Mr. Bruno Jaspaert, Chairman of EuroCham

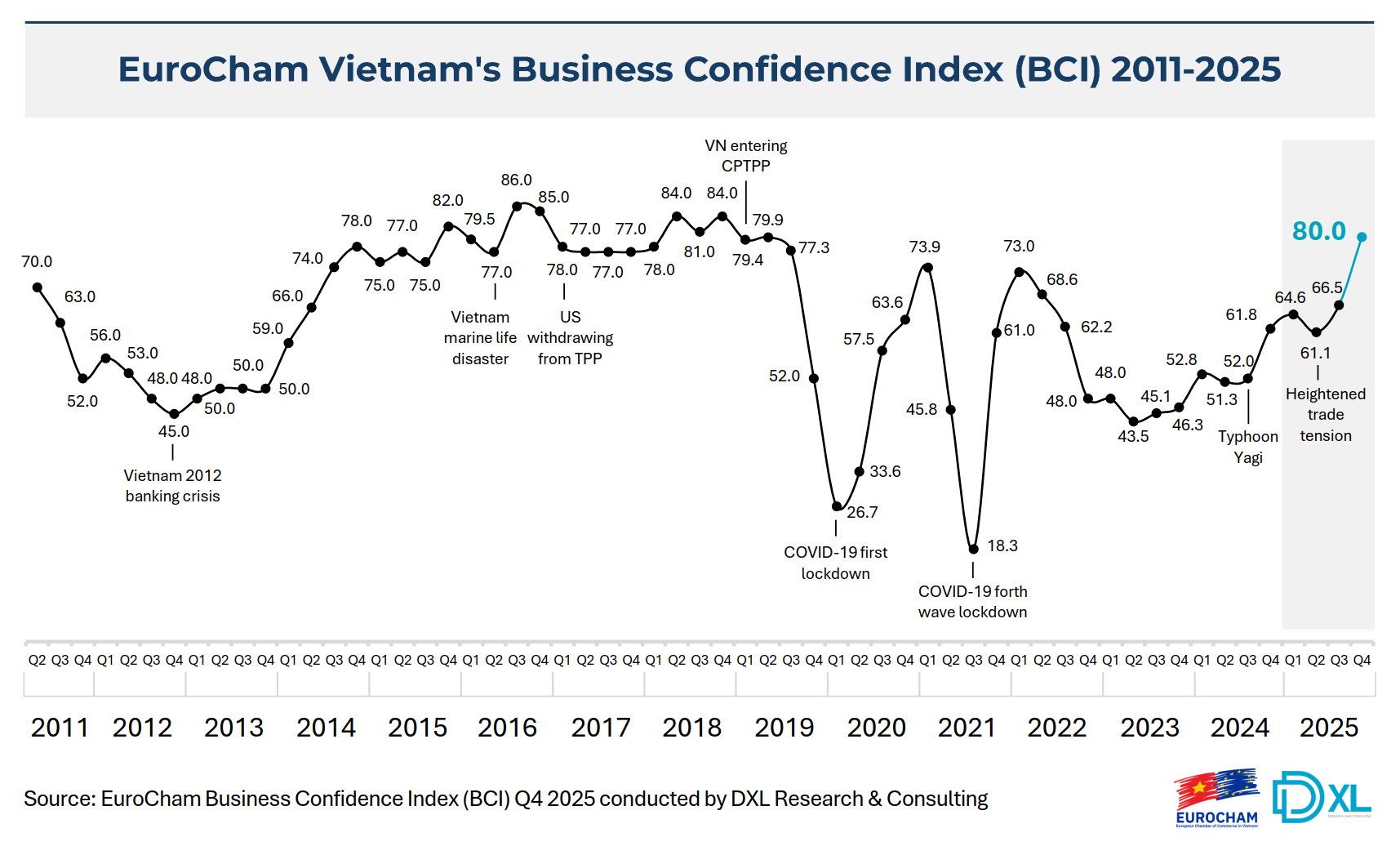

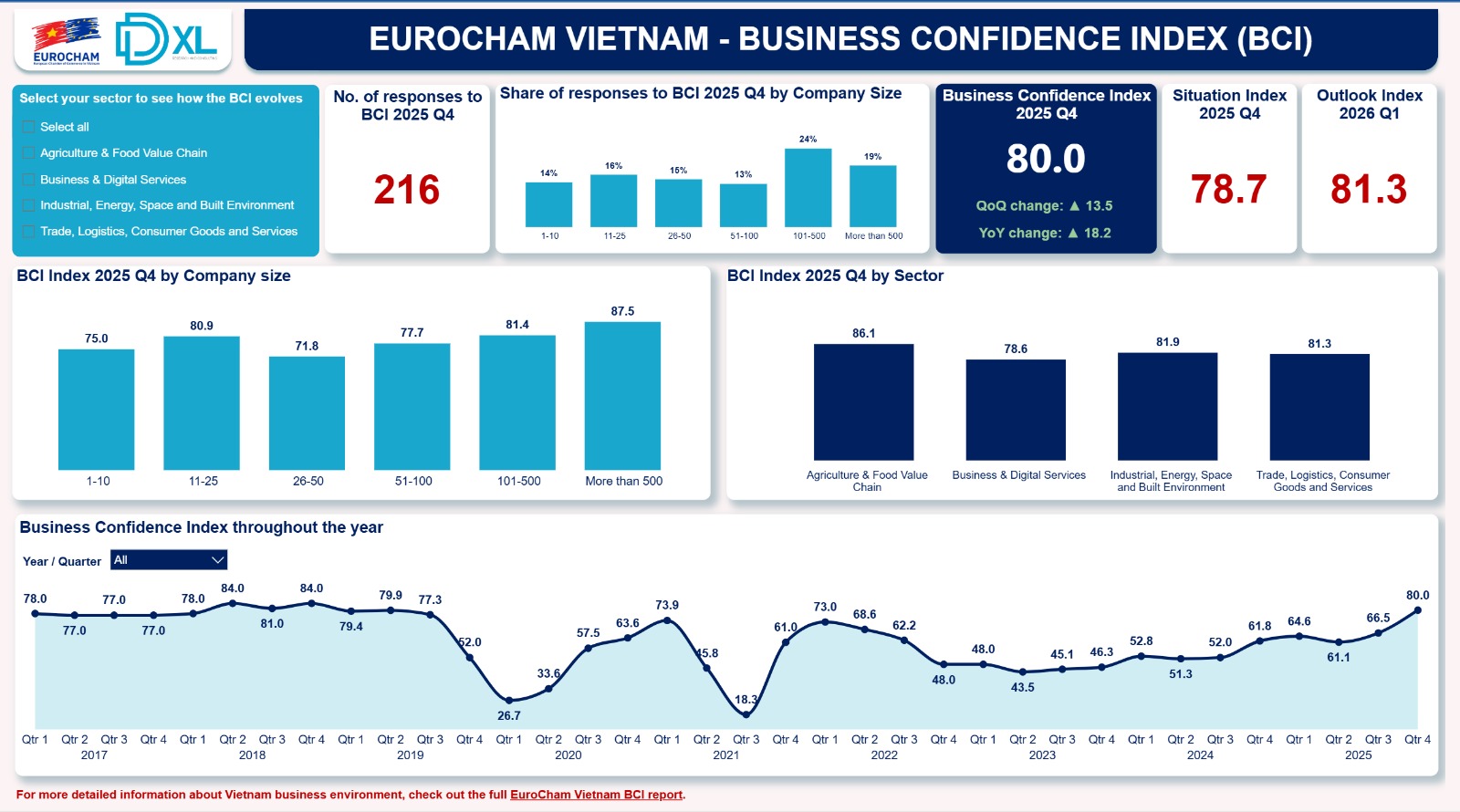

The European Chamber of Commerce in Vietnam (EuroCham) has released its Business Climate Index (BCI) report for the final quarter of 2025, revealing positive signals that surpass initial forecasts. After nearly a decade of supply chain disruptions and pandemic impacts, the BCI has surged to 80 points—its highest level in seven years. This marks a significant recovery, even surpassing pre-tariff and pre-Covid-19 levels.

Source: EuroCham

Data from the report, conducted by DXL Research and Consulting, highlights a clear shift in sentiment from cautious exploration to robust growth. Specifically, 65% of surveyed businesses view their current business situation as positive.

Notably, this figure significantly exceeds the 56% projected in Q3, indicating that European businesses in Vietnam are performing better than their earlier conservative estimates.

Commenting on these impressive figures, Mr. Bruno Jaspaert, Chairman of EuroCham, stated:

“The latest BCI confirms what many of us have intuitively felt. After years of fluctuating around average levels, reaching 80 points demonstrates that confidence is now grounded in tangible results—factories are operational, orders are returning, and investments are being disbursed. We’re witnessing a structural shift, with Vietnam rapidly emerging as a powerful growth engine, poised to enter the top 3 economies in ASEAN.”

Source: EuroCham

This optimism aligns with Vietnam’s macroeconomic recovery, as Q4 2025 GDP growth reached 8.46%, the fastest expansion since 2007.

Mid-Term Expectations and Business Health Disparities

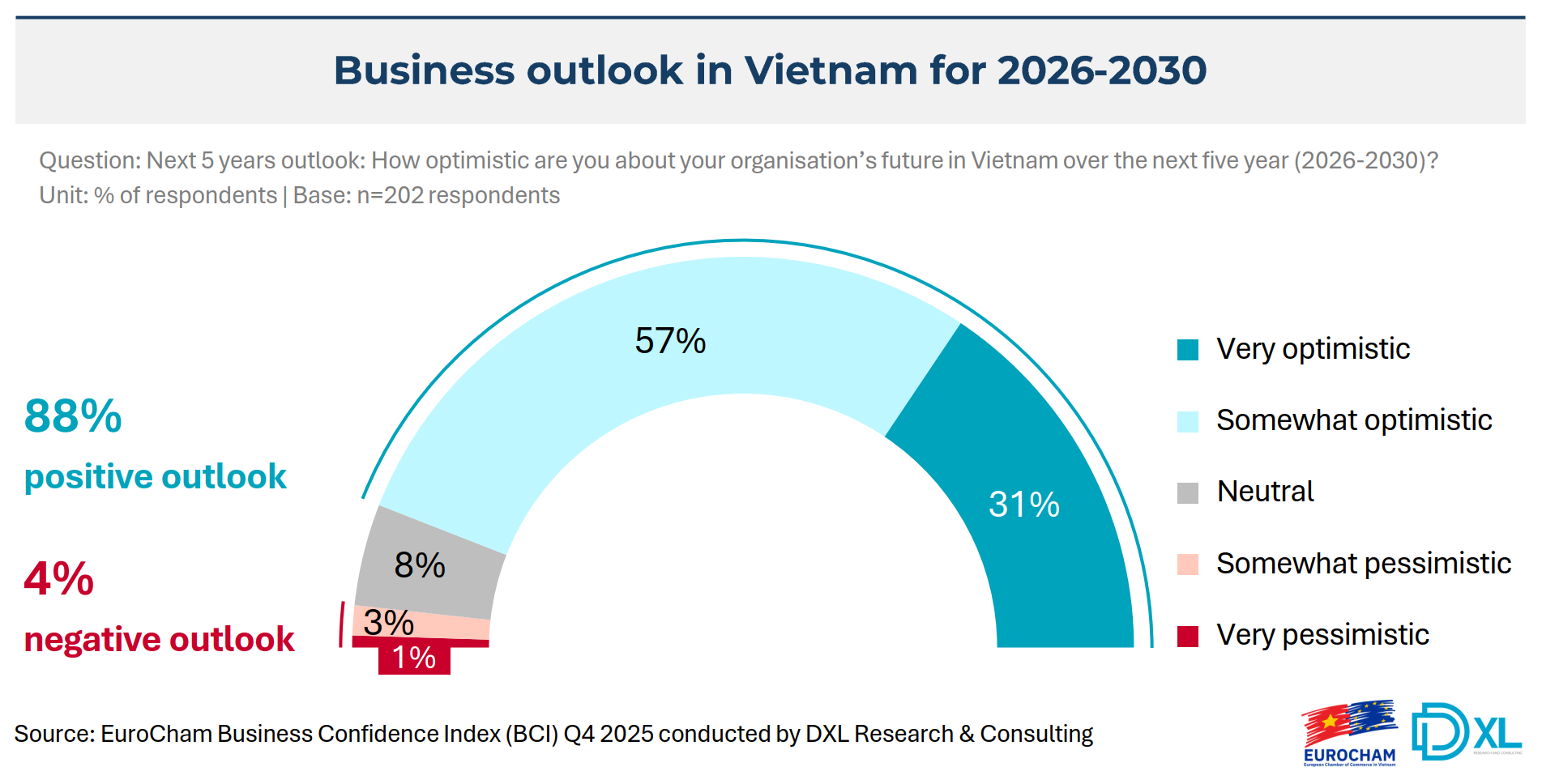

The most significant highlight of this report lies in its mid-term outlook. A remarkable 88% of surveyed businesses expressed optimism about Vietnam’s business prospects from 2026 to 2030, with 31% stating they are “very optimistic.”

Source: EuroCham

Regarding this figure, Mr. Bruno Jaspaert emphasized the rationality of European investors:

“While 88 may seem like a lucky number, it holds deeper significance than a mere optimistic prediction: for our members, it’s a completely rational figure. Over the next 5 to 7 years, with the right moves, Vietnam will enter a golden era of growth and transformation.”

This confidence is bolstered by actual business performance, with 60% of companies reporting better results in 2025 than in 2024, and 82% expecting this growth to continue in 2026. Another critical indicator of market attractiveness is that 87% of businesses are willing to recommend Vietnam as an investment destination to foreign partners.

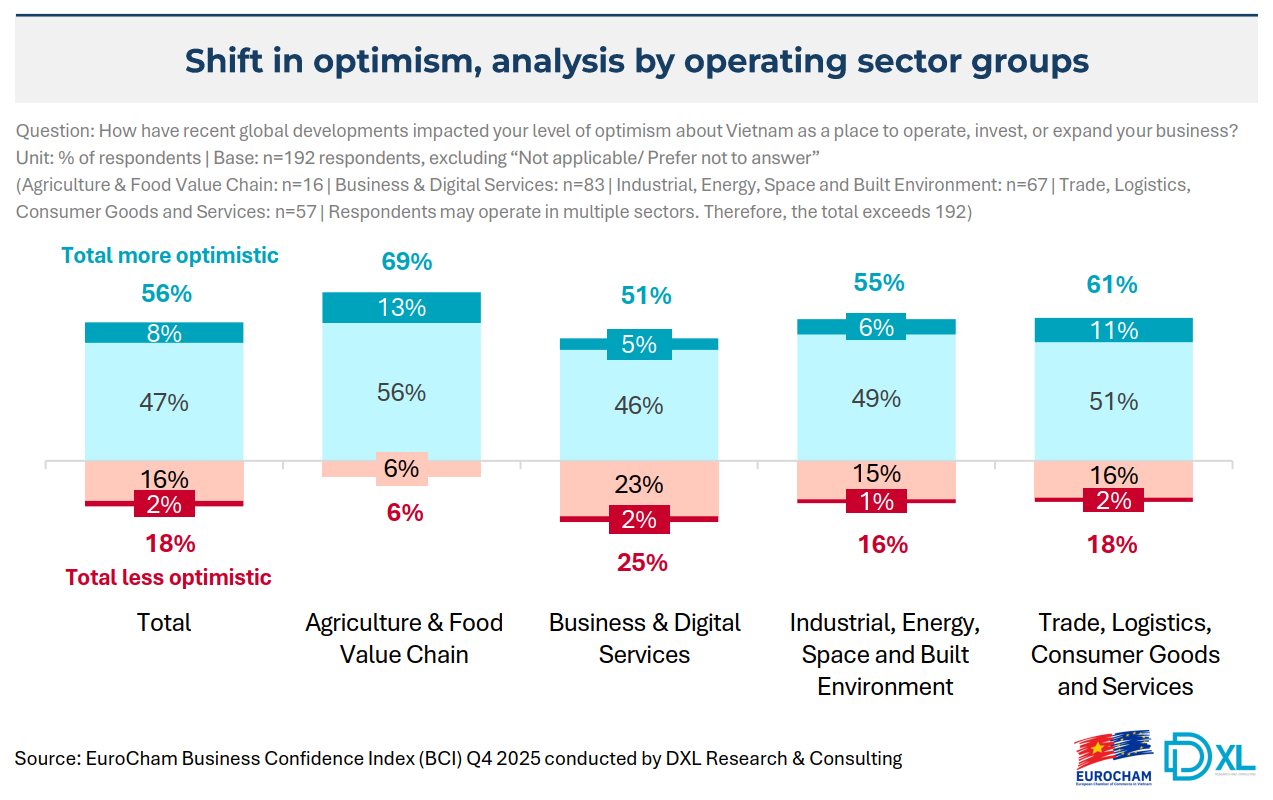

However, the economic landscape is not uniformly rosy. The report highlights a stark disparity in resilience between multinational corporations (MNCs) and small and medium-sized enterprises (SMEs). Amid global trade tensions, particularly U.S. tariff policies, 42% of businesses reported negative impacts. Larger corporations, with their ample resources, are leveraging their scale to strengthen long-term positions, while SMEs remain more vulnerable to external shocks and are prioritizing short-term survival.

Administrative Burdens Ease but Remain a Major Hurdle

Despite rising confidence, administrative burdens remain the top concern, cited by 53% of businesses. However, this figure has decreased by 12 percentage points from the previous quarter, indicating that government reform efforts are beginning to impact the business environment.

Initiatives such as Resolution 68 and the implementation of the VNeID electronic identification system have been positively acknowledged by the business community, though execution challenges persist. Approximately 25% of businesses have noted improvements in their operating environment, but most are still awaiting greater consistency and faster implementation of reform policies.

Source: EuroCham

As 2026 begins, European businesses are focusing their strategies on business development and portfolio diversification (50%), talent retention (45%), and technology adoption, particularly AI (41%). The Q4 2025 BCI data confirms that despite lingering administrative challenges and global volatility, Vietnam’s fundamental strengths are robust enough to absorb shocks and maintain its position as a critical component in European capital’s long-term growth strategy.

Government Standing Committee’s Conclusion on Accelerating Public Investment

During the 2021-2025 period, the Government and the Prime Minister have demonstrated unwavering commitment, providing rigorous and consistent oversight to accelerate the disbursement of public investment capital. This focused effort aims to significantly bolster economic growth.

Anticipating the 14th National Party Congress: Selecting the Right ‘Breakthrough of Breakthroughs’ to Elevate the Nation’s Stature

The 14th National Party Congress convenes amidst profound global shifts, as Vietnam stands poised on the brink of a transformative era of robust development. Scholars and intellectuals alike anticipate the Congress to chart the right strategic priorities, fostering genuine breakthroughs in institutional frameworks, growth models, enterprise development, and high-quality human resources. Such advancements are expected to propel the nation onto a trajectory of rapid, sustainable progress.

Rural Vietnam: The Long-Term Runway for Modern Retail Growth

According to the Retail Industry Report by SHS Research, Vietnam’s food retail market is currently valued at approximately $70 billion. However, the penetration rate of modern retail channels stands at only about 14%—significantly lower than Thailand (approximately 48%) and Indonesia (around 23%). This gap highlights the substantial growth potential for modern retail in Vietnam, particularly as domestic consumption rebounds and consumer behavior increasingly prioritizes product quality and convenience.