Thien Viet Securities Corporation (Stock Code: TVS, HoSE) has recently submitted a report detailing the results of its stock issuance for dividend payments to shareholders.

As of the issuance closure on January 6, 2025, Thien Viet Securities successfully distributed 24.04 million shares as dividends to 3,265 shareholders. The remaining 992 fractional shares will be canceled.

The share allocation ratio was 100:2, meaning shareholders holding 100 shares received an additional 12 newly issued shares. The transfer of these shares is scheduled for Q1 and/or Q2 of 2026.

The total issuance value, based on the par value, amounts to approximately VND 240.5 billion. The capital for this issuance was sourced from undistributed after-tax profits.

Illustrative image

Following this issuance, Thien Viet Securities’ total shares increased from nearly 200.4 million to over 224.4 million, raising its charter capital to nearly VND 2,244.4 billion.

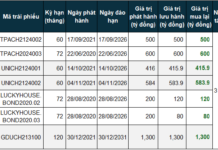

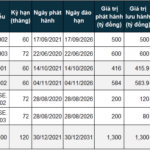

In other developments, Thien Viet Securities recently reported on the utilization of funds raised from its public offering.

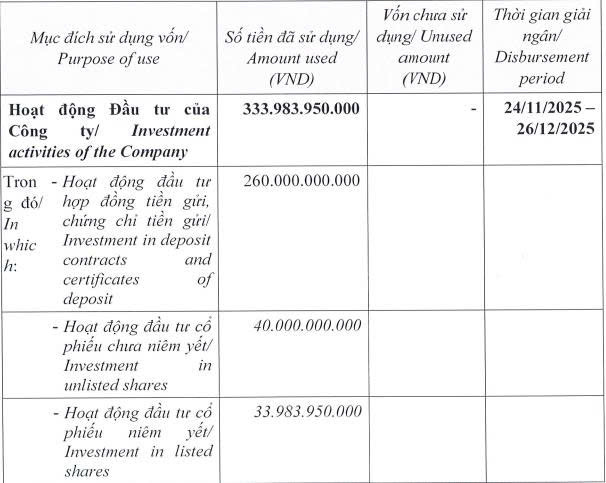

On November 14, 2025, the company completed the public offering of nearly 33.4 million shares at VND 10,000 per share, raising a total of approximately VND 334 billion.

The raised capital was allocated to investments in term deposits, deposit certificates, and corporate stocks. The disbursement period spanned from November 24, 2025, to December 26, 2025.

Source: TVS

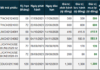

In terms of business performance, Thien Viet Securities recorded a total operating revenue of over VND 778.7 billion in the first nine months of 2025, a 9.6% decrease compared to the same period in 2024. After deducting taxes and fees, the company reported a net profit of more than VND 276.8 billion, a 57% increase.

As of September 30, 2025, the company’s total assets rose by 3.1% from the beginning of the year to nearly VND 7,614.5 billion. Held-to-maturity investments accounted for VND 3,607.5 billion, or 47.4% of total assets.

On the liabilities side, total payables stood at over VND 5,017.4 billion, slightly lower than at the start of the year. Short-term loans constituted nearly 90% of total liabilities, amounting to VND 4,514.1 billion.

ADS Targets ₫145 Billion Profit by 2026

Following its recent investment and divestment plan, Damsan Joint Stock Company (HOSE: ADS) has unveiled its 2026 business production plan, featuring targets that surpass those set for the previous year.