The year 2026 is considered a pivotal milestone in Vietnam’s economic development trajectory. It marks not only the beginning of the 2026–2030 five-year plan but also the year when Vietnam officially sets its sights on achieving double-digit economic growth for several consecutive years.

Against this backdrop, on January 13th, at the Sheraton Hotel in Hanoi, CafeF hosted a series of events: the FChoice 2025 Awards Ceremony and the “Drivers of Double-Digit Economic Growth and Investment Opportunities in 2026” forum. The event brought together leading Vietnamese economists and numerous business leaders.

Speaking at the event, Dr. Vo Tri Thanh, Director of the Institute for Brand and Competition Strategy Research, encapsulated Vietnam’s 2025 lessons into three words: “extraordinary,” “unusual,” and the need to turn these into “ordinary.”

According to Dr. Thanh, the world is entering a period of profound uncertainty, with geopolitical competition, climate change, the explosive development of technology, digital transformation, green transition, and global economic restructuring occurring simultaneously.

“Never before has the intersection of politics, geopolitics, technology, and economics been so profound and complex. Never before has globalization, trade, investment, and rule-based systems clashed so intensely. And never before have people spoken so much about both catastrophe and aspiration,” Dr. Thanh emphasized.

In this context, he identified two critical questions: how to enhance resilience while maintaining growth, and how Vietnam can continue its development path to achieve long-term goals by 2030–2045, avoiding the middle-income trap.

Dr. Thanh suggested that Vietnam needs to respond flexibly to the international environment, leveraging both external and domestic markets. It must also maintain macroeconomic stability and avoid pursuing growth at all costs. Institutional reforms, infrastructure development, and improving human resource quality remain decisive pillars for the new development phase amidst global volatility.

During Panel Discussion 1 on “Drivers of Double-Digit Economic Growth,” Prof. Tran Dinh Thien, Member of the Prime Minister’s Policy Advisory Council, highlighted that Vietnam has turned the ordinary into the extraordinary, particularly by viewing the private sector as a key growth driver. According to him, by 2025, the private sector will finally assume its rightful role as the foundation, core, and engine of the economy.

The second extraordinary change Prof. Thien mentioned is the shift in the approach to policy resolutions. Instead of isolated, independent, and uncoordinated resolutions, Vietnam is adopting a set-based approach, such as “quadrilateral” or “octagonal” frameworks. This approach addresses systemic issues, enabling policies to take effect more swiftly.

Prof. Thien believes that these changes are fostering new growth dynamics. However, the biggest challenge remains implementation capacity. If the spirit of the resolutions is effectively executed, Vietnam can achieve growth not only in scale but also in quality and resource efficiency.

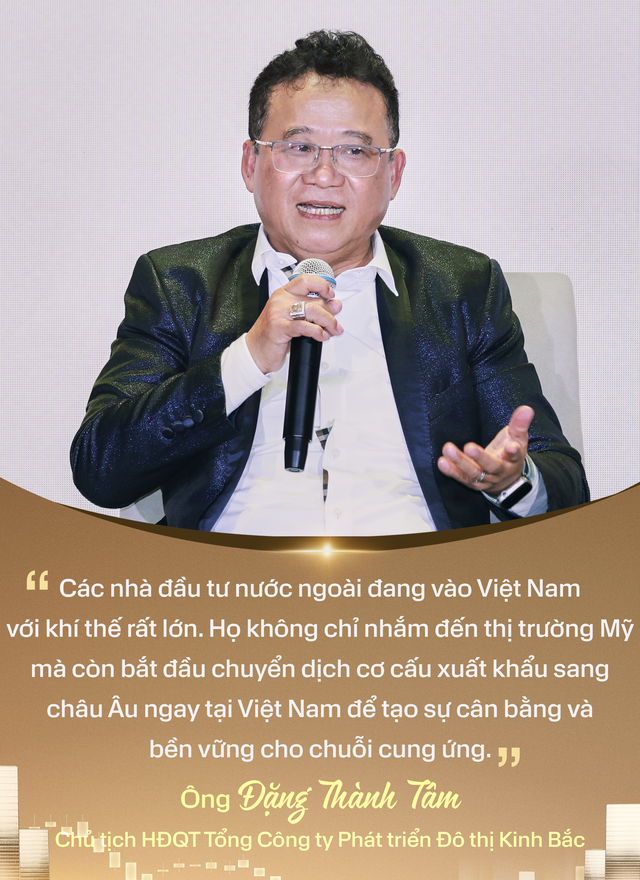

Despite global investment uncertainties, Vietnam remains attractive to FDI. Mr. Dang Thanh Tam, Chairman of Kinh Bac Urban Development Corporation (KBC), attributes this to the significant restructuring of the economic framework. Focused and efficient investment is key to reducing waste, controlling inflation, and promoting sustainable growth.

“Investment decisions at ministries, sectors, and provinces are being made faster than ever,” Mr. Tam shared.

He also emphasized the need for Vietnam to enhance localization and increase domestic value-added, laying the groundwork for double-digit growth.

Another factor sustaining FDI appeal is the state’s outstanding diplomatic achievements and the contributions of people-to-people diplomacy. Mr. Tam stressed that Vietnam has created a unique distinction compared to the rest of the world.

However, KBC’s Chairman also pointed out existing bottlenecks, including a heavy reliance on exports to the U.S. To foster sustainable development, the government has proactively signed multiple free trade agreements (FTAs) to access new markets like the EU and South Africa.

“I observe that foreign investors are entering Vietnam with great momentum. They are not only targeting the U.S. market but also shifting export structures to Europe within Vietnam to balance and sustain supply chains,” Mr. Tam noted.

Highlighting the “momentum” of 2026, Mr. Tam believes Vietnam has a clear growth advantage over many regional countries. He is confident that within a decade, Vietnam’s GDP could enter the global top 10. The key lies in capital absorption, policy implementation, and project execution through a unified planning framework from central to local levels.

For KBC specifically, Mr. Tam stated that the company aims to attract high-quality FDI by preparing robust infrastructure, linking economic growth with green development. The focus is on investing in clean energy, diversifying capital sources, and attracting high-tech projects, particularly AI Data Center infrastructure, to support double-digit growth goals.

As a globally engaged enterprise, Mr. Nguyen Duc Hung Linh, Deputy CEO of AgriS Investment, noted that the most significant change impacting Vietnamese goods is the emphasis on green standards (ESG) and traceability. These are critical for all sectors aiming to maintain and enhance global competitiveness.

Adopting ESG requires a long-term transformation, substantial investment, leadership commitment, and deep digitalization of production chains to meet data provision demands within tight timelines. Traceability is also expanding to include environmental and social criteria.

The Deputy CEO of AgriS emphasized that Vietnamese businesses not only compete domestically but also face global giants, particularly from Thailand, Brazil, and other advanced supply chain nations. In this competitive landscape, ESG and traceability are becoming sustainable competitive advantages for Vietnamese goods, alongside quality and pricing.

Regarding strategies to overcome the “low scale–low profit trap,” Mr. Linh identified two main paths. The first involves shifting to higher value-added, premium products. The second is expanding production overseas.

“In my view, exporting isn’t just about producing in Vietnam and selling abroad, but also establishing factories and raw material regions directly in foreign markets, similar to how Taiwanese and Korean companies invested in Vietnam,” the AgriS representative explained.

Beyond production, businesses need to transition to providing agricultural services and solutions, from cultivation consulting and farm management to green financing for supply chains. Building a digital platform that delivers real value to farmers is key to sustainable long-term growth.

From a credit institution perspective, Mr. Pham Hong Hai, CEO of OCB Bank, highlighted a shift toward faster decision-making, execution, and clear accountability. Previously, launching a new product could take 12–18 months for approval and implementation, with every process change requiring multiple layers of review.

“Today, this is becoming the ‘new normal’ as banks empower executive boards and specialized councils, enabling quicker piloting, early measurement, and flexible adjustments,” Mr. Hai shared.

Agile methodologies and squad teams are increasingly common in organizations. Empowering teams to execute quickly, aligned with shared goals, and embracing a “try and learn” mindset fosters rapid, flexible results.

Since late 2024, OCB has intensified cash flow-based lending, a global standard previously underutilized in Vietnam, where lending was primarily asset-based. This shift has expanded access to capital for startups and young enterprises.

Green credit is a strategic pillar, driven not only by social responsibility but also long-term business opportunities. Despite higher standards and short-term trade-offs, green credit ensures stable portfolio growth, lower non-performing loans, and reduced operational costs through digitalization.

Mr. Hai also identified bottlenecks requiring attention, such as enhancing corporate transparency, eliminating dual accounting practices, and adopting performance-based operational models.

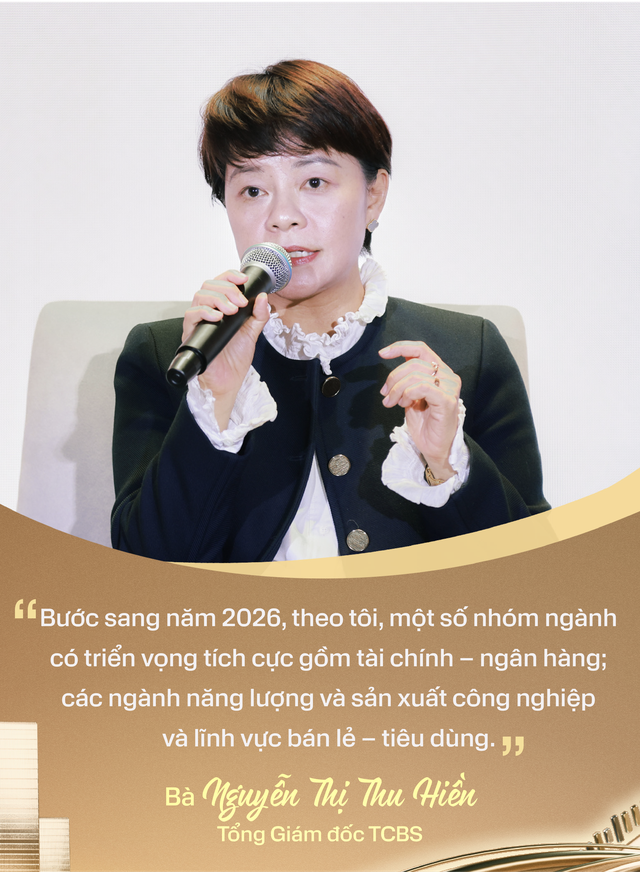

During Panel Discussion 2 on “Investment Opportunities in 2026,” Ms. Nguyen Thi Thu Hien, CEO of Techcom Securities (TCBS), described 2026 as a pivotal year in Vietnam’s new development cycle, following 2025’s 8% economic growth and a 40% stock market rise.

In 2026, key growth drivers will include continued public investment and a stronger recovery in the private sector. These factors will bolster production, business foundations, and support the stock market.

Sustainable market development hinges on listed companies’ quality. With expected 15–20% profit growth, the market offers ample investment opportunities, as IPOs and M&A activities regain momentum, attracting new capital.

Ms. Hien is optimistic about finance, energy, industry, retail, and consumer sectors, advising investors to diversify portfolios, maintain reasonable cash ratios, and leverage adjustments for long-term asset building.

With the VN-Index surpassing 1,800 points this year, growth potential remains significant. Given current valuations (P/E 16x) and profit outlooks, a 15–20% market rise toward 2,000 points is feasible in the medium term.

However, Ms. Hien stressed that success lies not in specific numbers but in investors’ market approach. Adjustments are healthy, offering opportunities for long-term investment accumulation.

In wealth management, investors should adopt a holistic portfolio view, balancing stocks with bonds, funds, and professional products, while maintaining appropriate cash levels.

As domestic capital gains prominence and Vietnam’s financial market democratizes, diversification, basket investing, and technology utilization, including AI, will underpin sustainable investment in Vietnam’s economy during 2026–2030.

On the gold market, Mr. Dinh Ngoc Dung, Chairman and CEO of Bao Tin Capital, noted that gold, as an international asset, commodity, and currency, generally moves in tandem with global prices.

However, Vietnam’s gold market remains partially disconnected from international markets, resulting in significant domestic-global price gaps, primarily due to supply-demand dynamics. Decree 232 and plans for a national gold trading floor aim to end SJC’s monopoly, enhance transparency, and narrow this gap.

“This process is akin to a battle: initially challenging, but once key hurdles are overcome, progress accelerates. International gold prices have repeatedly tested $4,500/ounce and recently surpassed this level, signaling a promising growth cycle for investors,” Mr. Dung said.

With the national gold trading floor, a key goal is mobilizing gold held by the public, estimated at 500 tons, equivalent to $80 billion. Effectively harnessing this resource could significantly boost investment and economic development.

Regarding silver, Mr. Dung noted that prices surged from $29/ounce to nearly $80/ounce in 2025, driven by global geopolitics, monetary easing, and industrial demand. However, this rapid rise increases profit-taking and adjustment risks, requiring investors to balance opportunities and risks.

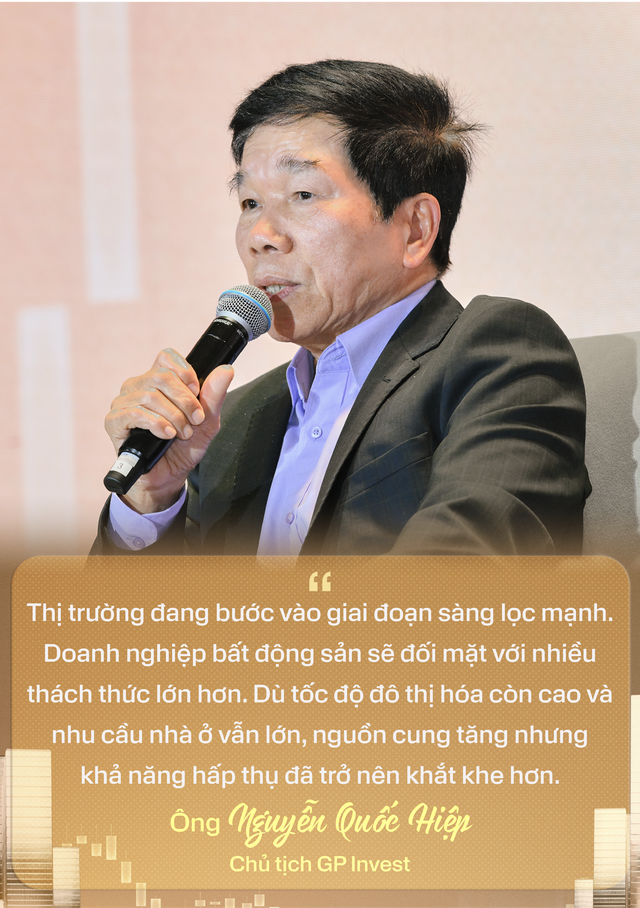

For the real estate market, Mr. Nguyen Quoc Hiep, Chairman of GP Invest, observed that Vietnam’s real estate crises recur every decade, with the latest in 2022 coinciding with the COVID-19 pandemic.

Since late 2024, the market has rebounded, supported by legal reforms, including new laws on land, housing, and real estate business.

In 2025, supply recovered, but prices rose 15–20%, outpacing income growth, challenging affordability. Approximately 60% of transactions are investment-driven, prompting cautious 2026 market approaches.

Mr. Hiep expects 2026 to partially address supply-demand imbalances through social housing, commercial housing under Resolution 171, and old apartment renovations in Hanoi and Ho Chi Minh City.

“The market is entering a strong selection phase. Real estate firms face greater challenges. Despite high urbanization and housing demand, increased supply meets stricter absorption criteria,” Mr. Hiep assessed.

Companies remain reliant on bank credit amid rising interest rates, while bond issuance remains restricted. Late 2025 buying power slowed as higher borrowing costs deterred homebuyers.

Mr. Hiep sees 2026 opportunities with significant risks, requiring careful investment location, legal, absorption, product, pricing, and cash flow management to mitigate financial pressures.

Why Japan and South Korea Face Challenges While Vietnam Surges Ahead?

Driven by the ambition for double-digit growth, capital flows are shifting, and market confidence is surging. The vision unveiled at FChoice 2025 illustrates why Vietnam is defying the challenges faced by many other economies.