Giaiphong Automobile Joint Stock Company (stock code: GGG) has released its Q4/2025 financial report.

In Q4/2025, the company recorded net revenue of VND 27.5 billion, a 59% increase compared to the same period in 2024. For the full year 2025, net revenue surged to nearly VND 116 billion, 5.1 times higher than the previous year. This marks the highest annual revenue for GGG in the last decade, since 2016.

However, the significant revenue growth has not been enough to turn the company profitable, as it continues to operate below cost.

In Q4, the company reported a gross loss of over VND 510 million, and for the entire year 2025, a gross loss of over VND 1 billion, down from a gross loss of over VND 6 billion in 2024.

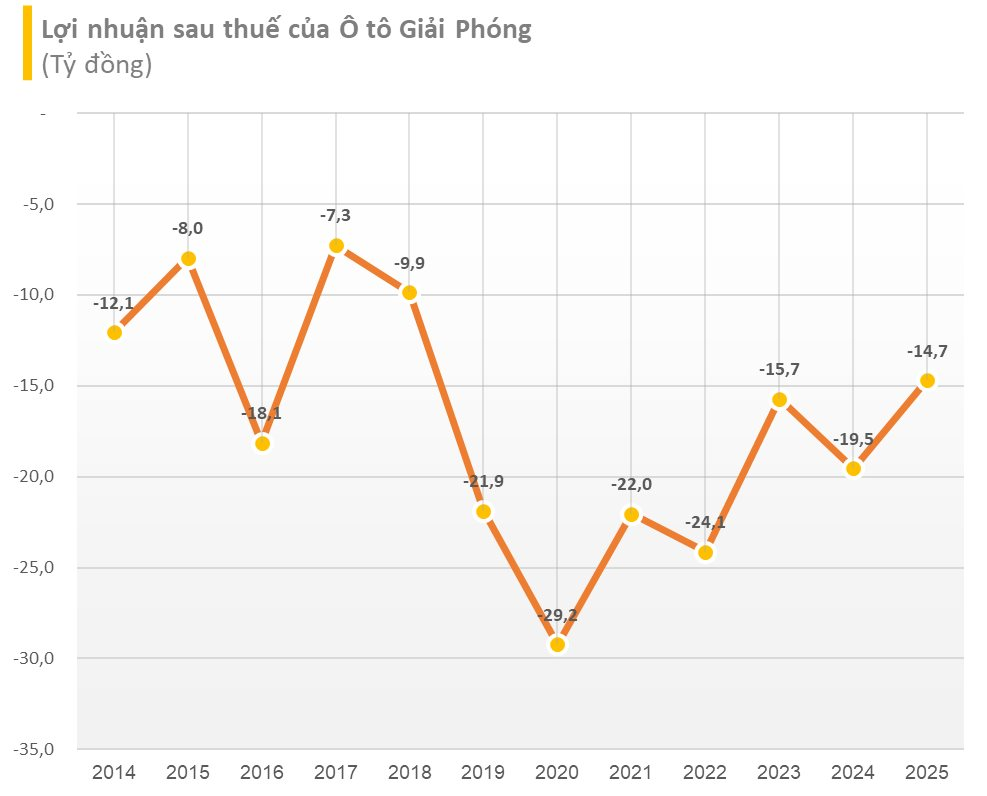

After deducting expenses, GGG posted a post-tax loss of nearly VND 4 billion in Q4 and a post-tax loss of nearly VND 15 billion for the year 2025. This marks the 15th consecutive year of losses for GGG.

As of December 31, 2025, the company’s accumulated losses reached over VND 360 billion, with negative equity of nearly VND 66 billion.

By the end of 2025, GGG’s total assets stood at nearly VND 20 billion, a 41% decrease from the beginning of the year. The primary reason was an 82% reduction in inventory, dropping from nearly VND 13 billion to over VND 2 billion.

Total liabilities as of year-end were VND 86 billion, with financial debt totaling over VND 57 billion.

Giaiphong Automobile was established in 2001, originally named Ha Giang Electromechanical Joint Stock Company.

The company’s core business includes manufacturing and assembling trucks, automobile trading, designing and modifying road motor vehicles, and producing new or modified road motor vehicles.

Leveraging its strategic location near the Thanh Thuy international border gate (approximately 2 km away), the company also operates in logistics, warehousing, cross-border services, and import-export activities.

Currently, the company operates a 70,000 m² assembly plant in Tuyen Quang province, with a capacity of 5,000 vehicles per year. GGG listed its GGG shares on HNX in 2009 but was delisted and moved to UPCoM in late 2013 due to continuous losses.