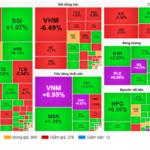

Vietnam’s stock market continues its robust surge, fueled by widespread capital flow and a seamless rotation among key pillar stocks. On January 13th, the VN-Index closed with a remarkable 25.6-point gain (1.36%), surpassing the 1,900-point milestone for the first time in history. Trading liquidity remained high, with HoSE’s order-matching value exceeding VND 39 trillion.

The energy sector stole the spotlight, with numerous stocks hitting their ceiling prices and even witnessing “zero sell orders.” Vingroup-affiliated stocks also rebounded strongly, alongside individual performers like SAB and GVR, further bolstering the market. Meanwhile, the banking sector showed mixed results, with VCB and BID continuing their upward trajectory while others faced profit-taking pressures.

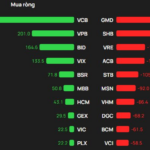

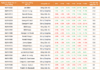

Notably, foreign investors turned net sellers with a VND 600 billion outflow across the market, ending a four-session net buying streak. However, the net selling value wasn’t substantial enough to signal a trend reversal. Moreover, Vietnam’s stock market is anticipated to attract long-term foreign capital from 2026, driven by the country’s potential upgrade.

Speaking at the FChoice 2025 Awards and the “Double-Digit Economic Growth Drivers and 2026 Investment Opportunities” seminar on January 13th, Ms. Nguyễn Thị Thu Hiền, CEO of TCBS, emphasized that the upgrade’s impact would be medium-term, spanning several years, rather than an immediate effect in 2026.

Estimates suggest that over approximately five years, the total foreign capital inflow into Vietnam through the upgrade could reach around USD 25 billion. For 2026 alone, this inflow is projected at USD 2–6 billion, primarily from passive investment funds (ETFs) and a portion of active capital.

“The positive aspect is that foreign capital will enter the market gradually, steadily, and with a clear roadmap, rather than in a rush. This aligns with the market’s technical dynamics. As Vietnam is progressively included in various indices, the index basket will expand, incorporating more blue-chip stocks and attracting passive investment capital sustainably,” Ms. Hiền emphasized.

Additionally, the TCBS CEO noted that the high-interest rate environment in international markets has increased foreign investors’ capital costs. Coupled with exchange rate fluctuations, this prompts them to carefully evaluate Vietnam’s investment efficiency compared to their domestic markets. Consequently, foreign capital inflows will be selective and cautious.

Assessing market prospects, Ms. Hiền attributed Vietnam’s stock market momentum to both macroeconomic growth and the strengthening fundamentals of Vietnamese enterprises. A crucial point is that the current market uptrend is no longer characterized by the uncontrolled “rush” seen in previous cycles.

The core factor remains the quality of listed companies. An increasing number of high-quality companies are entering the market, while existing ones continuously enhance their governance and risk management capabilities. “With an expected profit growth rate of 15–20%, I believe this is a quite positive outlook for the market,” the TCBS CEO commented.

Considering a scenario where the market’s valuation adjusts to around 13 times in the future, a 15–20% growth potential for the market next year is entirely feasible. Therefore, the VN-Index surpassing 1,800 points and even approaching the 2,000-point region, as many forecasts suggest, is a well-founded scenario.

However, the TCBS CEO stressed the importance of investors’ market approach. “Opportunities always exist, even when the market declines, as those are ideal times to accumulate long-term investment assets. The key is for each investor to prepare a reasonable and diversified asset portfolio,” Ms. Hiền advised.

Foreign Block Reverses to Sell on VN-Index Record Day, Contrasting with Over 500 Billion VND Inflow into a Banking Stock

In today’s sell-off, GMD topped the list of stocks heavily offloaded by foreign investors, recording a net outflow of approximately VND 252 billion.

Market Pulse 14/01: Fluctuations Around the 1,900-Point Threshold

The VN-Index experienced intense volatility in the latter half of the morning session, briefly approaching the 1,920-point threshold, only to swiftly retreat as profit-taking pressures resurfaced.