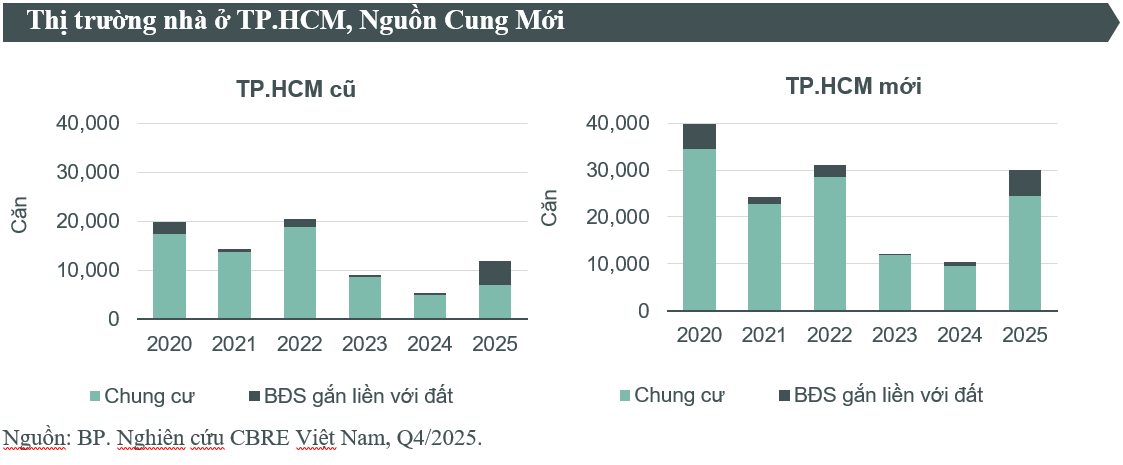

According to the Q4/2025 Ho Chi Minh City Real Estate Market Spotlight by CBRE Vietnam, the former HCMC area recorded over 12,000 residential units launched in 2025, including apartments and low-rise houses. Notably, low-rise housing saw a record supply growth.

When considering the expanded HCMC area post-merger, the total supply significantly improved, thanks to the former Binh Duong region, which contributed over 17,300 new units, dominating the 2025 supply. This highlights the growing importance of expanded regions in meeting market demand, as the core area faces land scarcity, rising prices, and legal challenges.

Commenting on HCMC’s housing market, Ms. Duong Thuy Dung, Senior Director of CBRE Vietnam, stated: “The merger of provinces and cities, coupled with synchronized investment in key infrastructure, is a major driver for the real estate market, especially as the city’s land resources become increasingly scarce.

Additionally, new supply is showing signs of recovery, despite unresolved legal issues. The government’s efforts demonstrate its priority for this sector.

A prime example is the plan to digitize real estate transactions, with asset identification expected to roll out in March 2026. This will be a crucial step toward a more transparent market, reducing risks and fostering sustainable growth, rather than short-term speculation.”

Record Growth in Low-Rise Housing Supply

In Q4/2025, the low-rise housing market in the former HCMC area saw a record supply of approximately 4,500 units, bringing the annual total to nearly 5,000. This figure is 20 times higher than in 2024, marking the strongest growth ever in this segment. The Can Gio mega-urban project, spanning 2,870 hectares, was the primary contributor, offering 64,000 landed and apartment units.

With strong housing demand, new project sales averaged 70% across quarters. Primary market prices fell 25% quarter-on-quarter and 28% year-on-year, influenced by the new supply in Can Gio.

The Can Gio mega-urban project significantly boosts low-rise housing supply in HCMC.

Looking ahead, low-rise housing supply in HCMC is expected to improve with new urban projects in the East and South. In 2026, new supply is projected at 5,500 units, gradually increasing to over 15,000 by 2028. Major developers like Vingroup, Masterise, and GS E&C will drive this growth through large-scale projects.

Ho Chi Minh City Real Estate Sets a New Record

According to CBRE Vietnam, the low-rise housing market in the former Ho Chi Minh City area recorded a historic supply in Q4/2025, with approximately 4,500 units launched, bringing the total annual supply to nearly 5,000 units. This figure is 20 times higher than in 2024, marking the most significant surge ever witnessed in this region.

Unlocking Real Estate Identity: Three Critical Equations to Solve

According to experts, data synchronization, file digitization, and civil servant accountability are the three critical challenges that must be addressed to effectively establish property identification.

Secure Shophouse Investment Solutions in a Recovering Market

As of early 2025, the real estate market has shown clear signs of recovery, marked by improved liquidity, more positive investor sentiment, and capital flowing back into segments with genuine utility value. Among these, shophouses remain a lucrative investment channel, provided they are developed in the right location, at the right scale, and aligned with market demand.

Why Do Successful Individuals Favor Owning Centrally Located Homes?

Once financial stability is achieved and relationships are refined, the successful individual seeks a residence that offers both the conveniences of urban living and the privacy and warmth of a family home in the heart of the city.