The 2026-2027 period is anticipated to be a pivotal phase for selective and sustainable growth in the real estate market.

In this context, 2025 serves as a critical transitional year, laying the groundwork for future developments. The subsequent period, 2026-2027, is expected to mark a significant shift towards more selective and sustainable growth in the real estate sector.

“As we move into 2026, the real estate market will not experience a uniform recovery. Instead, macroeconomic factors, monetary policies, and new legal frameworks will collectively reshape the market, fostering a more cautious and selective approach, with distinct segmentation across sectors and regions,” remarked Ms. Giang Huỳnh.

2025: Strengthening Macroeconomic Foundations

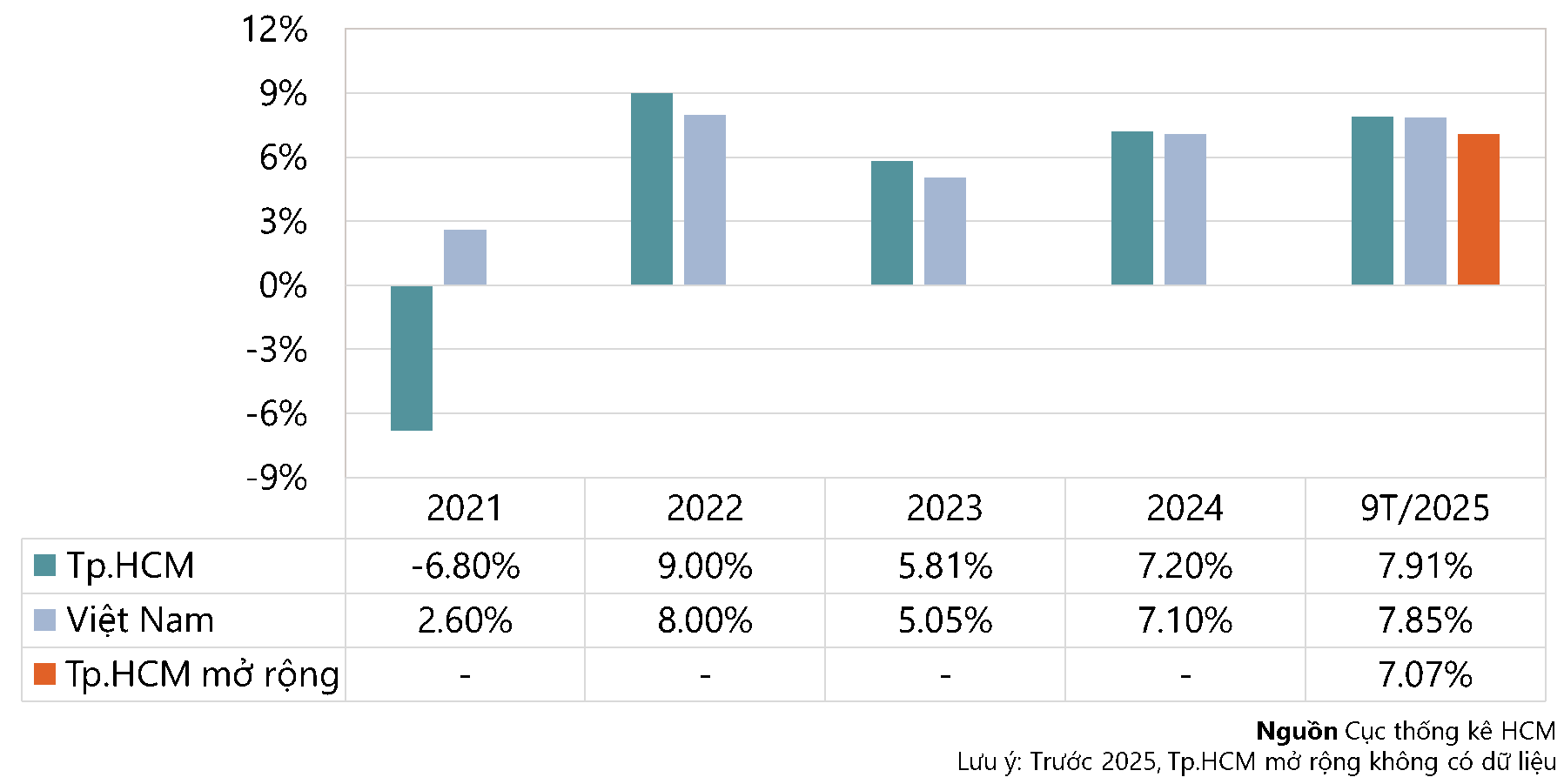

According to a report by Savills Vietnam, the first nine months of 2025 witnessed robust macroeconomic indicators. Vietnam’s GDP grew by 7.9%, one of the highest rates in recent years, while inflation remained controlled at 3.3%. Total registered FDI reached $28.5 billion, a 15% increase year-on-year, reflecting foreign investors’ confidence in Vietnam’s medium and long-term prospects.

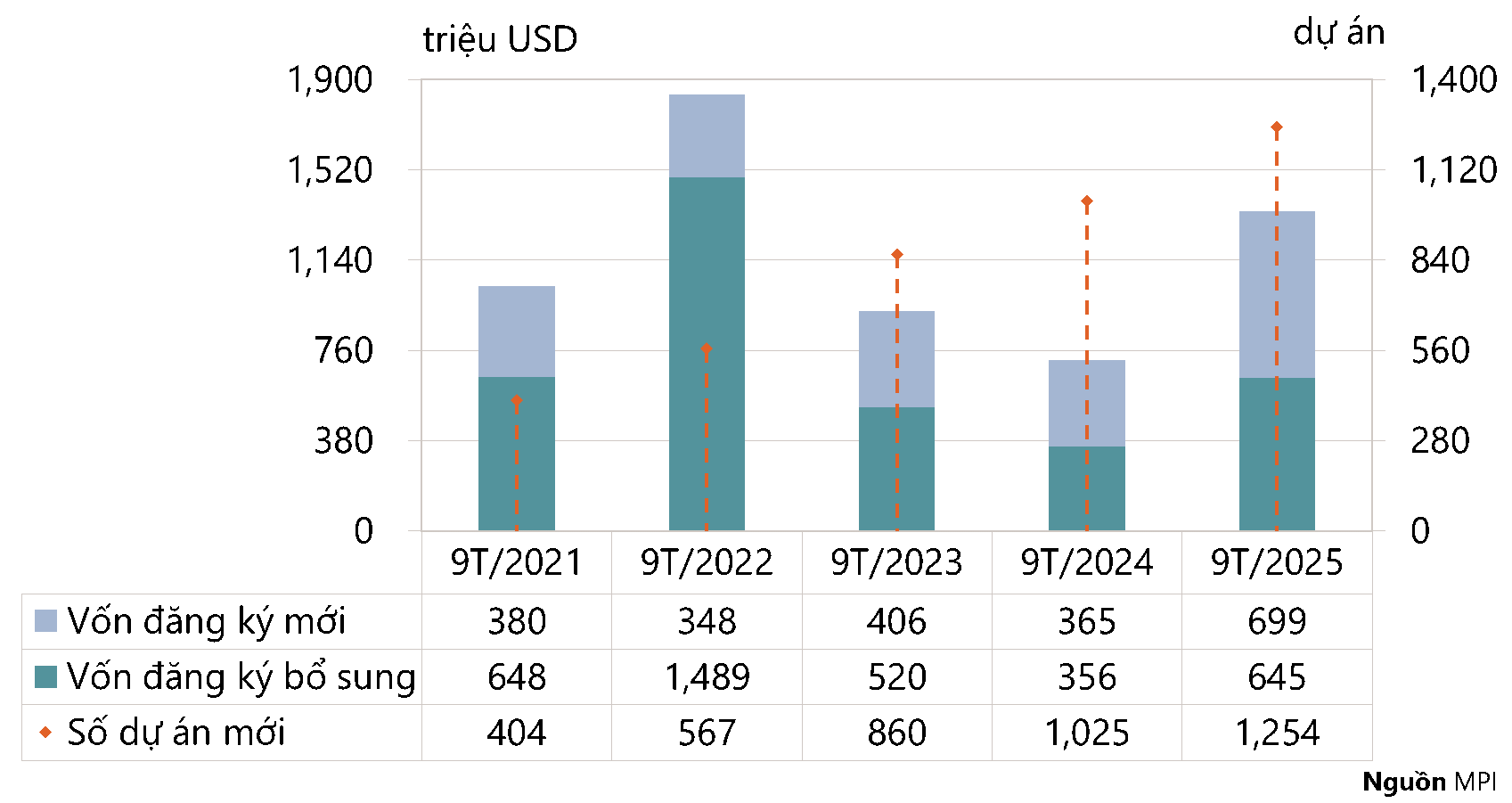

FDI Trends in Ho Chi Minh City (former)

Additionally, the Ministry of Planning and Investment (MPI) reported that in the first nine months of 2025, the total FDI in the expanded Ho Chi Minh City reached $4.8 billion. Among the three merged provinces, the former Ho Chi Minh City led with $699 million in new registered capital, a 92% annual increase from 1,254 projects, accounting for 48%.

These factors are establishing a solid foundation for the real estate market, particularly in Ho Chi Minh City. In the residential sector, the primary supply in Q3 2025 reached approximately 5,200 units, an annual increase but still modest compared to actual demand. The absorption rate stood at 51%, indicating improved market sentiment, although affordability remains a challenge due to the limited supply of affordable housing. This trend is driving demand towards suburban areas and neighboring provinces, where prices are more accessible and benefit from improved infrastructure connectivity.

In the office segment, the Ho Chi Minh City market remains stable with a total supply of nearly 3 million square meters of leasable space. Average occupancy rates hover around 90%, even with new supply entering the market, reflecting sustained demand from businesses, particularly in technology, media, and finance. Given the limited future supply, rental prices are expected to remain stable in the short term.

2026-2027: Peak Growth Phase with Selective and Substantial Focus

According to Ms. Giang Huỳnh, the anticipated growth peak in the real estate market during 2026-2027 is well-founded, as several key factors are converging. Firstly, starting in 2026, the market will operate under the comprehensive influence of new laws (Land Law 2024, Housing Law 2023, Real Estate Business Law) and the new land price schedule effective from January 1, 2026. While the new land prices may increase financial obligations for businesses and individuals, they will create a more transparent and equitable investment environment in the long run. Previous bottlenecks in determining project land prices are expected to be resolved, facilitating improved market supply.

Simultaneously, economic growth momentum continues to be bolstered by sustained FDI inflows, with total retail sales and services in the first nine months of 2025 exceeding $5.2 trillion, a real growth rate of over 7%. These factors directly support demand for housing, office space, and commercial real estate in major urban centers.

Furthermore, a key driver of the real estate market is the massive public investment plan. Accelerated investment in critical infrastructure projects over the next five years will be a primary growth driver, enhancing inter-regional connectivity, promoting urban population decentralization, and fostering new development hubs along key infrastructure routes.

Economic Growth in Ho Chi Minh City

By segment, Savills predicts that industrial and logistics real estate will continue to lead due to stable demand from manufacturing enterprises. The residential segment will see clearer differentiation between core urban areas—where prices are high and supply is limited—and suburban areas, which benefit directly from infrastructure connectivity and urbanization trends.

Meanwhile, commercial and office real estate have positive prospects tied to economic growth and business activity, with advantages favoring well-located, high-quality projects.

Overall, Savills anticipates that the next growth cycle in the real estate market will likely be firmly established during 2026-2027, characterized by a more selective and sustainable approach.

“Despite challenges such as high land costs, affordability issues for genuine buyers, and risks from external macroeconomic fluctuations, real estate remains a stable long-term asset accumulation channel. However, in this new context, the market demands greater caution from investors, focusing on asset quality, legal compliance, and practical exploitation potential, rather than pursuing short-term expectations,” emphasized Ms. Giang Huỳnh.

Chairman of Hoa Binh Construction Group Le Viet Hai: Real Estate Must Develop Steadily to Prevent Ecosystem Disruptions and Ensure Continuous Employment for Businesses

At the forum “Real Estate Market Outlook 2026 – Momentum for a New Growth Cycle,” organized by Construction Newspaper, many opinions suggested that the market is poised to enter a new growth cycle.

Luxury Villa and Townhouse Prices in Hanoi Surge Past $30,000/m²

In West Hanoi, villa prices remain steady at $14,000–$16,000 per square meter, with select luxury projects surpassing $30,000 per square meter. Meanwhile, in the East Hanoi area along Ring Road 2–3, terraced houses typically range from $7,200 to $8,800 per square meter, while villas fluctuate between $10,000 and $12,800 per square meter.

Unraveling the Housing Price Conundrum: A Quest for Solutions

According to experts and policymakers, housing prices are rising significantly faster than income growth, necessitating macro-level interventions to regulate the market.