĐ-CP.

Seven Individuals Penalized for Manipulating SJS Stock

During the period from April 10, 2023, to January 10, 2024, two individuals exploited 26 securities accounts to manipulate SJS stocks. Additionally, five individuals lent their accounts, contributing to market manipulation activities.

Two Individuals Manipulate SJS Stock Using 26 Accounts, Driving Prices Up 60% Without Illegal Profits

Two individuals manipulating SJS stock prices have been fined VND 1.5 billion each, banned from securities trading, and prohibited from holding positions at securities companies, investment fund management companies, branches of foreign securities and fund management companies in Vietnam, and securities investment companies for two years starting January 10, 2026.

Where Can People Exchange USD Safely to Avoid Severe Penalties?

Authorized currency exchange agents are clearly identified with signage. Individuals should refrain from engaging in unauthorized foreign currency transactions, as these activities violate legal regulations and carry significant risks.