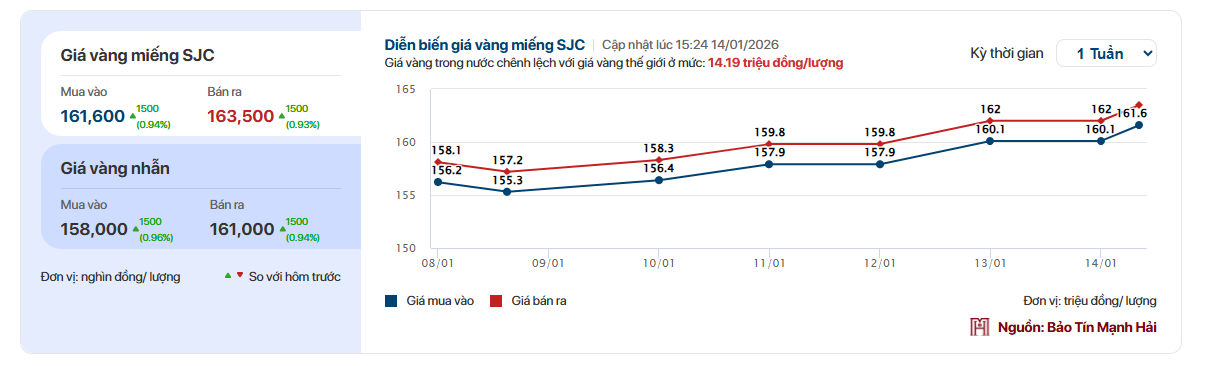

Specifically, the price of SJC gold bars currently stands at 161.5 – 163.5 million VND per tael, marking a 1.5 million VND increase compared to yesterday.

For gold rings, SJC Company raised the price by a total of 1.5 million VND per tael today, now listed at 157.9 – 160.5 million VND per tael.

Meanwhile, DOJI increased the price of round gold rings to 158.0 – 161.0 million VND per tael, a significant jump of 2 million VND per tael from yesterday.

Since January 9th, domestic gold prices have shown no signs of decline. Various types of gold, including SJC gold, smooth gold rings, and 0.1 tael gold, have all surged by approximately 6 – 7 million VND per tael.

—————

On the morning of January 14th, domestic gold prices surged by 900 thousand VND per tael at the opening. Consequently, gold prices approached the 163 million VND per tael mark, reaching an all-time high.

At SJC Company, the price of gold bars is currently listed at 160.9 – 162.9 million VND per tael, reflecting a 900 thousand VND increase in both buying and selling prices. Gold ring prices also saw a similar rise, now at 157.4 – 160.0 million VND per tael.

At Bao Tin Minh Hai, gold prices were adjusted early. The price of gold bars here is now 161.0 – 162.9 million VND per tael. Xiao Jin Cat 24k (999.9) gold is listed at 159.5 – 162.5 million VND per tael.

In the international market, spot gold prices surpassed the $4,600 USD per ounce mark, currently standing at $4,616 USD per ounce. Earlier, the precious metal hit a peak of $4,630 USD per ounce.

According to Citi analysts, gold prices are expected to exceed $5,000 USD per ounce in Q1, while silver could reach $100 USD per ounce. However, despite silver and other industrial metals likely continuing to outperform, gold prices may face significant downward pressure in late 2026 as global tensions ease.

The strategy team led by Kenny Hu raised their 0–3 month gold price target to $5,000 USD per ounce and their silver price target to $100 USD per ounce on Tuesday, as the Wall Street financial group forecasts the precious metals bull market to persist at least until early 2026.

The strategists noted that the decision to raise forecasts stems from heightened geopolitical risks, prolonged physical market shortages, and renewed uncertainty surrounding the independence of the U.S. Federal Reserve (Fed).

Although both gold and silver have set new all-time highs early in the year, Citi maintains its view that silver will outperform gold, though in the long term, base metals may take center stage.

“Our consistent view of silver outperforming gold, the precious metals bull market spilling over into industrial metals, and industrial metals taking center stage during the same period has proven highly effective,” the strategists wrote.

The analysis team also highlighted that physical market supply remains extremely tight, particularly for silver and platinum group metals. They noted that delays and uncertainties related to Section 232 tariffs on critical minerals are creating “significant binary risks” for trade flows and prices.

Citi warned that in a high-tariff scenario, physical shortages could worsen, potentially triggering extreme price spikes as metals are heavily imported into the U.S. However, once tariff policies become clear, this inventory is likely to re-enter the global market, alleviating shortages and pressuring prices downward.

The strategists also cautioned that “a sharp drop in silver prices due to Section 232 metal outflows could trigger a tactical sell-off across the entire precious and base metals market.” Nonetheless, Citi emphasized they would view this as a buying opportunity during a price correction within a long-term uptrend, as the core drivers of this metal group’s price increases remain intact.

In the updated scenario, Citi assumes geopolitical tensions will ease after Q1, reducing demand for precious metals in subsequent quarters, with gold being the most vulnerable to downward adjustments. In contrast, the bank expects industrial metals, particularly aluminum and copper, to perform positively in the second half of 2026.

Lan Anh

SJC Gold Price, Ring Gold Price Update for the Afternoon of September 13th

International gold prices surged on January 12th, reaching a new peak of $4,630 per ounce before sharply retreating below $4,600. How will domestic gold prices fluctuate on January 13th?

A New Breeze Sweeps Through Ho Chi Minh City’s Gold Market

A renowned, long-standing gold brand from the North has entered the Ho Chi Minh City market, bolstering supply amidst soaring gold prices.