Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.3 billion shares, equivalent to a value of more than 42.2 trillion VND; the HNX-Index reached over 122 million shares, equivalent to a value of more than 2.7 trillion VND.

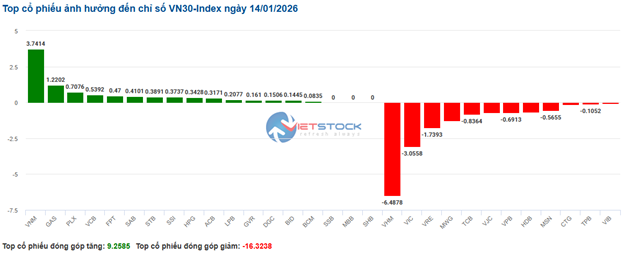

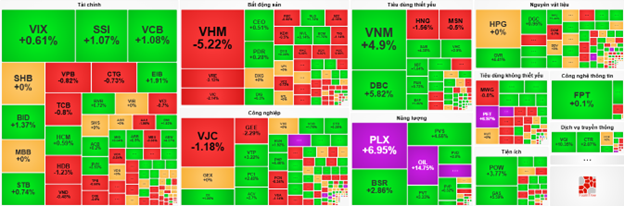

The VN-Index opened the afternoon session with a bias towards sellers, causing the index to fluctuate around the reference level and then plummet. Although buying support emerged, narrowing the decline, the VN-Index still closed in the red. In terms of impact, VIC, VHM, VPB, and TCB were the most negatively influential stocks on the VN-Index, contributing to a decrease of over 21.6 points. Conversely, BID, VCB, GVR, and VNM maintained their green status, pulling the index up by more than 13.6 points.

| Top 10 stocks influencing the VN-Index on January 14, 2025 (calculated in points) |

In contrast, the HNX-Index showed a more optimistic trend, positively influenced by stocks such as KSV (+9.94%), NTP (+9.97%), PVS (+1.77%), and PTI (+6.9%).

| Top 10 stocks influencing the HNX-Index on January 14, 2025 (calculated in points) |

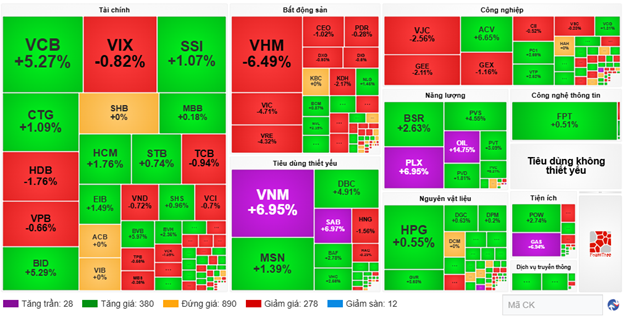

The communication services sector was the best-performing group in the market with an 11.8% increase, primarily driven by stocks such as CTR (+6.93%), VGI (+14.96%), VTK (+7.86%), and YEG (+0.41%). Following this recovery were the energy and industrial sectors, with increases of 3.43% and 2.99%, respectively. Notable stocks included PLX (+6.95%), OIL (+14.75%), PVC (+9.7%), VTP (+6.96%), and HVN (+6.85%).

Conversely, the real estate sector recorded the largest decline in the market, dropping by 3.62%, mainly due to VHM (-5.75%), VIC (-4.59%), VRE (-5.22%), and CEO (-2.55%).

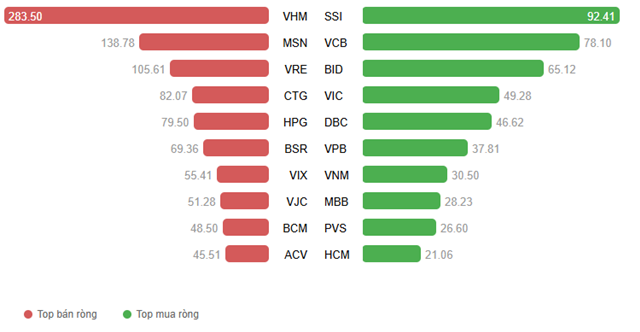

In terms of foreign trading, foreign investors continued to net sell over 462 billion VND on the HOSE, concentrated in stocks such as VHM (268.48 billion), MSN (195.88 billion), VRE (147.91 billion), and VJC (128.19 billion). On the HNX, foreign investors net bought over 100 billion VND, focusing on PVS (52.45 billion), CEO (36.52 billion), IDC (12.82 billion), and SHS (8.69 billion).

| Foreign net buying and selling trends |

Morning Session: Fluctuations around the 1,900-point mark

The VN-Index experienced strong fluctuations in the final morning session, reaching nearly 1,920 points at one time but quickly cooling down due to increased profit-taking pressure.

At the mid-session break, the VN-Index hovered close to the reference level at 1,901.02 points, while the HNX-Index saw a slight increase to 253.29 points. Market breadth favored buyers, with 408 stocks rising and 290 falling.

Among the top 10 stocks influencing the VN-Index, VIC and VHM had the most negative impact, reducing the index by 12.55 points and 7.19 points, respectively. Conversely, VCB, BID, and GAS were the most positively contributing stocks, adding a total of 15.69 points to the index.

| Top stocks influencing the VN-Index |

Green dominated most sectors, with 7 out of 11 sectors recording increases of over 1%. Viettel-related stocks continued to attract significant interest, with VGI rising 10.07%, CTR 1.98%, and VTK 2%, helping the communication services sector maintain its leading position with an impressive increase of nearly 8%.

Additionally, the energy sector remained a notable highlight, with a year-to-date cumulative increase of over 28% since the beginning of 2026. Leading stocks continued to trade impressively, with PLX and OIL hitting their ceiling prices, and BSR (+6.95%), PVS (+4.55%), PVD (+1.81%), PVT (+3.09%), PVC (+8.21%), and PVB (+2.09%) also performing well.

On the other hand, the real estate and non-essential consumer sectors temporarily lagged, with decreases of 3.94% and 1.21%, respectively, influenced by adjustments in leading stocks such as VIC (-4.71%), VHM (-6.49%), VRE (-4.32%), KDH (-2.17%); VPL (-3.06%), MWG (-0.8%), PNJ (-1.17%), and HUT (-0.63%).

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of 873.12 billion VND across all three exchanges, with selling pressure concentrated mainly on VHM, totaling 283.5 billion VND, far exceeding other stocks. Meanwhile, SSI led the net buying list with a value of 92.41 billion VND, followed by VCB (78.1 billion VND) and BID (65.12 billion VND).

|

Stocks with the highest foreign net buying/selling

Source: VietstockFinance

|

Vingroup stocks continue to pressure the VN-Index

Investors appeared hesitant, causing the main indices to move in opposite directions. As of 10:30 AM, the VN-Index slightly decreased by 3.86 points, trading around 1,899.07 points. The HNX-Index increased slightly by 0.17 points, trading around 253 points.

The VN30-Index basket showed a mix of green and red, with VNM contributing 3.74 points, GAS 1.22 points, PLX 0.71 points, and VCB 0.54 points on the positive side. Conversely, VHM, VIC, VRE, and MWG collectively reduced the index by over 12.4 points.

Source: VietstockFinance

|

The real estate sector showed mixed movements, with selling pressure concentrated mainly on large-cap stocks. Notable stocks included VHM (-5.45%), VIC (-2.2%), VRE (-3.28%), and KBC (-0.7%). On the buying side, CEO increased by 1.02%, PDR by 0.28%, and NLG by 1.62%.

Conversely, the energy sector showed optimistic movements, with oil and gas stocks continuing to receive buying support, such as PLX (-6.95%), BSR (-2.63%), PVS (-4.55%), and OIL (-14.75%).

Additionally, three other sectors supporting the overall market increase were essential consumer goods, communication services, and utilities, maintaining good increases with stocks like VNM (+4.9%), DBC (+5.64%), VGI (+10.35%), CTR (+2.87%), GAS (+5.59%), and POW (+3.77%).

Compared to the opening session, buyers still had the upper hand, although the majority of stocks remained unchanged (over 980 stocks). There were 320 rising stocks (21 at the ceiling) and 25 falling stocks (12 at the floor).

Source: VietstockFinance

|

9:30 AM: Cautious sentiment emerges, energy sector continues to shine

A slight red appeared at the beginning of the trading session, indicating cautious investor sentiment in the market. The main indices fluctuated around the reference level after rebounding from the ATO session.

The VN-Index decreased by over 1.3 points, with foreign investors net selling, trading around 1,905 points; the HNX-Index traded around 253 points.

The VN30 basket showed a mix of green and red, with 12 stocks decreasing, 14 increasing, and 4 remaining unchanged. FPT, VJC, and VHM were the most negatively influential stocks on the index. Conversely, VIC, HPG, and VPB were the most supportive stocks.

The energy sector was one of the most outstanding sectors in the market, with green dominating most stocks early on, such as PLX (+5.84%), BSR (+2.39%), PVS (+3.28%), PVD (+1.81%), and PVC hitting its ceiling.

The financial sector showed mixed movements, but green still dominated. On the buying side were VIX (+1.02%), EIB (+1.49%), and SSI (+0.46%). Conversely, large banking stocks faced selling pressure, such as VCB (-1.08%), BID (-1.18%), and CTG (-1.21%).

Additionally, some large-cap stocks also recorded impressive early increases, such as SAB (+4.18%), GAS (+3.09%), and VNM (+1.74%).

– 15:40 14/01/2026

State-Owned Enterprise Stocks Surge Ahead

Consider Resolution 79 the guiding compass that has propelled Vietnam’s stock market into a new era of transformation.

Q4/2025 Financial Report Update: Bank Profits Surge 124% in Q4, While Seafood Company Posts Loss

The fourth quarter of 2025 is shaping up to be a promising period for businesses, as early indicators reveal robust growth across various sectors. This quarter’s earnings outlook is painting a picture of profitability, with many companies already reporting impressive gains. The initial results set the stage for what could be a highly successful end to the fiscal year.

Vietstock Daily 15/01/2026: Turbulence at the Peak?

The VN-Index paused its upward momentum as intense volatility emerged near the new peak around the 1,900-point mark. With the Stochastic Oscillator reversing and signaling a sell in overbought territory, the index may require additional time to establish a new price equilibrium. The previous October 2025 high has been decisively breached, positioning it as a robust short-term support level.

Massive Capital Inflow Returns: Brokerages Highlight Stocks Poised for January Breakout

The formation of a higher low price structure indicates that institutional money has begun re-entering the market, providing crucial support and reigniting investor interest.