In recent years, alongside the surge in real estate prices, the trend of renting homes instead of buying, particularly among young urban professionals, has become increasingly prominent. However, according to Dr. Nguyen Van Dinh, Chairman of the Vietnam Association of Realtors (VARS), the desire to own a home remains deeply ingrained in Vietnamese culture. “A home is not just a place to live; it represents security and stability for the future.”

He argues that while renting is often seen as a less stressful option compared to buying, it is only truly cost-effective under specific conditions and may not suit everyone.

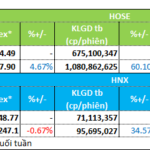

Data from the Vietnam Institute of Real Estate Market Research (VARS IRE) reveals that over the past three years, the relationship between home prices and rental rates in major cities has become increasingly mismatched.

Specifically, primary apartment prices in Hanoi, Ho Chi Minh City (old), and Da Nang have risen by an average of 35–40% annually. With most new projects falling into the luxury and high-end segments, secondary market prices have been significantly inflated. In some areas, property values have doubled in just two years.

Meanwhile, rental prices, though also rising due to high demand, have increased at a much slower pace. Average apartment rental rates have only grown by about 10–15% annually, and by 2025, this increase will be roughly one-third of the growth in home prices.

This disparity offers a relative advantage to renters, as monthly housing costs do not skyrocket in line with home prices. However, this advantage is most meaningful for those without a strong financial foundation.

According to the VARS Chairman, renting is most suitable for individuals with low to moderate incomes, limited savings, and insufficient equity to secure a mortgage. Given Vietnam’s floating interest rates on home loans, leveraging large amounts of debt can place a significant burden on household finances.

“For those without a solid financial base, renting provides flexibility, reduces risk, and helps avoid long-term debt when income is unstable,” Dr. Nguyen Van Dinh explains.

Conversely, for those with higher incomes and substantial savings, the picture is quite different. Current lending rates are relatively low, and developers often offer supportive policies such as interest rate discounts, principal grace periods, or capped interest rates during the initial phase. This narrows the gap between monthly mortgage payments and rental costs.

With home prices in major cities showing little sign of decline, delaying a purchase could expose buyers to even higher prices in the future.

Additionally, Vietnam’s rental market still lacks robust legal protections for tenants in the long term, including lease duration and price adjustment mechanisms. Therefore, VARS emphasizes that renting remains a flexible short- to medium-term solution rather than a sustainable housing option.

Dr. Nguyen Van Dinh stresses that renting can only become a truly affordable and sustainable choice with strong government involvement in developing rental housing. Experiences from countries like Germany demonstrate that rental markets operate efficiently when three conditions are met: a large supply of reasonably priced housing, strong legal protections for tenants, and a well-developed public transportation system.

Based on this, VARS recommends that, alongside promoting social housing, Vietnam should swiftly establish a long-term rental housing fund through the National Housing Fund, offering affordable rates prioritized for young workers, laborers, civil servants, and young intellectuals. Simultaneously, policies should incentivize developers to build low-cost housing through tax breaks, credit facilities, and reduced land costs.

Equally important is significant investment in public transportation connecting city centers with outlying areas. Improved infrastructure will make peripheral regions—where housing prices are 20–30% lower than in central areas—more viable options for both renters and buyers, thereby easing housing pressure in major cities.

The Win City: Unleashing Potential Through Saigon’s 04 Dynamic Inner-City Infrastructure Axis

Beyond the formidable consortium of developers, competitive pricing, and superior construction quality, it is the “diamond location” that truly sets The Win City apart.