On January 13th, the FChoice 2025 Awards Ceremony and the “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026” Seminar officially took place at the Sheraton Hotel (Hanoi).

The event honored outstanding businesses, entrepreneurs, and economic milestones of Vietnam in 2025, while opening a platform for in-depth dialogue on the path towards achieving a growth rate of over 10% during 2026–2030.

In his opening speech, Mr. Pham Quang Minh – Director of CafeF, painted a picture of Vietnam’s remarkable transformation through the message “Extraordinary Normality.” This extraordinariness is also evident in the maturity of domestic enterprises. With confidence in the shift of FDI flows and the determination to remove institutional “bottlenecks,” Vietnam is entering an era of reaching new heights, posing an inspiring question for investors: “As Vietnam rises daily, why not bet on its future?”

Mr. Pham Quang Minh – Director of CafeF delivering the opening speech

Following this, Dr. Vo Tri Thanh – Director of the Brand and Competition Strategy Institute (BCSI), provided profound analysis of the international context and Vietnam’s strategy. He noted that the world is in an unprecedented period of uncertainty, where significant risks and challenges coexist with immense opportunities. In this context, Vietnam steadfastly pursues its ambition to become a developed nation within 20-25 years, based on four strategic pillars.

First, flexible engagement in a multipolar world: Vietnam does not “choose sides” but flexibly approaches all major partners such as the US, China, middle powers, and the potential-rich ASEAN region. He emphasized that ASEAN will soon become a consumer market comparable to Europe within 5-7 years.

Second, enhancing domestic capacity and macroeconomic stability: This is a crucial pillar to absorb external shocks and create a foundation for production and business. He cautioned against maintaining excessively high credit growth and stressed the need for close coordination between fiscal and monetary policies.

Dr. Vo Tri Thanh – Director of BCSI speaking at the Seminar

Third, unlocking domestic resources: Dr. Vo Tri Thanh pointed out that while domestic savings are substantial (37% of GDP), actual investment only reaches 32-33% of GDP, with a significant portion being foreign investment. A large amount of capital is tied up in real estate, gold, and other financial channels, which need to be mobilized through trust to serve sustainable growth.

Lastly, new rules and ways of playing: To leverage new development spaces like the digital and international financial spaces, Vietnam requires a revolution in legal frameworks, technology, and high-quality human resources. He particularly emphasized that “strategic autonomy” and “technological sovereignty” are key for Vietnamese enterprises to reach global heights.

Session 1 of the Seminar with the theme “Double-Digit Economic Growth Drivers”

Based on these strategic directions, Session 1 featured discussions by speakers Prof. Tran Dinh Thien, Mr. Dang Thanh Tam – Chairman of Kinh Bac (KBC), Mr. Pham Hong Hai – CEO of OCB Bank, and Mr. Nguyen Duc Hung Linh – Deputy CEO of AgriS (SBT) on the theme “Double-Digit Economic Growth Drivers.”

Amid significant changes in mechanisms and policies in 2025, Prof. Tran Dinh Thien noted that the country has turned the world’s normality into extraordinariness by viewing the private sector as the strongest growth driver, the foundation, core, and impetus. He highlighted that the difference this time lies in the approach by ministries and sectors—such as the “quartet” and “octave”—a comprehensive, systemic approach that changes the entire landscape rather than addressing individual issues.

Prof. Tran Dinh Thien sharing insights at Session 1

According to him, the new growth model is based on three factors: recognizing the private sector’s role, science and technology as foundational productive forces, and a systemic approach to infrastructure development. Despite concerns about implementation capacity, he believes that if successful, the country will develop optimally in both quantity and quality.

Echoing this perspective in the banking sector, Mr. Pham Hong Hai (CEO of OCB) stated that the mindset of “Decide quickly – Execute quickly – Take clear responsibility” is becoming the norm. The banking sector has seen important shifts, such as lending based on cash flow rather than just collateral, and recognizing green credit not only as a social responsibility but also as a business opportunity for stable, safe growth.

Mr. Pham Hong Hai – CEO of OCB Bank

From a macroeconomic and FDI attraction perspective, Mr. Dang Thanh Tam (Chairman of KBC) observed a synergy where the gap between words and actions is narrowing more than ever, accelerating investment progress and controlling inflation. He highly praised diplomatic achievements as Vietnam established Comprehensive Strategic Partnerships with most major powers, creating remarkable economic stability. With the momentum of this rising era, he believes that within 10 years, Vietnam’s GDP could enter the top 10 globally, leveraging its “golden population” period and high-quality human resources returning from abroad.

Mr. Dang Thanh Tam – Chairman of KBC

While countries like Japan and South Korea face growth challenges, Vietnam’s momentum is soaring. The remaining issue is how Vietnam absorbs capital, implements policies, and executes projects through a unified planning framework from central to local levels.

We all need to build and execute this plan with love for the country and extraordinary determination to firmly step into the new era.

For domestic enterprises entering the global market, Mr. Nguyen Duc Hung Linh (Deputy CEO of AgriS) emphasized that green standards (ESG) and traceability are two critical factors for competition. Enterprises must fully digitize and centralize data to provide source files within 4 hours as required internationally. Traceability now extends beyond food safety to include social and environmental criteria such as no deforestation and ensuring labor rights.

Mr. Nguyen Duc Hung Linh – Deputy CEO, AgriS Investment Division

Regarding banking strategy, Mr. Pham Hong Hai clarified that the green growth strategy does not conflict with rapid growth but creates new momentum. With a need for approximately $150,000 USD in renewable energy investment by 2030, green credit helps banks reduce bad debts and lower operating costs through digitization.

In the 2000s, we talked a lot about mobile and cell phones, but now, the new trend is ESG and AI. This is the trend that any enterprise leveraging can achieve extraordinariness, shared the CEO of OCB.

Contributing to the double-digit growth goal, Mr. Dang Thanh Tam noted that KBC is leading in green growth and actively inviting international consultants for carbon credit advice. Alongside developing social housing to stabilize workers’ lives, KBC is proactively planning AI Data Centers to attract high-tech capital from giants like NVIDIA, Amazon, and Apple. He likened Kinh Bac City to building “smart ports” to welcome “global ships.”

Concluding Session 1, Mr. Pham Hong Hai highlighted the need to eliminate “abnormalities” for sustainable development, such as double bookkeeping and “greasing” practices, replacing them with transparency and work efficiency.

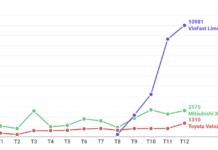

Between the two sessions, Mr. Nguyen Quang Thuan – Chairman of FiinGroup and FiinRatings, presented on the economic outlook for 2026 and the core question: “How to achieve sustainable double-digit growth?” A notable highlight he shared was that in 2025, Vietnam’s stock market achieved an all-time record by mobilizing approximately 141 trillion VND.

However, to turn policies into tangible growth figures, he stressed the recurring message: “Everything is ready, resolutions are in place, but the first question is where is the money?” According to his analysis, 2025 growth relied mainly on public investment (contributing 30%) and FDI, while private sector investment remained weak (increasing only 8.4%) and consumer demand was pessimistic. He warned that without appropriate capital structure and continuing to use short-term bank capital for long-term financing, financial risks would arise.

Mr. Nguyen Quang Thuan – Chairman of FiinGroup and FiinRatings

Forecasting capital channels for 2026, Mr. Thuan expected the corporate bond market to surge to 1 million billion VND, and equity capital to continue surpassing 2025 records due to interest from new-generation foreign investors.

He also noted the importance of upgrading the national credit rating to reduce foreign currency borrowing costs, affirming that state-owned enterprises have significant growth potential if they focus on efficiency and productivity rather than just the private sector. Concluding his presentation, he emphasized that without jointly opening up the capital market, good policy intentions would not translate into specific financial figures for the growth strategy.

Session 2 with the theme: “Investment Opportunities in 2026”

Session 2, themed “Investment Opportunities in 2026,” featured speakers: Ms. Nguyen Thi Thu Hien (CEO of TCBS); Mr. Dinh Ngoc Dung (Chairman and CEO of Bao Tin Capital); and Mr. Nguyen Quoc Hiep (Chairman of GP Invest).

Opening the investment opportunity discussion, Ms. Nguyen Thi Thu Hien noted that 2026 is a pivotal year with a focus on double-digit economic growth and a strong recovery in the private sector. She emphasized comprehensive asset management strategies including stocks, bonds, gold, real estate, and digital assets. With market upgrade prospects, foreign capital inflows could reach $25 billion within 5 years, offering significant portfolio diversification opportunities.

Ms. Nguyen Thi Thu Hien – CEO of TCBS

Regarding the gold market, Mr. Dinh Ngoc Dung (CEO of Bao Tin Capital) highlighted the 10% price gap between domestic and international markets due to supply shortages. However, breaking SJC’s gold monopoly under Decree 232 and plans for a national gold trading floor in 2026 will enhance transparency, narrow price gaps, and boost investor development.

Mr. Dinh Ngoc Dung, Chairman and CEO of Bao Tin Capital

In real estate, Mr. Nguyen Quoc Hiep (Chairman of GP Invest) predicted that 2026 would partially address supply-demand imbalances through social housing and old apartment renovations. The market will shift towards suburban areas along infrastructure axes and urban railways, with intense selection favoring only visionary and experienced developers.

Analyzing the stock market further, Ms. Nguyen Thi Thu Hien believed that 2026 still holds potential with expected 15–20% corporate profit growth. She forecast VN-Index could surpass 1,800 points, even reaching 2,000 points. However, she advised investors to remain cautious, focus on sectors like finance-banking, energy, manufacturing, and retail, while leveraging AI for financial literacy enhancement.

On real estate challenges, Mr. Nguyen Quoc Hiep warned of pressures from approximately 26,000 unsold units and rising bank interest rates. He stressed that without reasonable pricing strategies and cash flow control, 2026 risks would be significant.

Mr. Nguyen Quoc Hiep – Chairman of GP Invest

Concluding the discussion, speakers agreed that with “destiny unlocked” and sufficient trust, Vietnam can achieve extraordinary feats. The financial market is moving towards “democratization,” requiring investors to continuously learn and diversify assets for sustainable strategies in the new era.

Unprecedented Milestone: Vietnamese Stock Market Achieves Historic Feat

In 2025, Vietnam’s stock market achieved an unprecedented milestone: mobilizing a record-breaking 141 trillion VND, a feat never seen before, according to Mr. Nguyễn Quang Thuân, Chairman of FiinGroup and FiinRatings.

FChoice Awards 2025: Celebrating Vietnam’s Pioneering Achievements in the Era of Ascendancy

Unveiling a fresh new look, FChoice 2025, hosted by CafeF, continues to solidify its position, celebrating the achievements of the economy. The event on the morning of January 13th is not merely a ceremonial awards ceremony but a strategic nexus where experts and businesses reshape the macroeconomic landscape for the upcoming phase of explosive growth.

Expert Forecast: 2026 Inflation Projected at 3.5%, Caution Advised Amid Persistent Pressures

Inflation in 2026 is projected to rise above the previous year’s levels, though not dramatically. However, monetary factors, growth dynamics, and exchange rate fluctuations demand a more cautious approach in policy coordination to balance growth support with macroeconomic stability.