I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

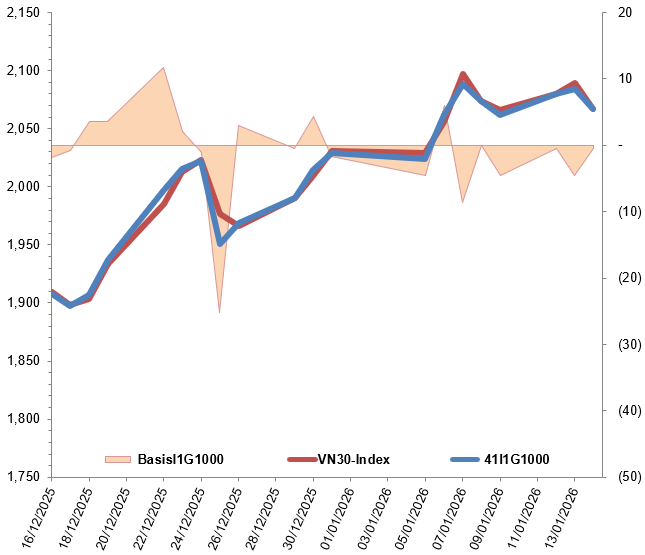

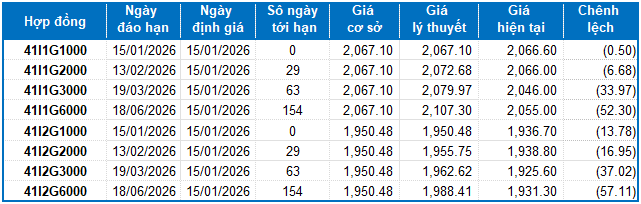

On January 14, 2026, all VN30 futures contracts experienced declines. Specifically, 41I1G1000 (I1G1000) dropped by 0.86% to 2,066.6 points; 41I1G2000 (I1G2000) fell by 1.1% to 2,066 points; 41I1G3000 (I1G3000) decreased by 1.99% to 2,046 points; and 41I1G6000 (I1G6000) declined by 1.33% to 2,055 points. The underlying index, VN30-Index, closed at 2,067.1 points.

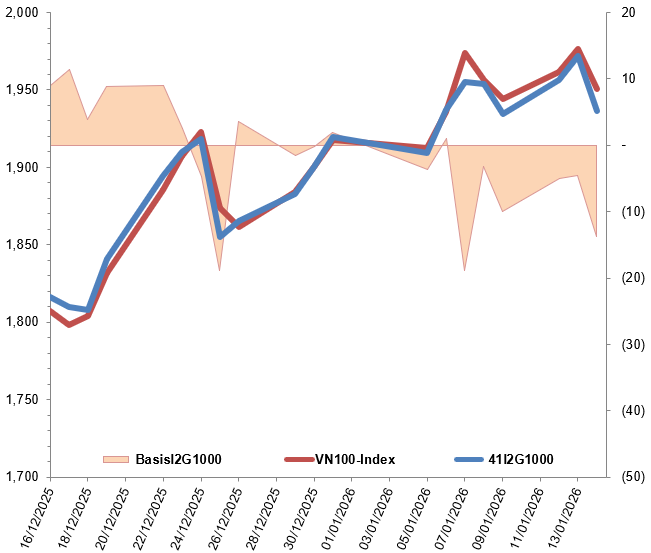

Similarly, VN100 futures contracts also saw widespread declines. The 41I2G1000 (I2G1000) contract fell by 1.79% to 1,936.7 points; 41I2G2000 (I2G2000) dropped by 0.85% to 1,938.8 points; 41I2G3000 (I2G3000) decreased by 2.12% to 1,925.6 points; and 41I2G6000 (I2G6000) declined by 1.17% to 1,931.3 points. The underlying VN100-Index closed at 1,950.48 points.

During the January 14, 2026 session, the 41I1G1000 contract entered a prolonged stalemate around the reference mark for most of the session. Short sellers gained the upper hand toward the end of the morning session, pushing I1G1000 into negative territory. In the afternoon session, selling pressure intensified, causing the contract to plummet despite buyers re-entering the market. Ultimately, I1G1000 closed in the red, shedding 18 points.

Intraday Chart of 41I1G1000

Source: https://stockchart.vietstock.vn

At the close, the basis of the I1G1000 contract narrowed compared to the previous session, reaching -0.5 points. This suggests a slight improvement in investor sentiment.

Fluctuations of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

In contrast, the basis of the I2G1000 contract widened compared to the previous session, reaching -13.78 points. This indicates a more pessimistic outlook among investors.

Fluctuations of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

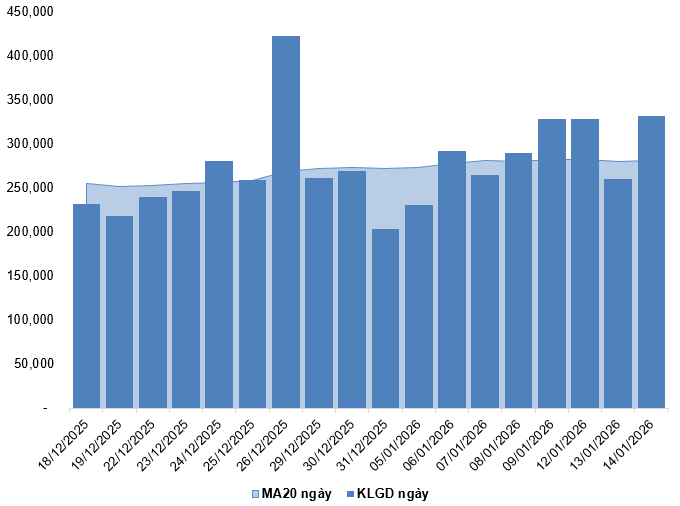

Trading volume and value in the derivatives market increased by 27.35% and 26.37%, respectively, compared to the January 13, 2026 session. Specifically, the trading volume of I1G1000 rose by 23.98% to 316,715 contracts. The trading volume of I2G1000 reached 36 contracts, up 9.09%.

Foreign investors continued to sell off, with a net selling volume of 222 contracts during the January 14, 2026 session.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of January 15, 2026, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) has been replaced by the average deposit rate of major banks, with term adjustments suitable for each type of futures contract.

I.3. Technical Analysis of VN30-Index

On January 14, 2026, the VN30-Index declined, accompanied by trading volume exceeding the 20-session average, indicating subdued investor sentiment. The index is currently retesting the October 2025 high (equivalent to the 2,035-2,080 range), which was previously breached. Meanwhile, the Stochastic Oscillator has issued a sell signal in the overbought territory.

If conditions do not improve and the indicator exits this zone in upcoming sessions, short-term risks will escalate.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

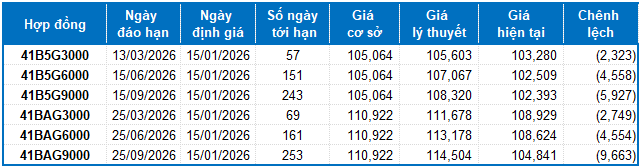

Based on the fair pricing method as of January 15, 2026, the fair price range for government bond futures contracts currently trading in the market is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) has been replaced by the average deposit rate of major banks, with term adjustments suitable for each type of futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, 41B5G9000, 41BAG3000, 41BAG6000, and 41BAG9000 are currently attractively priced. Investors should focus on these contracts and consider buying in the near term, as they present a favorable opportunity in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 14/01/2026

Technical Analysis for the Afternoon Session of January 13th: Continuing to Set New Highs

The VN-Index continues its upward trajectory, setting a new all-time high. The index is now targeting the 1,935-1,950 point range. Meanwhile, the HNX-Index shows robust growth, breaking above the upper boundary of its Falling Wedge pattern.