Who is at Risk of Being Denied Departure?

1. Individual Business Owners and Household Business Heads

Individuals operating sole proprietorships or registered as household business heads may face temporary departure restrictions if they have outstanding tax debts of VND 50 million or more, overdue by more than 120 days. This group is particularly prone to overlooked tax obligations, especially those who have ceased operations but failed to complete tax code closure procedures.

2. Legal Representatives of Enterprises

Legal representatives of companies or cooperatives may be denied departure if their entity owes taxes of VND 500 million or more, overdue by more than 120 days. Tax authorities are legally empowered to enforce this measure, even if the individual does not directly manage day-to-day financial operations.

3. Individuals Named in Defunct Businesses

If a business has ceased operations, is no longer present at its registered address, and has outstanding tax debts without completing dissolution procedures, its legal representative may still face departure restrictions. This scenario is common among small businesses, dormant post-pandemic companies, or cases where individuals lent their names for company registration.

4. Individuals Emigrating or Foreigners Leaving Vietnam

Vietnamese citizens emigrating abroad and foreigners departing Vietnam must settle all tax obligations before leaving. Failure to do so will result in temporary departure restrictions until resolution.

Other Common Causes: Many travelers face airport delays not due to intentional tax evasion but inadvertent reasons such as: forgetting to file personal income tax returns when changing jobs; being associated with defunct businesses that failed to close their tax codes; or unpaid taxes from family businesses or land leases without timely notifications.

3 Fastest Ways to Check Tax Debt Status

To minimize risks, individuals should verify their tax status using these three official methods:

Method 1: General Department of Taxation Website

This method checks if you’re listed for tax debt enforcement related to departure restrictions.

Step 1: Visit https://gdt.gov.vn/wps/portal. Select Public Services -> Public Tax Debt Enforcement.

Step 2: Choose Taxpayers with Departure Notifications.

Step 3: Enter required details (Tax Code, ID/Passport Number) and click Search.

Result: No information displayed means you’re not listed. If details appear, address tax obligations immediately.

Note: Data updates periodically; recheck before departure.

Method 2: Individual Tax Code Verification

This method checks if your personal documents are misused for business registrations—a common cause of unintended tax liabilities.

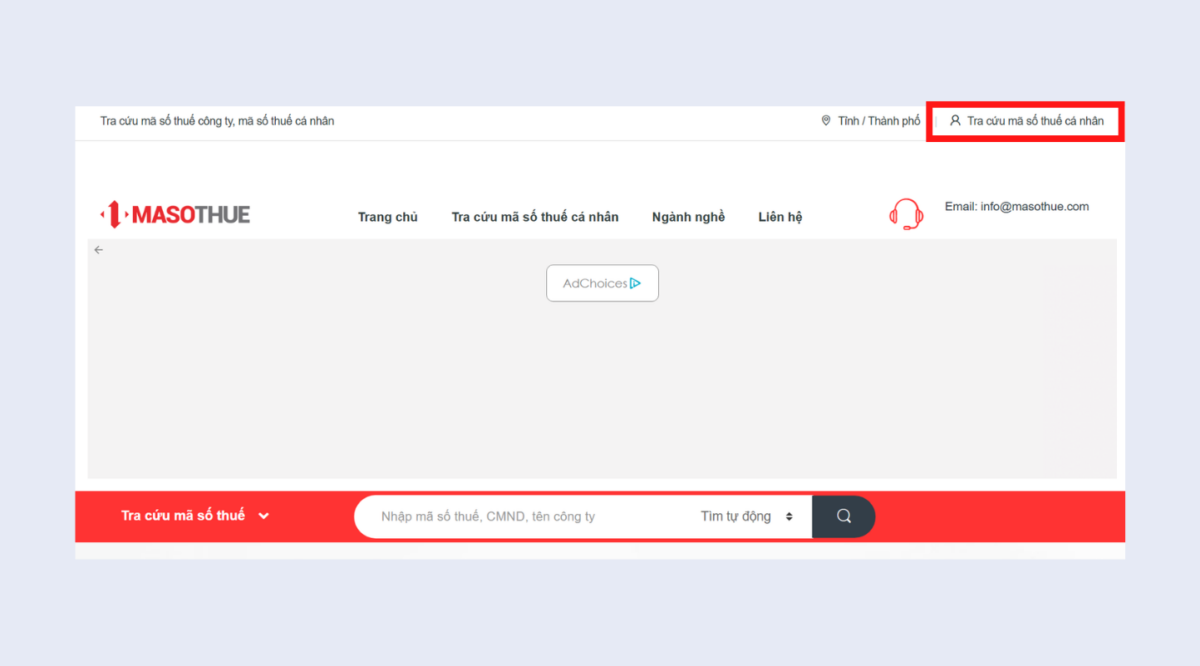

Step 1: Visit https://masothue.com.

Step 2: Enter your 12-digit ID number or old 9-digit ID to check business associations.

Step 3: Verify displayed information:

Case 1 (Your business): Contact finance/accounting for tax verification.

Case 2 (Unrelated business): Report to Business Registration Office, Tax Authority, and Police for fraud investigation.

Case 3 (No information): You’re clear of unauthorized business associations.

Method 3: eTax Mobile App

The quickest and most convenient method for working professionals and business owners.

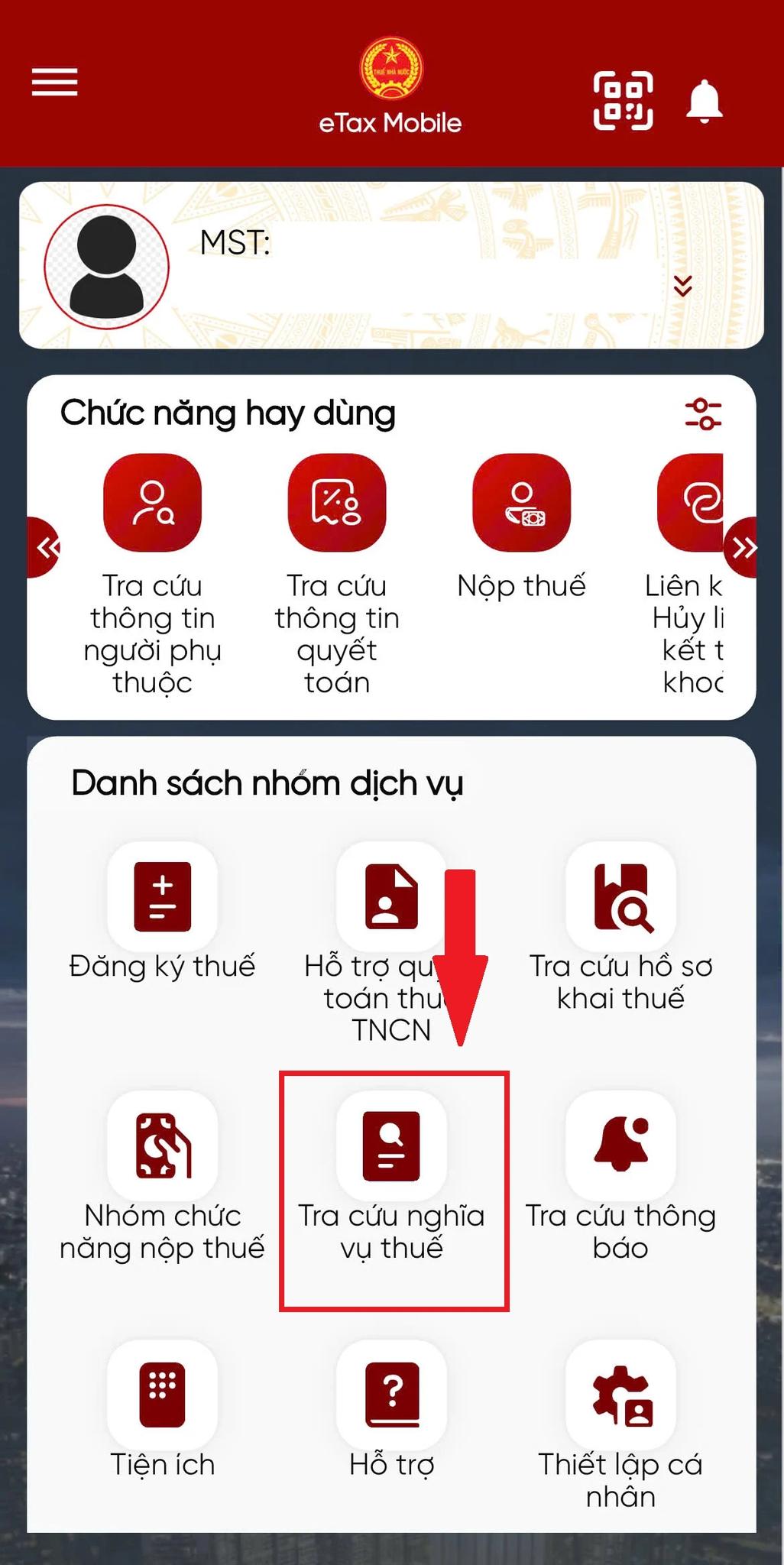

Step 1: Log into eTax Mobile using VNeID or e-tax account.

Step 2: Select Tax Obligation Inquiry.

Step 3: Choose Tax Obligation Details.

Step 4: Tap Search for results.

The app lists outstanding taxes and late fees. Settle debts promptly via the app to avoid enforcement actions.

Top Real Estate Companies in Ho Chi Minh City Owe Massive Tax Debts, One Firm Tops VND 2 Trillion

Several real estate companies continue to top the tax debt list in Ho Chi Minh City. Notably, many of these firms are affiliated with major property developers in the Southern region, including Novaland (NVL), Thuduc House (TDH), HDTC, Kim Oanh, and others.