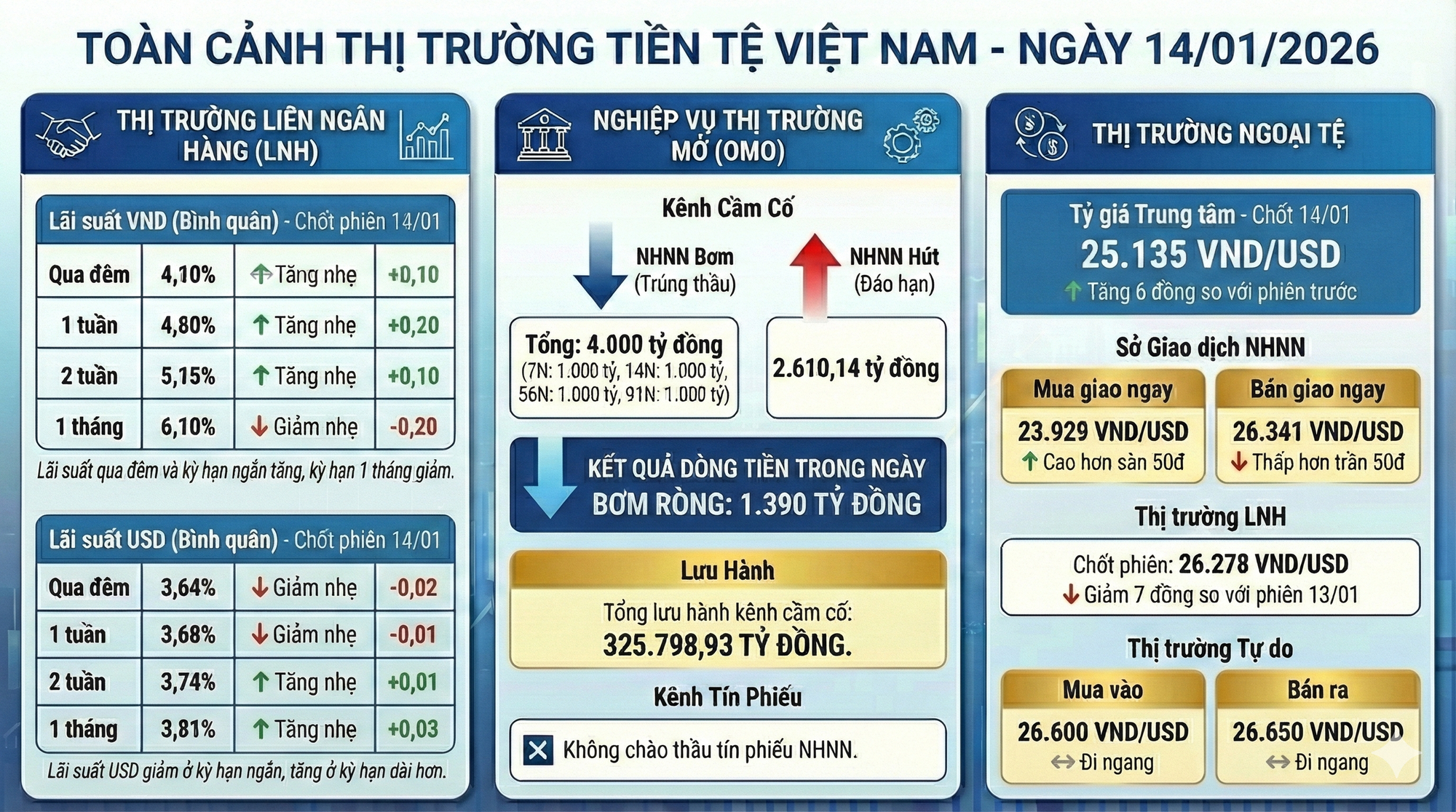

As of the trading session on January 14th, the average interbank VND interest rates exhibited mixed movements across different terms compared to the previous session. Specifically, the overnight rate increased by 0.10 percentage points to 4.10% per annum. The one-week rate rose by 0.20 percentage points, trading at 4.80% per annum, while the two-week rate climbed by 0.10 percentage points to 5.15% per annum. Conversely, the one-month rate decreased by 0.20 percentage points, settling at 6.10% per annum.

For USD, interbank rates experienced slight declines in shorter terms but rose in longer terms. The overnight rate dropped by 0.02 percentage points to 3.64% per annum, and the one-week rate fell by 0.01 percentage points to 3.68% per annum. Meanwhile, the two-week rate increased by 0.01 percentage points to 3.74% per annum, and the one-month rate rose by 0.03 percentage points to 3.81% per annum.

In the Open Market Operations (OMO) channel, during the session on January 14th, the State Bank of Vietnam offered 1,000 billion VND for each term of 7 days, 14 days, 56 days, and 91 days, with a uniform interest rate of 4.5% per annum. All offered amounts were successfully bid.

On the same day, 2,610.14 billion VND matured. The State Bank of Vietnam did not issue treasury bills. As a result, in this session, the State Bank of Vietnam net injected approximately 1,390 billion VND into the market, following six consecutive sessions of net withdrawal. The total outstanding volume in the collateral channel reached 325,799 billion VND.

In the foreign exchange market, the State Bank of Vietnam adjusted the central exchange rate upward in the session on January 14th. The central rate was set at 25,135 VND/USD, an increase of 6 VND compared to the previous session.

At the Trading Center, the buying spot rate was listed at 23,929 VND/USD, 50 VND higher than the floor rate, while the selling spot rate was listed at 26,341 VND/USD, 50 VND lower than the ceiling rate.

In the interbank market, the USD/VND exchange rate closed at 26,278 VND/USD, down 7 VND from the session on January 13th. In the free market, the USD rate remained unchanged in both buying and selling directions, trading around 26,600 VND/USD and 26,650 VND/USD.

Preventing Overheating in Real Estate Credit

In 2026, the State Bank of Vietnam mandated that commercial banks limit real estate lending to no more than 13% of the previous year’s growth in this sector.

Latest Currency Market Update (Jan 13): State Bank Nets Over VND 80 Trillion Since Year-Start, Interbank Rates Rebound

On January 12th, the State Bank of Vietnam continued its net liquidity withdrawal through the open market operations channel. This move led to a resurgence in short-term interbank VND interest rates, while the USD exchange rate experienced minor fluctuations.