Identifying Factors Driving Inflationary Pressure

Speaking at the First Annual Forum on Market and Price Developments in Vietnam, held on January 12th in Hanoi, Dr. Nguyen Duc Do, Deputy Director of the Institute of Economics and Finance (Ministry of Finance), stated that the Consumer Price Index (CPI) in December 2025 increased by 3.48% compared to the same period in 2024, with an average monthly increase of 0.29%.

Overall, in 2025, the CPI rose by 3.31%, higher than the average of 3.09% during the 2016-2025 period. This marks the 11th consecutive year that Vietnam has successfully kept inflation below 4%, indicating a relatively stable price level over the past decade.

Dr. Nguyen Duc Do further analyzed that in 2025, inflationary pressure primarily stemmed from high credit growth, reaching 17.65%, along with a 3.92% increase in the exchange rate. Additionally, the recovery in domestic consumption has led to greater CPI pressure compared to previous years.

Beyond monetary factors and consumer demand, adjustments in the prices of certain public services also contributed to the CPI increase. According to calculations by the Statistics Bureau (Ministry of Finance), the 13.07% rise in the medicine and healthcare services group accounted for approximately 0.61 percentage points of the overall CPI increase in 2025.

However, compared to the average CPI of 3.63% in 2024, the CPI growth rate in 2025 was lower. Excluding the impact of medicine and healthcare services prices, inflationary pressure is considered not overly significant.

One crucial reason is that the prices of many basic commodities in the global market, such as crude oil, steel, and rice, have shown a downward trend, partially offsetting the CPI increase caused by the exchange rate. Moreover, the effects of credit and exchange rates typically have a certain lag.

Dr. Nguyen Duc Do also noted that a substantial portion of credit growth in 2025 flowed into the asset market, particularly real estate. This resulted in high credit growth primarily affecting asset prices, while its direct impact on the CPI was not substantial.

Inflation Forecast for 2026 and the Need for Cautious Management

Moving into 2026, Dr. Nguyen Duc Do predicts that inflationary pressure will continue to arise from the delayed effects of credit growth. However, given that the credit growth in 2025 was not excessively high compared to the past decade, its impact on inflation is expected to be moderate, especially as capital continues to flow into the asset market.

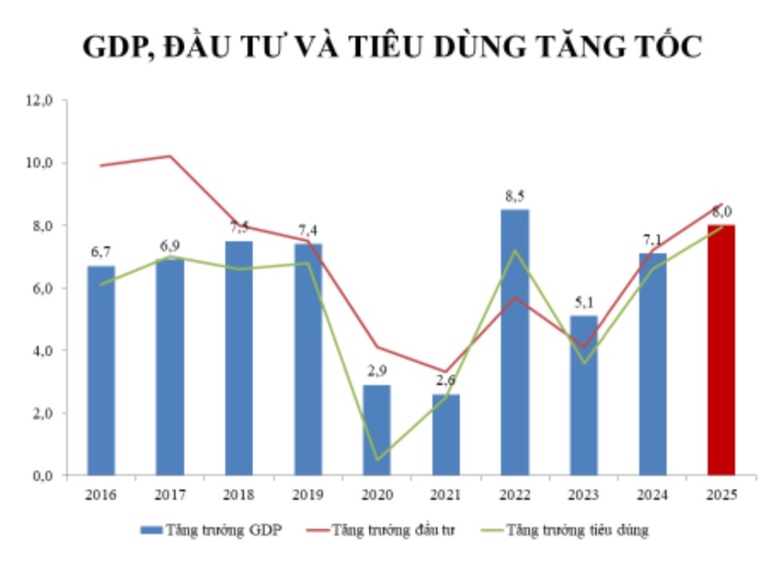

Nevertheless, the 10% GDP growth target for 2026 will exert additional pressure on prices, as high economic growth implies a significant increase in aggregate demand, including investment and consumption.

Furthermore, the exchange rate is forecasted to continue influencing the CPI in 2026. In addition to the carry-over effect from the previous year, exchange rate pressure in the coming year will stem from increased investment and consumption, leading to higher imports. Meanwhile, export growth in 2026 may face challenges due to slow global economic growth.

Conversely, inflationary pressure from global commodity prices is not expected to be significant. With low global growth prospects, commodity prices are unlikely to rise sharply in 2026, although the potential for deep declines, as seen in 2025, is limited.

In 2025, interest rates showed a slight upward trend due to higher credit growth compared to deposit growth. This trend is projected to continue in 2026 and will contribute to curbing inflation.

Considering these factors, Dr. Nguyen Duc Do forecasts that inflationary pressure in 2026 will be higher than in 2025 but not by much. Monthly CPI may increase by around 0.3%, with average annual inflation hovering around 3.5%.

Nonetheless, the expert emphasizes that caution is necessary, as inflationary pressure from monetary factors could accumulate if high credit growth is sustained over an extended period.

Effective Coordination Between Fiscal and Monetary Policies is Essential

To achieve high GDP growth while maintaining inflation below 4-4.5%, Dr. Nguyen Duc Do believes that effective coordination and division of responsibilities between fiscal and monetary policies are crucial.

Given that the credit-to-GDP ratio in 2025 was relatively high compared to many countries at a similar development level, monetary policy should prioritize macroeconomic stability, inflation control, exchange rate and interest rate stability, non-performing loan management, and ensuring the safety of credit institutions.

Meanwhile, fiscal policy still has room to support growth but needs to accelerate public investment disbursement. Although the public debt-to-GDP ratio is currently low, at around 34% and well below the 60% ceiling, annual debt repayment obligations should be kept under 25% of budget revenue to ensure fiscal safety, especially in a rising interest rate environment.

In the long term, Dr. Nguyen Duc Do asserts that high growth cannot rely on expanding money supply and credit but must be based on increased labor productivity linked to technological advancements.

Dr. Vo Tri Thanh: High Savings Rate, Yet Challenges Remain in Effective Investment Conversion

Dr. Vo Tri Thanh emphasizes that to sustain Vietnam’s development trajectory, especially with long-term goals set for 2030–2045, fostering trust, strengthening institutional frameworks, and creating a conducive business investment environment are paramount.

Seven Mega Projects by Vingroup with a Combined Investment of Over 2 Quadrillion VND

From megacities and railways to power, steel, and beyond, Vingroup’s deployment portfolio spans multiple economic sectors. A common thread unites these ventures: capital investments measured in hundreds of trillions of VND, driving infrastructure development, job creation, and visitor influx. This momentum fuels regional growth and fuels Vingroup’s ambition to shape new iconic landmarks.