Global silver prices have officially surpassed the $90/ounce mark—a threshold considered critical both technically and psychologically in the market. This development has not only captured the attention of precious metals investors but also revived a once-controversial prediction: Robert Kiyosaki’s warning, author of the renowned book Rich Dad Poor Dad, about silver entering a significant uptrend due to supply shortages.

In previous statements, Kiyosaki revealed his ownership of a silver mine and expressed his belief that the market underestimates the metal’s role and scarcity. According to Kiyosaki, silver is not merely a precious metal for investment but also a critical raw material across industries, including electronics, healthcare, and renewable energy.

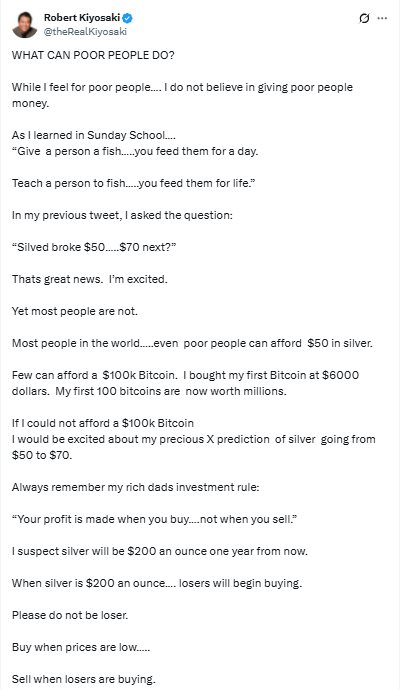

He previously forecasted that silver prices could skyrocket, potentially reaching $200/ounce in the future—a figure many analysts deemed overly optimistic at the time.

When these statements were initially made, silver prices were significantly lower than current levels and often overshadowed by gold as a safe-haven asset. Many argued that silver’s volatility, driven by economic cycles and industrial demand, made it unlikely to sustain a long-term rally. However, recent market trends are forcing investors to reconsider this perspective.

The surge past $90/ounce reflects multiple intersecting factors. On one hand, silver demand in sectors like solar panels, electric vehicles, and electronics continues to rise amid global energy transitions. On the other hand, new silver mining supply remains stagnant, constrained by high extraction costs and prolonged investment timelines. As Kiyosaki noted, silver is a finite resource that cannot be rapidly scaled to meet sudden demand spikes.

Beyond supply and demand dynamics, investment flows also play a significant role. Amid persistent global inflation risks, geopolitical tensions, and volatile financial markets, silver is increasingly viewed as a defensive asset alongside gold. This perception has propelled silver prices to new highs, surpassing the expectations of many cautious investors.

Nevertheless, the current rally does not guarantee that all optimistic forecasts will materialize. The $200/ounce target Kiyosaki mentioned remains a distant milestone, contingent on variables such as global monetary policies, economic growth rates, and market corrections at higher price levels. Speculative activity could also trigger sharp downturns.

At present, however, one thing is clear: warnings about silver supply shortages and its price potential are no longer dismissed as far-fetched. With prices breaching $90/ounce, the once-debated remarks of the Rich Dad Poor Dad author are gaining renewed credibility. The question now is not whether silver will rise further, but how far—and at what cost to the market.

Silver Prices Hit Yearly Peak, Reaching 86 Million VND per Kilogram

Silver prices today surged significantly both domestically and globally, marking a notable upward trend in the precious metals market.