Awkward Record-Keeping, Fear of Penalties

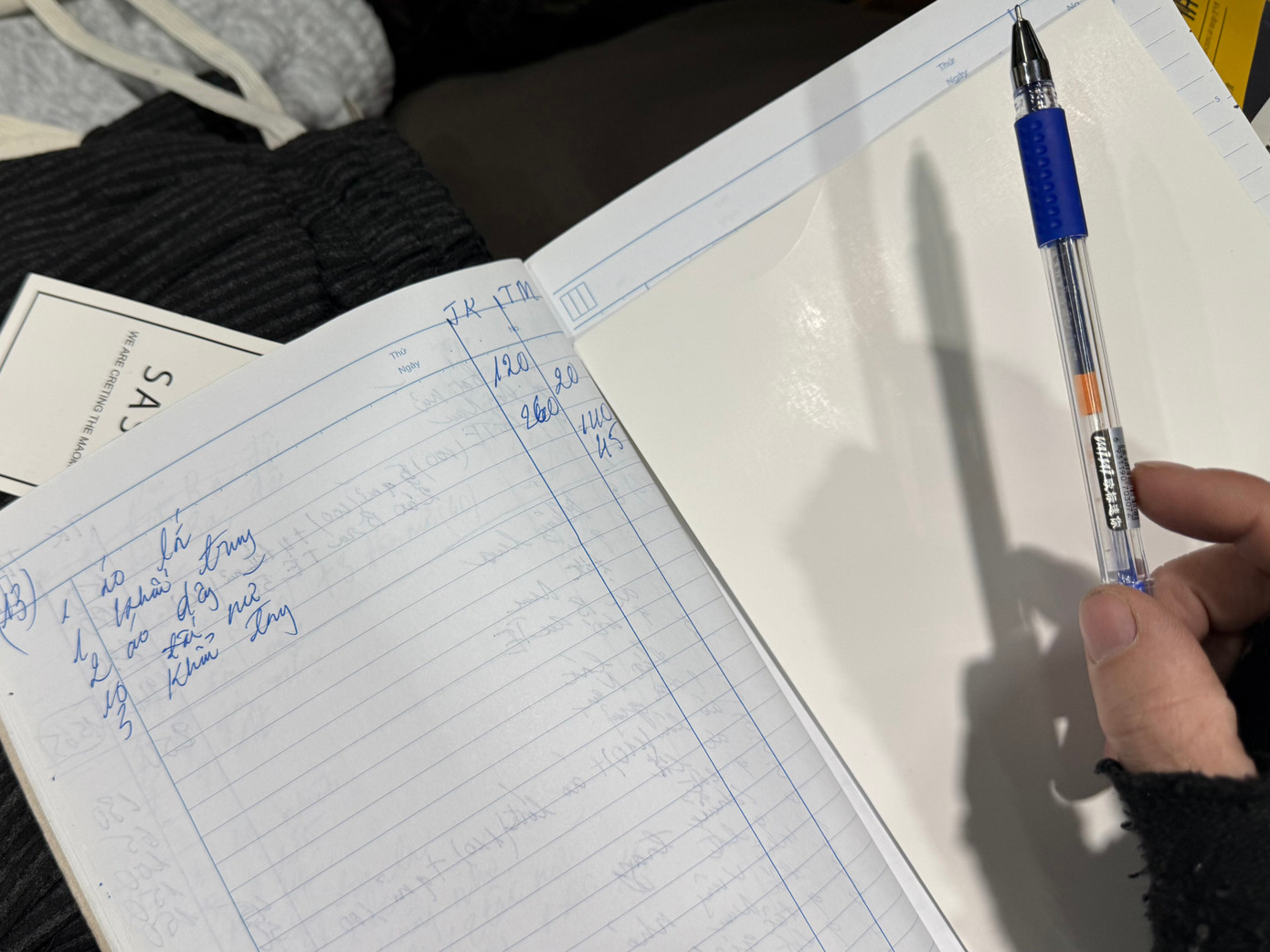

In reality, business households are adopting various methods to adapt. Mrs. Phuong Loan, a clothing and accessory vendor at Chợ Mơ market in Hanoi, shared that since January 1st, she has been manually recording all transactions. She divides her notebook into simple columns for quantity, product name, cash, and bank transfers to track daily sales.

From January 1, 2026, business households officially implement self-declaration and tax payment methods.

“I’m not sure if my method is correct or if the tax authority will accept it, but for now, I’m just getting used to it,” said Mrs. Loan. She added that although she registered for a sales software as instructed, she is still unsure about operations like inventory data entry and order creation.

According to Mrs. Loan, many middle-aged vendors at the market are using similar manual recording methods, learning as they go, unsure of their accuracy. Business households hope for direct and clear guidance from tax officials, especially during this initial transition phase.

Sales record book created by business households.

Mrs. Lan (over 60 years old), a clothing vendor at Chợ Mơ, manages everything herself and plans to hire an accounting service for support. She purchased the software but hasn’t started bookkeeping due to uncertainty about the process.

“We’ve been in business for years and are willing to fulfill our tax obligations. But our biggest concern is not knowing if we’re doing it right and whether we’ll face penalties years later during inspections,” Mrs. Lan expressed.

Many vendors mentioned that stall rental fees at the market range from around 6 million VND/month, while purchasing power at traditional markets is slowing. Business picks up closer to Tet, but overall revenue is declining. The new regulation raising the tax-exempt revenue threshold to 500 million VND/year for business households is welcomed but still causes concern due to rapidly changing rules that are hard to keep up with. Particularly, issues like inventory and previously purchased goods without invoices remain unclear.

Complex Ledger Templates Persist

The Ministry of Finance issued Circular 152/TT-BTC guiding accounting for business households and individuals, effective from January 1, 2026, replacing Circular 88/2021/TT-BTC. Circular 152 introduces changes such as reducing the number of required books and documents.

Speaking with Tiền Phong, Mr. Le Van Tuan, Director of Keytas Tax Accounting Company, noted that Circular 152 changes the approach by no longer requiring traditional accounting documents like receipts, payment vouchers, or inventory slips. It allows business households to choose between electronic or paper storage for tax-related documents. Circular 152 also reduces the number of ledger templates from 7 to 4, with simpler designs resembling personal cashbooks.

Despite these simplifications, Mr. Tuan believes the circular should have been issued 45 days before implementation to allow preparation time. In reality, Circular 152 was issued on December 31, 2025, and only widely publicized after the New Year holiday.

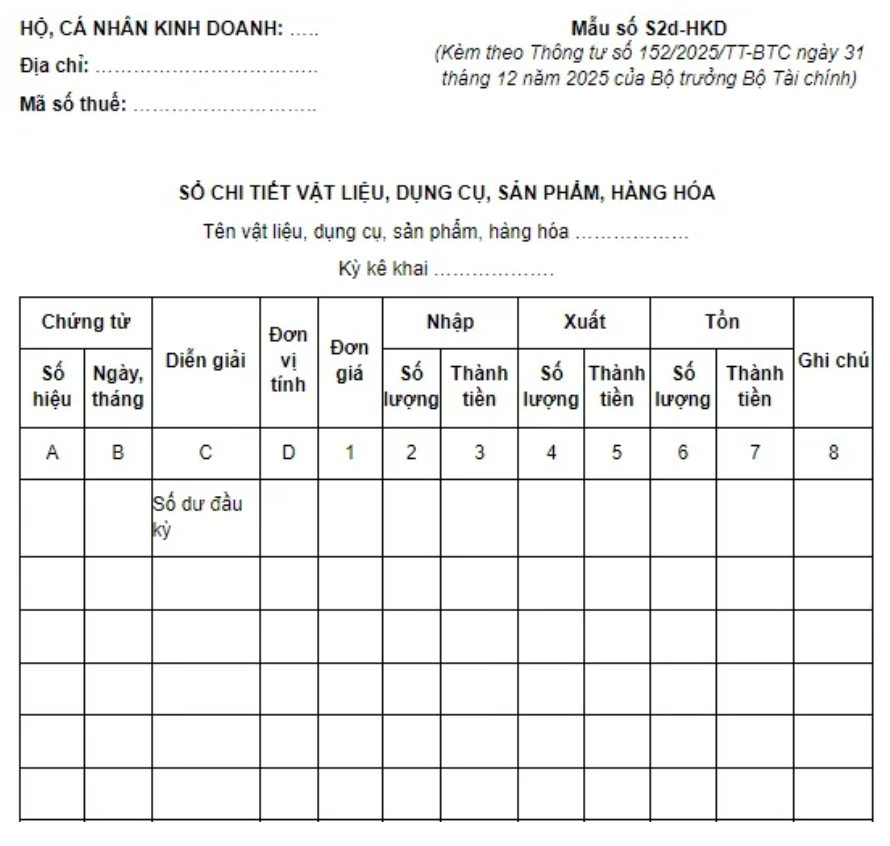

S2d-HKD Ledger Template

Another limitation is the S2d-HKD template for detailed records of materials, tools, products, and goods. This can be challenging for households dealing with multiple items. “The template is complex and requires extensive information, making it impractical for monthly/quarterly tax filings or annual settlements,” said Mr. Tuan. He suggests requiring households to prepare and conduct year-end physical inventory checks instead. This would allow better annual planning and reduce time spent on monthly/quarterly data preparation.

“Legalizing Tax Compliance: Protecting Honest Businesses from Unfair Advantages”

The expert emphasizes that the Tax Administration Law is designed with a risk-based management approach, categorizing different levels of compliance without rigidly or uniformly applying it to all entities.

How Long Should a Business Household Retain Accounting Records?

The Ministry of Finance has officially issued a circular outlining the new accounting regulations for business households. According to the guidelines, accounting documents must be retained for a minimum of five years. Notably, even business households below the tax threshold are required to maintain a ledger for recording revenue from the sale of goods and services.