Silver Prices Surge in Vietnam Amid Global Market Volatility

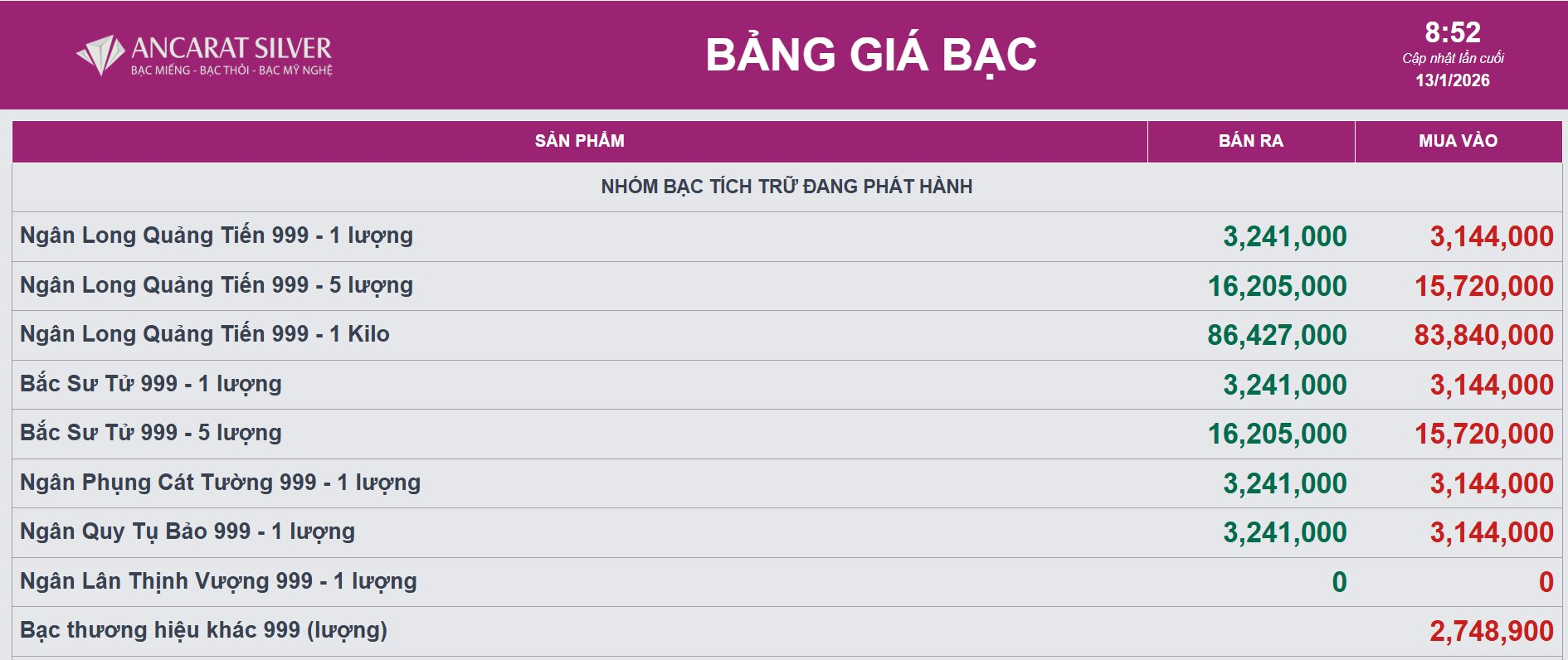

At Ancarat Vietnam Precious Metals Joint Stock Company, today’s silver price is listed at VND 3,144,000 per tael (buy) and VND 3,241,000 per tael (sell) in Hanoi, marking a VND 34,000 increase on the buying side and VND 21,000 on the selling side compared to yesterday morning’s session.

Meanwhile, 1kg silver bars of 999 purity are priced at VND 83,840,000 (buy) and VND 86,427,000 (sell), updated at 8:52 AM on January 9th.

Globally, silver trades at $83.9 per ounce.

Global Silver Price Chart (Illustrative Image)

Silver prices previously rallied 5% to nearly $84 per ounce on Monday, hitting a new record high as concerns over the Federal Reserve’s independence and escalating geopolitical risks boosted demand for safe-haven assets.

US federal prosecutors have launched a criminal investigation into Fed Chair Jerome Powell regarding his June testimony before the Senate Banking Committee, while Powell accused the Trump administration of pressuring the central bank to align with its policy priorities.

Markets are also weighing prospects for further US rate cuts after the January 9th jobs report showed weaker-than-expected December employment growth. Traders continue pricing in two Fed rate cuts this year despite widespread expectations for policy hold later this month.

Geopolitical tensions remain elevated as protests escalate in Iran, increasing risks of broader conflict with reports indicating President Trump is considering intervention options.

Silver Surges Ahead of Gold: Bao Tin Capital CEO Calls It the “Hyperactive Sibling” of Precious Metals

Silver is emerging as a standout investment channel, with prices soaring up to 175% in 2025, according to Dinh Ngoc Dung, Chairman and CEO of Bao Tin Capital. However, this meteoric rise also brings significant risks for investors.

Dr. Vo Tri Thanh: High Savings Rate, Yet Challenges Remain in Effective Investment Conversion

Dr. Vo Tri Thanh emphasizes that to sustain Vietnam’s development trajectory, especially with long-term goals set for 2030–2045, fostering trust, strengthening institutional frameworks, and creating a conducive business investment environment are paramount.