According to the Hanoi Stock Exchange (HNX), Viet My Hospital Investment Joint Stock Company (Viet My Hospital Investment) has announced the repayment of principal and interest on its only outstanding bond issuance.

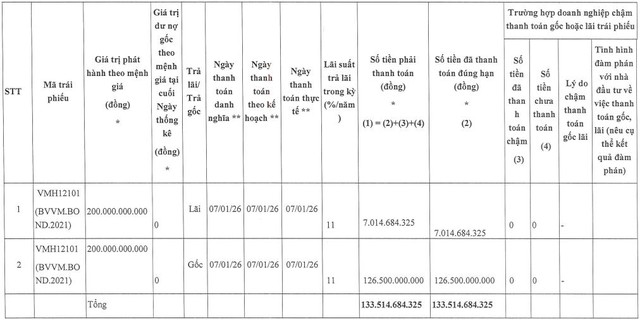

On January 7, 2026, Viet My Hospital Investment repaid over VND 7 billion in interest and the full VND 126.5 billion principal of the VMH12101 bond (BVVM.BOND.2021). Following this repayment, Viet My Hospital is now free of bond debt.

Source: HNX

The VMH12101 bond was issued on January 7, 2021, with a 3-year term, originally maturing on January 7, 2024.

However, in late 2023, the issuer obtained bondholder approval to extend the bond’s maturity by 2 years, pushing the due date to January 7, 2026.

After a buyback of VND 8.5 billion on January 8, 2024, the remaining outstanding value of the bond was VND 126.5 billion.

Established on February 13, 2017, in Phu Tho province, Viet My Hospital Investment specializes in medical equipment and laboratory chemicals.

The company’s initial charter capital was VND 300 billion, with the founding shareholders being Kanpeki Japan Co., Ltd. (98%), Mr. Le Duc Khanh (1%), and Ms. Nguyen Thi Quynh Anh (1%).

In October 2024, Director Ngo Van Hung replaced Chairman and CEO Le Duc Khanh (born 1984) as the legal representative.

In June 2017, AMV Pharmaceutical and Medical Equipment Production and Trading Joint Stock Company (AMV – HNX) acquired 25 million shares of Viet My Hospital Investment, gaining an 83.33% stake. This ownership percentage remained unchanged as of September 30, 2025.

In terms of business performance, Viet My Hospital Investment reported a post-tax loss of VND 3.6 billion in the first half of 2025, increasing accumulated losses to over VND 25 billion.

As of June 30, 2025, the company’s owner’s equity decreased to VND 274.6 billion. Total liabilities at that time were nearly VND 139 billion, including the aforementioned VND 126.5 billion bond debt.

Redistribution of UPCoM Market Share

VPS retains its lead in the UPCoM market share for 2025, though significantly reduced compared to 2024, indicating a more distributed market among competitors. TCBS climbs to second place, while VPBankS makes a notable ascent into the top ranks. Conversely, SHS and BSC exit the top 10.