Decree No. 306/2025/NĐ-CP amends and supplements several articles of Decree No. 156/2020/NĐ-CP dated December 31, 2020, issued by the Government, which regulates administrative penalties in the securities and stock market sector (amended and supplemented by Decree No. 128/2021/NĐ-CP dated December 30, 2021). It also amends Decree No. 158/2020/NĐ-CP dated December 31, 2020, regarding derivatives and the derivatives market (Decree No. 306/2025/NĐ-CP).

Decree No. 306/2025/NĐ-CP takes effect on January 9, 2026, and introduces significant changes related to the derivatives market, including: Conditions and documentation for issuing and adjusting the Certificate of Eligibility for Derivatives Trading; Suspension of derivatives trading activities; Conditions and documentation for issuing the Certificate of Eligibility for Providing Clearing and Settlement Services for Derivatives Transactions; and Suspension of clearing and settlement services for derivatives transactions.

Removal of Certain Conditions for Derivatives Trading

Decree No. 306/2025/NĐ-CP eliminates three conditions for obtaining the Certificate of Eligibility for Derivatives Trading for securities companies, as specified in points c, đ, and h of Clause 2, Article 4 of Decree No. 158/2020/NĐ-CP.

These conditions are: “c) Meeting internal control and risk management requirements for securities trading activities as prescribed by law; đ) Maintaining a minimum available capital ratio of 220% continuously for the last 12 months; fully provisioning for reserves as required by law; h) Not being in the process of reorganization, dissolution, or bankruptcy; not being suspended or temporarily ceased from operations by a competent authority.”

Additionally, two conditions for obtaining the Certificate of Eligibility for Fund Management Companies are removed, as specified in points đ and h of Clause 2, Article 4, including: “đ) Maintaining a minimum available capital ratio of 220% continuously for the last 12 months; fully provisioning for reserves as required by law; h) Not being in the process of reorganization, dissolution, or bankruptcy; not being suspended or temporarily ceased from operations by a competent authority.”

In line with the reduction of trading conditions, Decree No. 306/2025/NĐ-CP removes the requirement for the “Report on the financial safety ratio for the last 12 months” from the documentation, as specified in point c of Clause 1, Article 5 of Decree No. 158/2020/NĐ-CP.

Furthermore, the new Decree replaces “Identity Card” with “Citizen Identification Card” to align with the Law on Citizen Identification. It also removes the requirement for “securities trading practice certificates, professional certificates in derivatives and derivatives markets” to comply with the Law on Electronic Transactions (amending point d of Clause 1, Article 5 of Decree No. 158/2020/NĐ-CP).

To implement Scheme 06, Decree No. 306/2025/NĐ-CP amends Clause 2, Article 5, and Form No. 02 in the Appendix of Decree No. 158/2020/NĐ-CP. This ensures that individuals are not required to submit their Citizen Identification Card or passport if they use an electronic identification account for administrative procedures.

Given that electronic identity information and integrated information on the electronic identification card are valid proofs, they are equivalent to providing information or using documents containing such information for administrative procedures. If the employment contract is not integrated, individuals must submit the employment contract.

Regarding the suspension of derivatives trading activities, to align with the removal of points c and đ in Clause 2, Article 4 of Decree No. 158/2020/NĐ-CP, Decree No. 306/2025/NĐ-CP eliminates the suspension grounds related to the failure to “Meet internal control and risk management requirements for securities trading activities as prescribed by law” and “Maintain a minimum available capital ratio of 220% continuously for the last 12 months; fully provision for reserves as required by law” for securities companies. For fund management companies, similar suspension grounds are removed for not maintaining the specified capital ratio and reserves for six consecutive months (amending point a of Clause 1, Article 6 of Decree No. 158/2020/NĐ-CP).

Removal of Certain Conditions for Providing Clearing and Settlement Services for Derivatives Transactions

For securities companies, Decree No. 306/2025/NĐ-CP removes three conditions for obtaining the Certificate of Eligibility for Providing Clearing and Settlement Services for Derivatives Transactions, including:

Removing the condition that “The debt-to-equity ratio on the latest annual financial report must not exceed 05 times; fully provision for reserves as required by law” (amending point d of Clause 2, Article 9 of Decree No. 158/2020/NĐ-CP);

Removing the conditions “Meeting internal control and risk management requirements as prescribed by law” and “Not being in the process of reorganization, dissolution, or bankruptcy; not being suspended or temporarily ceased from operations by a competent authority” from points g and h of Clause 2, Article 9 of Decree No. 158/2020/NĐ-CP.

For commercial banks and foreign bank branches, Decree No. 306/2025/NĐ-CP removes two conditions for derivatives trading, including: “Maintaining a minimum capital adequacy ratio as prescribed by law for credit institutions for the last 12 months” from point c of Clause 3, Article 9 of Decree No. 158/2020/NĐ-CP;

Removing the condition “Not being in the process of reorganization, dissolution, or bankruptcy; not being suspended or temporarily ceased from operations by a competent authority” (amending point d of Clause 3, Article 9 of Decree No. 158/2020/NĐ-CP).

Regarding documentation, Decree No. 306/2025/NĐ-CP removes the requirement for “documents proving compliance with the minimum capital adequacy ratio (for commercial banks and foreign bank branches)” (amending point c of Clause 1, Article 10 of Decree No. 158/2020/NĐ-CP). It also removes the “Internal control process, risk management process for providing clearing and settlement services for derivatives transactions” from point d of Clause 1, Article 10 of Decree No. 158/2020/NĐ-CP.

For the suspension of clearing and settlement services for derivatives transactions, Decree 306/2025/NĐ-CP removes the suspension ground related to the failure to “Maintain a minimum capital adequacy ratio as prescribed by law for credit institutions for the last 12 months” for six consecutive months for commercial banks and foreign bank branches (amending point a of Clause 1, Article 11 of Decree No. 158/2020/NĐ-CP).

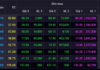

Seven Individuals Penalized for Manipulating SJS Stock

During the period from April 10, 2023, to January 10, 2024, two individuals exploited 26 securities accounts to manipulate SJS stocks. Additionally, five individuals lent their accounts, contributing to market manipulation activities.