Thanh Cong Securities Corporation (TCSC) recently submitted a report from the Bondholders’ Representative to the State Securities Commission (SSC) and the Hanoi Stock Exchange (HNX) regarding violations related to the GPRCH2123001 bond (code GPR12101).

According to the report, acting as the Bondholders’ Representative for Gia Phu Real Estate LLC (Gia Phu Real Estate), TCSC received Notification No. 07/2025-TB-GP from Gia Phu Real Estate on November 7, 2025, regarding the adjustment of the principal and interest payment deadline for the GPRCH2123001 bond to December 31, 2025.

TCSC issued a reminder regarding the principal and interest payment to Gia Phu and the bondholders (currently only one bondholder, MB Investment Fund Management JSC), urging all parties to promptly address the delayed payment.

However, as of December 31, 2025, the deadline specified in Gia Phu’s notification, TCSC had not received a resolution plan for the GPRCH2123001 bond.

TCSC stated that the delay in paying the principal and interest of the GPRCH2123001 bond has adversely affected the bondholders’ rights.

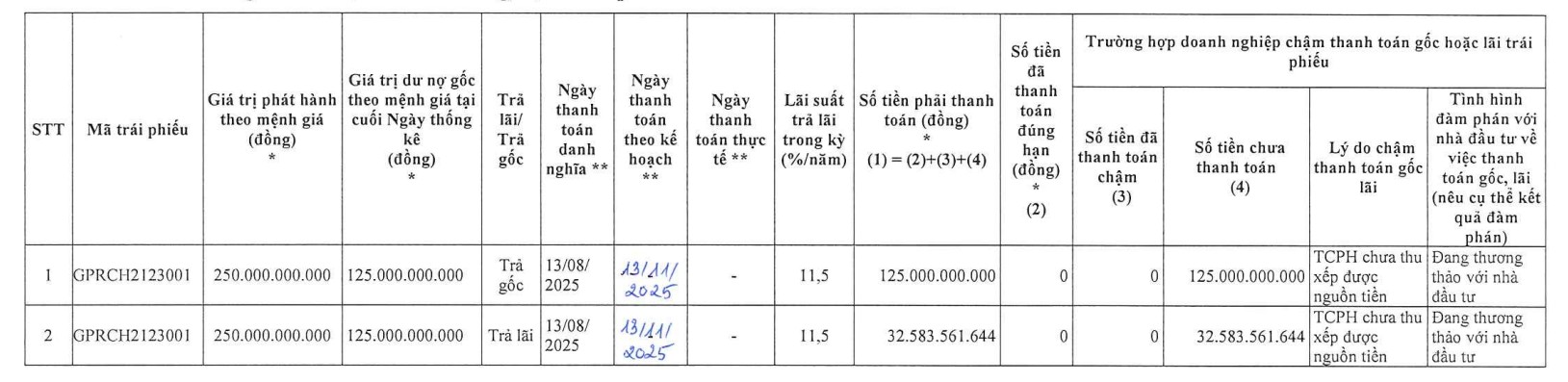

Previously, on November 13, 2025, Gia Phu Real Estate submitted a report to HNX regarding the delayed payment of principal and interest for the GPRCH2123001 bond.

Source: HNX

Specifically, according to the schedule, on August 13, 2025, Gia Phu Real Estate was to pay VND 125 billion in principal and interest for the GPRCH2123001 bond but failed to do so due to insufficient funds.

By November 13, 2025, Gia Phu Real Estate further delayed the payment of VND 125 billion in principal and nearly VND 32.6 billion in interest for the aforementioned bond, citing the same reason of insufficient funds. Gia Phu also mentioned that the company is negotiating with investors regarding the payment of principal and interest.

The GPRCH2123001 bond was issued on August 13, 2021, with a face value of VND 100 million per bond and a total issuance volume of 2,500 bonds, equivalent to VND 250 billion. On August 15, 2022, Gia Phu repurchased VND 125 billion worth of bonds, reducing the outstanding value of the GPRCH2123001 bond to VND 125 billion.

This non-convertible, unsecured bond is asset-backed with an interest rate of 10.5% per annum, paid quarterly. The transaction was arranged by Thanh Cong Securities Corporation, with buyers including a securities investment fund and an insurance company.

The collateral includes over 5 million NVL shares of No Va Real Estate Investment Group Corporation (Novaland, Ticker: NVL, HoSE). The issuance aimed to increase the company’s operating capital and invest in programs and projects meeting the capital mobilization requirements from bonds.

Initially, the bond had a 2-year term, but Gia Phu later obtained bondholder approval to extend the term by 23 months from the maturity date, resulting in a new maturity date of August 13, 2025.

The bond interest rate from September 13, 2023, until the end of the adjusted term is fixed at 11.5% per annum.

Additionally, Gia Phu Real Estate supplemented the collateral with real estate assets and property rights arising from projects in Ho Chi Minh City owned by the issuer and/or third parties. The supplemented collateral ratio corresponds to at least 100% of the total face value of the outstanding bonds.

Gia Phu Real Estate was established in September 2009, initially chaired by Mr. Bui Cao Nhat Quan as the Chairman of the Members’ Council and legal representative.

In March 2015, Mr. Nguyen Ba Doanh (born in 1985) became the General Director and legal representative. Just a few months later (October 2015), the company increased its capital from VND 730 billion to VND 1,065 billion; the shareholder structure at that time included Mr. Bui Cao Nhat Quan (0.01%) and Gia Huy Real Estate Investment and Development LLC (99.99%).

In July 2016, Ms. Nguyen Thi Thu Huong assumed the position of Chairwoman of the Members’ Council and legal representative. The list of capital contributors no longer included Mr. Bui Cao Nhat Quan, replaced by Mr. Nguyen Van Hien, with Gia Huy Real Estate’s ownership ratio unchanged.

In August 2017, Mr. Bui Dat Chuong replaced Ms. Nguyen Thi Thu Huong and also took over Mr. Nguyen Van Hien’s position as a shareholder of Gia Phu Real Estate.

In December 2019, the company reduced its capital to VND 245 billion, with the shareholder structure remaining unchanged; Mr. Nguyen Ba Doanh returned as General Director.

In a registration change in April 2023, Tan Kim Yen Real Estate Investment LLC (Tan Kim Yen) replaced Thanh Nhon Real Estate Investment LLC as the major shareholder, holding 99.99% of Gia Phu Real Estate’s charter capital, with the remaining 0.01% held by Mr. Bui Dat Chuong.

Currently, Mr. Tran Ngoc Dai serves as the General Director and legal representative of the company.

Regarding Tan Kim Yen, this company was established in January 2019 with a current charter capital of nearly VND 205 billion. The shareholder structure includes Novaland (99.993%) and Nguyen Ngoc Tuan (0.007%). Mr. Bui Dat Chuong is authorized to hold 100% of Novaland’s capital contribution in Tan Kim Yen.

Thus, Gia Phu Real Estate is an indirect subsidiary of Novaland through Tan Kim Yen. This explains why Gia Phu’s bond is secured by NVL shares.

The Sun Avenue Project. Photo: NVL

Gia Phu is the developer of The Sun Avenue project in Thu Duc City (formerly Thu Duc District), Ho Chi Minh City. According to Novaland’s website, The Sun Avenue is a complex featuring services, offices, and apartments, located on the frontage of Mai Chi Tho Avenue, a central hub of major routes: Long Thanh – Dau Giay Expressway, Ben Thanh – Suoi Tien Metro, and the inner ring road directly connecting to Thu Thiem Tunnel leading to District 1, Ho Chi Minh City.

The project comprises 8 towers with over 1,400 apartments, offering amenities such as a swimming pool, gym, gardens, and more.

What Collateral Does Novaland Offer for Its Subsidiary’s VND 2,320 Billion Loan?

Novaland’s subsidiary, Ngân Hiệp Real Estate, is the esteemed developer behind the NovaWorld Hồ Tràm project.

Government Inspectorate Proposes Revocation of 305 Land Titles in Novaland Project

The inspection findings reveal a series of violations pertaining to investor selection, land allocation and leasing procedures, land valuation, and construction density regulations.