The State Bank of Vietnam (SBV) has recently issued guidelines for commercial banks regarding credit growth control for 2026, targeting a system-wide increase of approximately 15%.

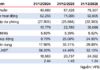

Accordingly, each commercial bank’s credit growth target is calculated using the formula: the bank’s rating score (as per Circular 52/2018/TT-NHNN, amended, with a scale of 1-5) multiplied by the common factor for 2026, which is 2.6% (lower than the 3.5% factor applied in 2024 and 2025). Therefore, if the rating score remains unchanged, a bank’s credit growth limit at the beginning of the year will decrease by nearly 1 percentage point compared to the previous year.

For instance, a bank with a rating score of 5 will have a credit growth limit of around 13% (5 × 2.6% = 13%) relative to the outstanding balance at the end of 2025.

Similar to previous years, the SBV allocates the entire credit growth quota at the beginning of 2026. A new requirement is that credit institutions must ensure that credit growth in the first three months does not exceed 25% of the annual target, to prevent early credit overheating.

Additionally, the regulator mandates that the growth rate of real estate loan balances must not surpass the bank’s overall credit growth rate compared to the end of 2025. This means if a bank has a general credit growth limit of 13%, its real estate loan balance can also increase by a maximum of 13% compared to the growth in this sector at the end of 2025.

For example, if the real estate loan balance at the end of 2025 is 100 billion VND, in 2026, the maximum loan amount can only increase to 113 billion VND (a 13% increase, equivalent to 13 billion VND). Banks violating this rule may face reductions in their overall credit quota.

Financial experts suggest that this requirement aims to reduce risks in the banking system, especially given the significant growth in real estate loans (33% in 2023, 34% in 2024, and 31% by September 2025), which has led to maturity mismatches, liquidity issues, and potential bad debt risks.

Regarding real estate credit, at a discussion on Vietnam’s and the global economic outlook for 2026, organized by Standard Chartered Vietnam in Ho Chi Minh City on January 13, Ms. Nguyen Thuy Hanh, CEO of the bank, stated that to control bad debt risks, the SBV aims for banks to maintain consistent growth throughout the year, rather than concentrating 15% growth in the first quarter. This is a new and positive development.

Why is it necessary to control the growth rate of real estate loans?

At Standard Chartered Vietnam, the bank’s management does not restrict credit growth in any economic sector but aims for balanced growth across sectors, especially those critical to customers.

Regarding real estate credit, the bank has always paid close attention to the inherent risks in the real estate market, not just this year. However, in reality, credit growth in the real estate sector in 2025 was significantly higher than in previous years. How can we achieve economic growth and credit expansion while managing risks, particularly those from real estate?

Banks are encouraged to increase lending to residential and social housing projects. Photo: Lam Giang

“Credit should be directed towards real estate projects that are crucial to the economy, ensuring quality and meeting genuine public needs. The focus should be on real estate projects in industrial zones, residential areas, and especially social housing. These areas are of significant importance. When banks prioritize capital for projects that benefit both the public and the economy, credit risks will be managed at a reasonable level,” said Ms. Nguyen Thuy Hanh.

By the end of 2025, the banking system’s credit growth for the economy reached approximately 19.1%—the highest in recent years. Real estate loans accounted for a significant portion, around 20-30% of the total outstanding balance in some commercial banks.

Latest Updates on Credit Growth Control

The State Bank has mandated that credit institutions strictly control credit growth in 2026 using a new formula, prioritizing lending for production and business activities while maintaining special oversight on real estate credit.