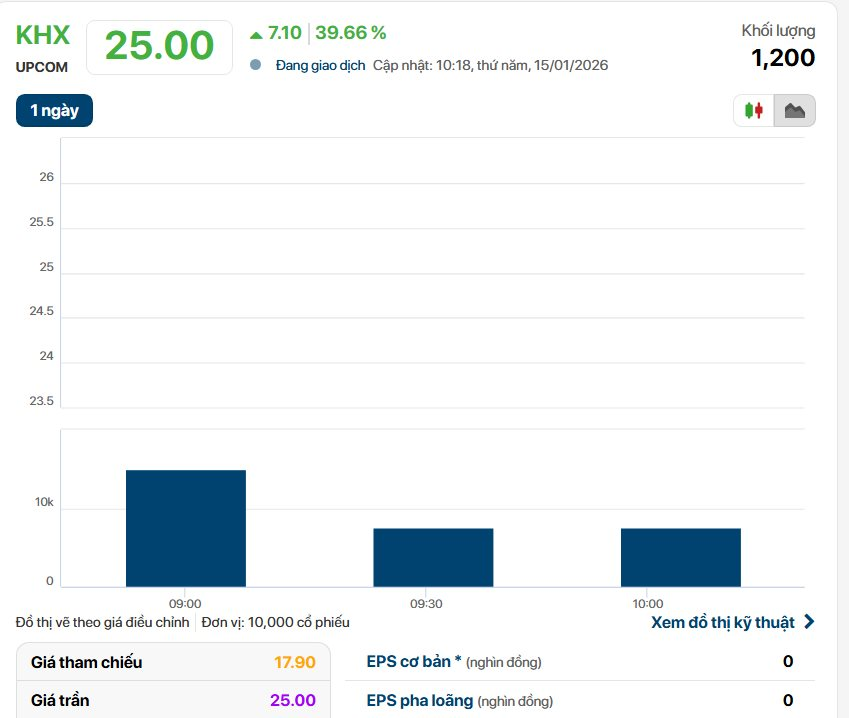

KHX Officially Lists on UPCoM Market

On January 15, 2026, 5 million shares of Khanh Hoa Publishing Joint Stock Company (stock code: KHX) officially debuted on the UPCoM market. With a reference price of VND 17,900 per share and a ±40% fluctuation range on the first day, KHX quickly captured investor attention.

KHX Hits Ceiling Price

At the opening session, KHX shares surged to the ceiling price of VND 25,000 per share. At this market price, the 50-year-old book publisher’s market capitalization reached VND 125 billion, a significant increase from the pre-opening valuation of VND 89.5 billion.

Established in 1976 as the Phu Khanh Book Distribution State Enterprise, the company underwent corporatization in 2003 with an initial charter capital of VND 1.4 billion.

Over five decades, the company’s charter capital has grown to VND 50 billion. It currently operates a network of 14 book centers in key locations across Khanh Hoa province, including Nha Trang, Cam Ranh, and Ninh Hoa, dominating the local cultural product distribution market.

Financial reports reveal consistent revenue growth in the last two fiscal years. Specifically, net revenue reached VND 136.2 billion in 2023 and increased to VND 139.9 billion in 2024, reflecting a 2.66% growth. Retail sales accounted for over 98% of revenue, with the remainder from rental income.

Image: KHX

Post-tax profit remained stable at approximately VND 3.9 billion in both 2023 and 2024. Management attributed the modest profit margin to increased selling and administrative expenses associated with expanding the retail network.

Leveraging its strengths, Khanh Hoa Publishing has set ambitious post-listing goals. For 2026, the company targets a 16% revenue growth compared to 2025, aiming for VND 200 billion. This growth is expected to be driven by expanded retail locations, a diversified product portfolio, and optimized operations at existing stores.

By 2027, the company plans to increase its book centers to 50, focusing on high-density urban areas and economic hubs nationwide, rather than limiting operations to the Central region. Alongside expansion, the company aims to standardize operations and enhance brand identity to improve profit margins per store.

Regarding dividend policy, the company maintained a 7% cash dividend payout for 2023 and increased it to 7.5% for 2024.

Unlocked Treasure: 500,000 kg of Gold Hidden Beneath Beds, in Storerooms, and Buried Underground by Vietnamese Citizens

Mr. Dinh Ngoc Dung, Chairman and CEO of Bao Tin Capital, shared his insights at the prestigious FChoice 2025 Awards Ceremony and the “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026” Seminar.

Liquidity Surge Unleashes Widespread Capital Flow Across Diverse Sectors

The stock market kicked off 2026 with a bang, as the VN-Index surged dramatically, accompanied by a significant boost in overall trading volume.