The Board of Directors of Intresco Joint Stock Company (Intresco, HOSE: ITC) has approved the acquisition of 10 million shares, valued at 100 billion VND, to secure a 90.58% stake in Nam Asia Housing Trading Joint Stock Company. This move will make Nam Asia Housing the fourth subsidiary of Intresco.

|

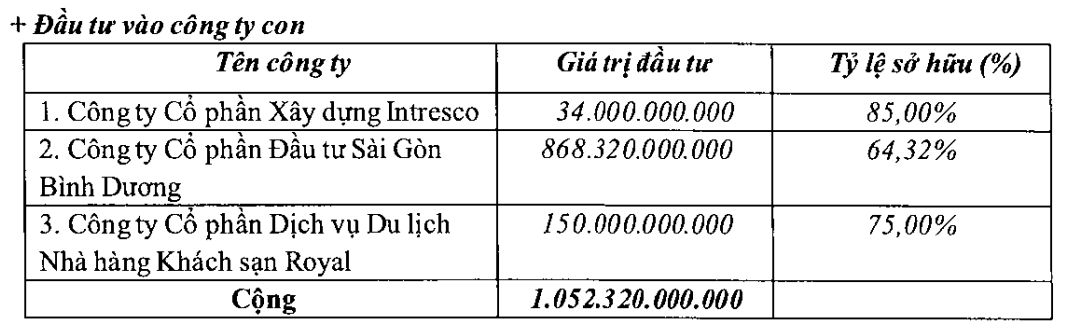

ITC’s Subsidiaries as of Q3/2025

Source: ITC

|

Established in January 2019, Nam Asia Housing is headquartered in Ba Ria Ward (Ho Chi Minh City) and primarily operates in the real estate sector. With an initial charter capital of 50 billion VND, its founding shareholders include Nam Asia Investment Joint Stock Company (90%), Ms. To Thi Minh Nhan (8%), and Ms. To Thi Minh Nghia (2%). Mr. Pham Ngoc Hai, Chairman of the Board, serves as the legal representative. In November 2021, the company increased its capital to over 110 billion VND, maintaining the same shareholder structure.

Mr. Pham Ngoc Hai also acts as the legal representative for Nam Asia Investment Joint Stock Company and several other entities, including Quoc Huong Tourism Investment Joint Stock Company, Dai Thanh Seafood Joint Stock Company, and Dong Hai Tourism Service and Trading Joint Stock Company.

Nam Asia Housing is the developer of the Phuoc Hoi Sea Pearl Apartment project in Dat Do District (formerly part of Ba Ria Vung Tau), with a total investment of 410 billion VND.

Intresco, originally a state-owned enterprise under Saigon Real Estate Corporation, was equitized on February 18, 2000. It began operating as a joint stock company in January 2001. By October 2009, the company was listed on HOSE under the stock code ITC, focusing on real estate operations.

Intresco’s notable projects in Ho Chi Minh City include Terra Royal (approximately 6,600 m² on Nam Ky Khoi Nghia Street), The Star Village (55.4 hectares), An Khang Tower (nearly 1 hectare within the An Phu – An Khanh urban area), An Cu Apartment, and Thinh Vuong Tower.

In the first nine months of 2025, Intresco reported net revenue of over 543 billion VND, a 34% increase year-on-year, with net profit exceeding 46 billion VND, doubling the previous year’s figure. Against its annual targets of 641 billion VND in revenue and 36 billion VND in net profit, ITC achieved 90% of its revenue goal and significantly surpassed its profit target after nine months.

| ITC’s Business Results from 2019 to 9M/2025 |

– 15:27 14/01/2026

SGI Capital: 2026 Market Kicks Off with Frenetic Pace, Fueled by Speculative Sentiment

According to SGI Capital, historical data over the past 20 years reveals a recurring pattern: following periods of robust economic growth fueled by high credit expansion, the stock market typically experiences a stellar year with gains exceeding 30%. This is often followed by rising interest rates, which subsequently lead to a credit slowdown, causing the economy to decelerate and the market to enter a corrective phase. “All these indicators are aligning in 2025,” the fund observes.

Unlocking Double-Digit Economic Growth: Key Insights and Investment Opportunities for 2026

At the prestigious FChoice 2025 Awards Ceremony and the insightful seminar titled “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026,” hosted by CafeF, esteemed experts and business leaders shared a wealth of compelling insights.