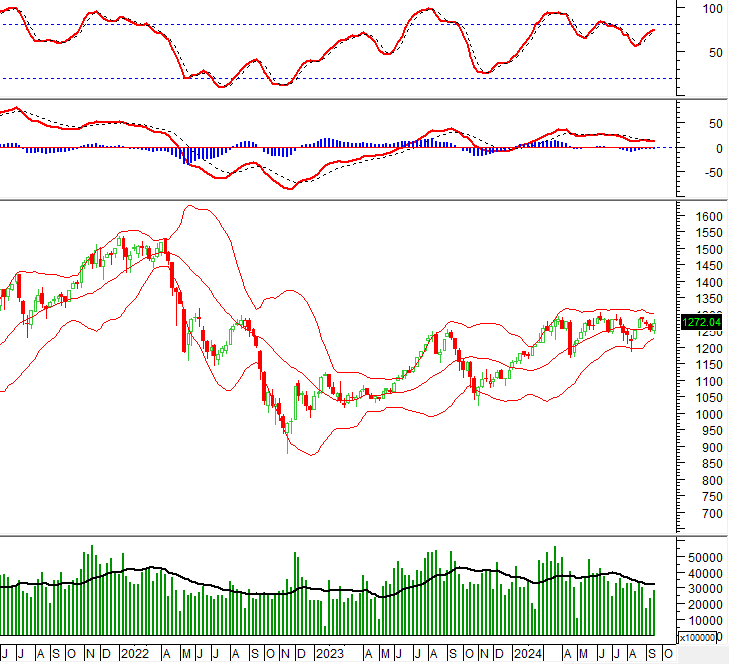

Despite significant fluctuations in 2025, rubber remains a billion-dollar export commodity for Vietnam. According to data from Vietnam Customs, in December 2025, Vietnam’s rubber exports reached 238 thousand tons, valued at $404 million, reflecting a slight increase in volume but a 10% decrease in value compared to December 2024.

For the entire year of 2025, Vietnam exported nearly 2 million tons of rubber, worth approximately $3.3 billion, marking a decline in both volume and value compared to 2024. This represents the lowest export volume in the past four years, yet the revenue remains the second-highest in history, surpassed only by 2024.

This indicates that stable rubber prices have helped offset the decline in production volume. The average export price of rubber increased by 2.6% compared to 2024, reaching $1,745 per ton.

China continued to be Vietnam’s largest rubber export market in 2025, accounting for 74% of total exports with 1.4 million tons, valued at $2.4 billion. Compared to 2024, export volume to China decreased by 2.3%, but the value increased by 0.3%, driven by an average export price of $1,731 per ton, up 2.7%.

Exports to India, the second-largest market, saw a sharp decline, with 2025 exports falling to 76 thousand tons, valued at $143 million.

Exports to other markets also trended downward, including a 6% drop to the United States, a 28% decline to Germany, and respective decreases of 28% and 24% to Taiwan and Russia.

However, rubber exports experienced positive growth in markets such as Malaysia, Indonesia, South Korea, and Pakistan. Notably, exports to Malaysia surged by 42% to 54,657 tons, while exports to Indonesia skyrocketed by nearly 95% to 51,202 tons. As a result, these two markets climbed to the third and fourth positions among Vietnam’s top rubber export destinations in 2025.

Vietnam’s rubber exports face mounting challenges amid intensifying global competition. Among the world’s leading rubber producers, Vietnam is one of the few countries to record a decline in export volume in 2025.

Unusual weather patterns in Southeast Asia have directly impacted harvesting activities. In Thailand, severe flooding in the southern region reduced output by an estimated 90,000 tons. In Vietnam, heavy rainfall from November 15–20 in the Central Highlands halted operations in key areas, causing losses of approximately 40,000 tons across nine major provinces.

Adding to these challenges, border tensions between Thailand and Cambodia in December disrupted factory operations within a 200 km radius, supporting a modest recovery in RSS3 prices to $2,071 per ton. However, this recovery remains cautious, as market demand shows no clear signs of improvement.

Meanwhile, Vietnam’s short-term outlook is less than optimistic, as China’s import demand—a key market—slows down. Despite China’s overall rubber imports growing by double digits in 2025, imports from Vietnam declined for the second consecutive year. China is increasingly shifting its sourcing to Thailand, Ivory Coast, and Indonesia.

In this context, expanding exports to promising markets like Malaysia and Indonesia, as well as diversifying into other markets, is crucial. This strategy not only boosts immediate sales but also reduces reliance on a single market, enhancing the long-term sustainability of Vietnam’s rubber industry.

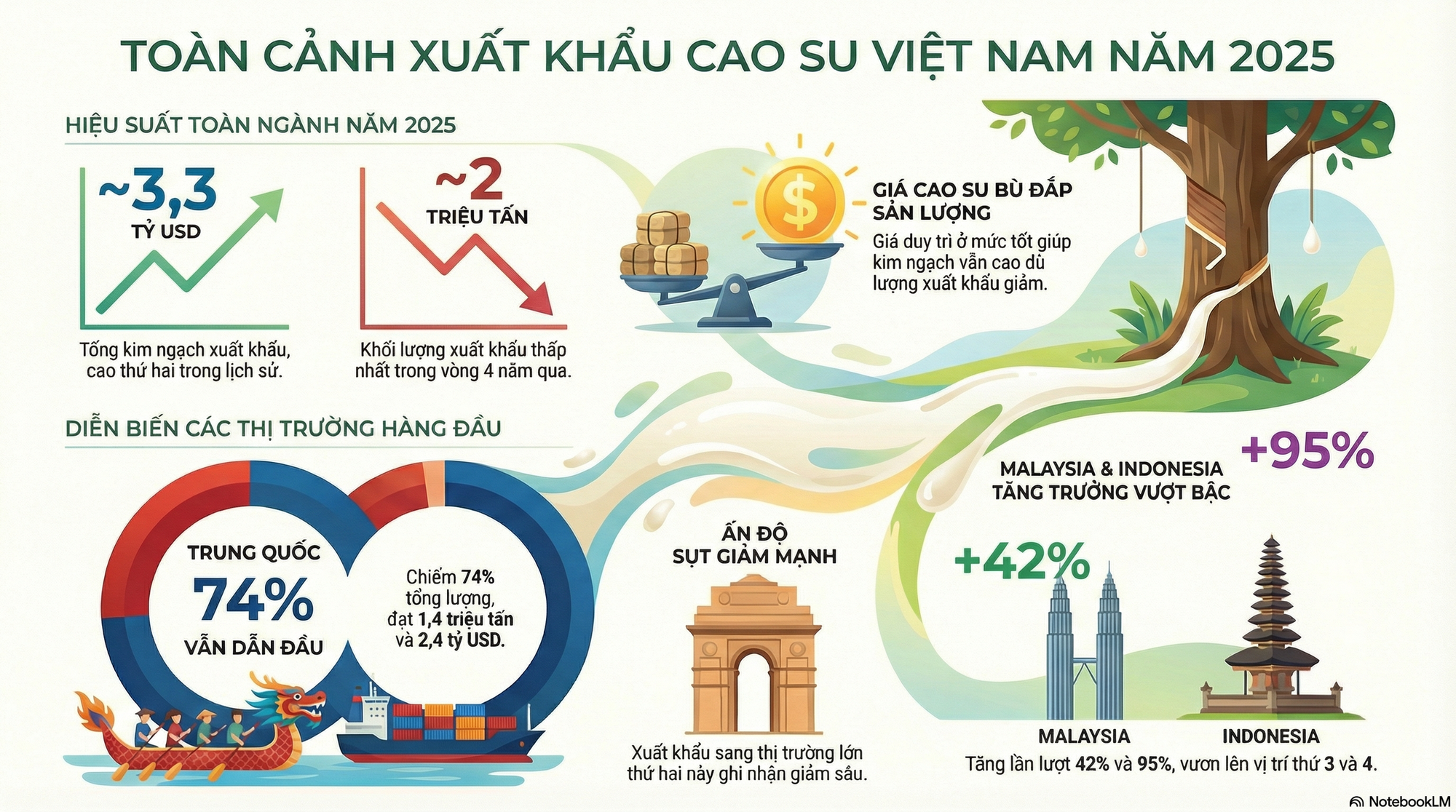

The Billion-Dollar Product from Vietnam: A Global Frenzy with Prices Soaring to a 2-Year High, China as its Top Patron

The export price of this commodity hit a 2-year high as of June 2022. This marks a significant peak, with prices soaring to levels not seen since 2020. This news is sure to capture the attention of investors and economists alike, as it indicates a potential shift in the market and could have far-reaching implications for the global economy. With such a dramatic rise, the question now is whether this upward trend will continue or if a correction is on the horizon.