Gold prices are projected to surge above $5,000 per ounce in the first quarter, while silver is expected to reach $100 per ounce, according to Citigroup analysts.

Led by strategist Kenny Hu, Citi’s team raised their 3-month targets for gold to $5,000 per ounce and silver to $100 per ounce on January 13th. The Wall Street giant forecasts that the current precious metals rally will persist into early 2026.

The strategists cited “heightened geopolitical risks, ongoing physical market deficits, and renewed uncertainty around Federal Reserve independence” as reasons for the upward revision.

While both metals have already hit record highs this year, Citi reiterates its expectation that silver will outperform gold. However, they predict base metals will be the top performers in 2026.

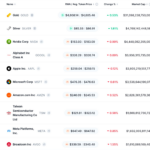

Gold and silver price movements over the past year.

“We maintain our view that silver will rally strongly and that the precious metals market will broaden into industrial metals, with the latter taking center stage,” the strategists wrote.

They also highlighted current physical market shortages, particularly in silver and platinum group metals. Uncertainty surrounding Section 232 tariff decisions on critical minerals poses “significant risks to trade flows and pricing.”

Citi warns that in a high-tariff scenario, physical shortages could worsen. While an influx of metals into the US might cause a price spike, clarity on tariffs could lead to an outflow, putting downward pressure on prices.

The strategists caution that “a silver price collapse from outflows (if any) due to S232 could trigger tactical selling across precious and base metals.” However, they would view this as a buying opportunity in a broader bullish market, as fundamental upside drivers remain intact across the metals complex.

Citi’s updated forecast assumes geopolitical tensions ease after Q1. As a result, precious metal demand is expected to wane later in the year, with gold most vulnerable to correction. However, the bank remains bullish on industrial metals like aluminum and copper for the second half of 2026.

Silver Skyrockets, Surpassing Big Tech to Become the World’s Second-Largest Asset

Silver prices continue to surge amid escalating concerns over the Federal Reserve’s independence, mounting geopolitical tensions, and a prevailing trend of monetary policy easing.

“Massive Gold Reserves Discovered Scattered in Safes and Under Beds Across Homes”

There are varying estimates, but according to a conservative assessment, the amount of gold held by the public could reach approximately 500 tons. Converted at current prices, this figure is equivalent to about 2,000 trillion VND, or roughly 80 billion USD. If effectively mobilized, this substantial asset could become a significant capital source for investment and economic development.

Silver Surges 13% in 13 Days, Gold Hits $4,600: Is a New Super-Bull Cycle on the Horizon?

Questions surrounding the Federal Reserve’s independence could spark the next $500 surge in gold prices.