Illustrative Image

According to preliminary statistics from the Customs Department, Vietnam’s wheat imports in December reached over 297,000 tons, valued at more than $78 million, marking a 30.6% decrease in volume and a 33.1% drop in value compared to November. Cumulatively, in 2025, the country imported over 5.4 million tons of wheat, worth over $1.4 billion, reflecting a 5.1% decline in volume and a 7.8% decrease in value compared to 2024.

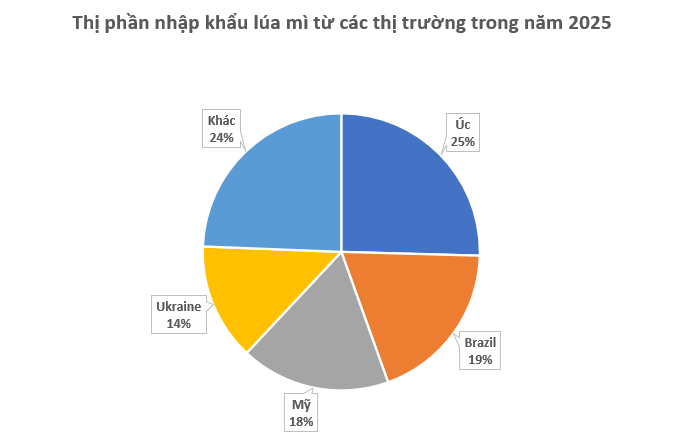

In terms of market share, Australia emerged as the largest supplier to Vietnam, providing over 1.3 million tons valued at more than $380 million, representing a 16% increase in volume and a 5% rise in value compared to the previous year. The average import price decreased by 9%, to $274 per ton.

Brazil ranked second, supplying over 1 million tons valued at more than $267 million, a decline of 11% in volume and 9% in value compared to 2024. The average import price increased by 3%, to $257 per ton.

The United States secured the third position with over 952,000 tons, valued at more than $258 million, showing a significant 96% increase in volume and a 73% rise in value compared to 2024. The average price decreased by 12%, to $271 per ton.

Ukraine ranked fourth, supplying over 744,000 tons valued at more than $189 million, though this represents a 50% decrease in both volume and value compared to the previous year. The average import price remained stable at $254 per ton.

Wheat is one of the world’s most essential food staples, widely consumed globally. In Vietnam, wheat is primarily used in the production of mixed animal feed. It not only meets domestic consumption needs but also supports the growing export demand. Given that Vietnam is virtually unable to cultivate wheat domestically, the country relies entirely on imports, currently ranking among the top 10 wheat importers worldwide.

To alleviate cost burdens amid fluctuating global raw material prices, Decree No. 101/2021/NĐ-CP reduced the MFN import tariff on wheat from 3% to 0%. This policy is expected to stabilize the supply for the domestic livestock industry and boost consumption of related products.

As a global leader in grain production and export, Ukraine typically exports the majority of its wheat during the first half of the season. Shipments gradually decrease in subsequent months as focus shifts to corn. For the 2024/25 wheat export season, Ukraine set a cap of 16.2 million tons. According to ministry data, traders have already exported nearly 13 million tons, a substantial portion of the total quota.

Globally, wheat production in 2026 is projected to increase, with the EU expected to achieve a 10-year high of 132.6 million tons. Argentina is forecasted to produce 23 million tons, while Russia is anticipated to yield 87.5 million tons. However, the U.S. wheat output is expected to decline by 2% compared to 2025 due to reduced harvested areas and lower yields.

Ukraine Surges with Hundreds of Tons of Exports to Vietnam in Just One Month: 0% Import Tax Propels Vietnam to Top Global Consumer Status

Russia, the United States, and Ukraine are all vying to bring this product to Vietnam, intensifying a competitive race in the market.