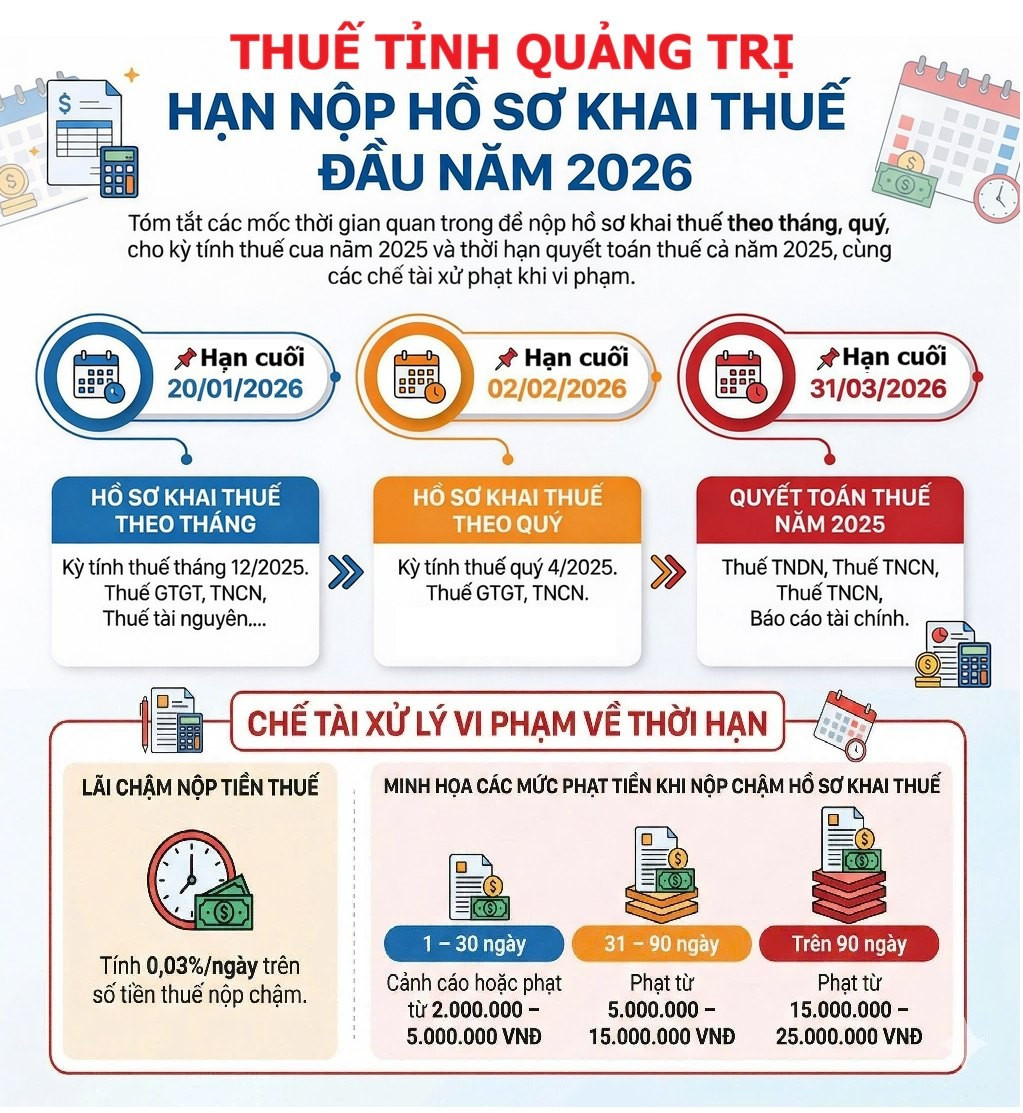

According to the Quang Tri Provincial Tax Department, there are three critical deadlines for tax filing in the final months of the year and the 2025 tax settlement.

Specifically, by January 20, 2026, taxpayers must submit their monthly tax returns for December 2025, including Value Added Tax (VAT), Personal Income Tax (PIT), Resource Tax, and related taxes.

Tax filing deadlines and penalties for violations. Source: Quang Tri Provincial Tax Department.

By February 2, 2026, taxpayers must file their quarterly tax returns for Q4/2025, applicable to VAT and PIT.

The final deadline for the 2025 tax settlement is March 31, 2026, covering Corporate Income Tax (CIT), PIT, and annual financial reports.

The tax authority emphasizes that late tax filings will incur penalties based on the severity of the delay. Specifically, delays of 1-30 days result in a warning or a fine of 2-5 million VND; delays of 31-90 days incur a fine of 5-15 million VND; and delays exceeding 90 days result in a fine of 15-25 million VND.

Additionally, late tax payments will accrue a late payment fee of 0.03%/day on the overdue tax amount.

Taxpayers, businesses, and households are advised to proactively review their records and accounting books, submit declarations and settlements on time, and avoid incurring penalties and late fees.

HT1 Fined and Taxed Over 2.6 Billion VND

Vicem Hà Tiên Cement has been issued an administrative penalty for tax violations, totaling over 2.6 billion VND, which must be paid to the State Budget.

Declared and Paid Full Taxes but Still Fined Up to 8 Million VND in This Scenario

Unveiling the Penalties for Tax Declaration Errors: What Every Citizen Must Know

Navigating the complexities of tax declarations can be daunting, and errors may lead to significant penalties. It’s crucial for individuals to understand the consequences of inaccurate or fraudulent tax filings. From fines to legal repercussions, the implications of mistakes in tax declarations are far-reaching. Stay informed and ensure compliance to avoid these costly pitfalls.

Kido to Distribute Nearly VND 350 Billion in Dividends to Shareholders in 2024

Kido is set to distribute a 12% cash dividend to its shareholders for the year 2024, with the final registration date for eligibility being January 14, 2026.