A significant influx of capital into the stock market has propelled energy sector stocks to new heights. The synergy between the Vingroup conglomerate and the robust performance of energy and banking sectors has driven the VN-Index beyond the 1,900-point milestone.

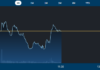

The VN-Index staged a remarkable late-session rally, surpassing a critical benchmark eagerly anticipated by investors.

VN-Index Reaches Historic High

At the close of trading, the VN-Index climbed 25.60 points (1.36%), settling at its intraday peak of 1,902.93 points.

The market’s optimism extended beyond the benchmark index, with widespread gains across various sectors. The VN30 basket of large-cap stocks reinforced its leadership role, closing at 2,089.21 points, up 8.97 points (0.43%). In the derivatives market, investor confidence remained strong, as evidenced by the VN30F1M futures contract gaining 4.9 points (0.24%) to end at 2,084.6 points.

Other exchanges mirrored this positive sentiment, with the HNX-Index rising 0.97 points (0.39%) to 252.85 points, and the UPCoM index advancing 0.59 points (0.48%) to reach 123.15 points.

Energy Stocks Surge

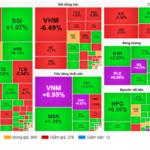

The market’s upward momentum was primarily fueled by the collective strength of key sectors. Notably, Vingroup-affiliated stocks rebounded strongly after a previous session’s decline. VIC (Vingroup) rose 2% to 167,900 VND, contributing nearly 7 points to the index. VHM (Vinhomes) and VRE (Vincom Retail) also regained positive territory, each climbing 2.9%.

The standout performers of the day were energy stocks, with many hitting their upper limits. GAS (PV Gas) surged 6.9% to 103,700 VND; PLX (Petrolimex) reached its ceiling with a 7% gain to 45,350 VND; and BSR (Binh Son Refining and Petrochemical) advanced 6.9% to 20,950 VND. Upstream players like PVD and PVS (on the HNX) also saw significant gains, trading at their maximum daily limits. Other energy-related stocks, including PVT, VSC, and PET, similarly shone brightly.

Banking and securities stocks maintained their supportive role, with notable gains in BID (+3.6%), VCB (+1.8%), and widespread increases across SSI, HCM, and VND. Speculative stocks such as EIB and VIX also hit their upper limits late in the session.

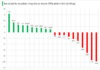

Domestic investors continued to dominate trading activity, with the HoSE recording a total trading value of 41,342.88 billion VND, corresponding to over 1.33 billion shares changing hands. Including the HNX and UPCoM, total market liquidity surpassed 45,000 billion VND, underscoring the strong appeal of the stock market in this phase.

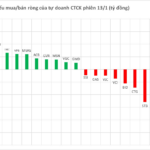

In contrast, foreign investors took advantage of the rally to lock in profits, net-selling 490.25 billion VND on the HoSE (buying 4,483 billion VND and selling 4,974 billion VND). However, this selling pressure had minimal impact on the market’s upward trajectory, given the overwhelming liquidity from retail investors.

Analysts suggest that with the VN-Index firmly above 1,900 points and record-high liquidity, investor sentiment is increasingly optimistic about the market’s sustainable growth prospects for 2026.

Seven Mega Projects by Vingroup with a Combined Investment of Over 2 Quadrillion VND

From megacities and railways to power, steel, and beyond, Vingroup’s deployment portfolio spans multiple economic sectors. A common thread unites these ventures: capital investments measured in hundreds of trillions of VND, driving infrastructure development, job creation, and visitor influx. This momentum fuels regional growth and fuels Vingroup’s ambition to shape new iconic landmarks.

FChoice Awards 2025: Celebrating Vietnam’s Pioneering Achievements in the Era of Ascendancy

Unveiling a fresh new look, FChoice 2025, hosted by CafeF, continues to solidify its position, celebrating the achievements of the economy. The event on the morning of January 13th is not merely a ceremonial awards ceremony but a strategic nexus where experts and businesses reshape the macroeconomic landscape for the upcoming phase of explosive growth.