|

VNM ETF Stock Adjustments in the First Week of 2026

|

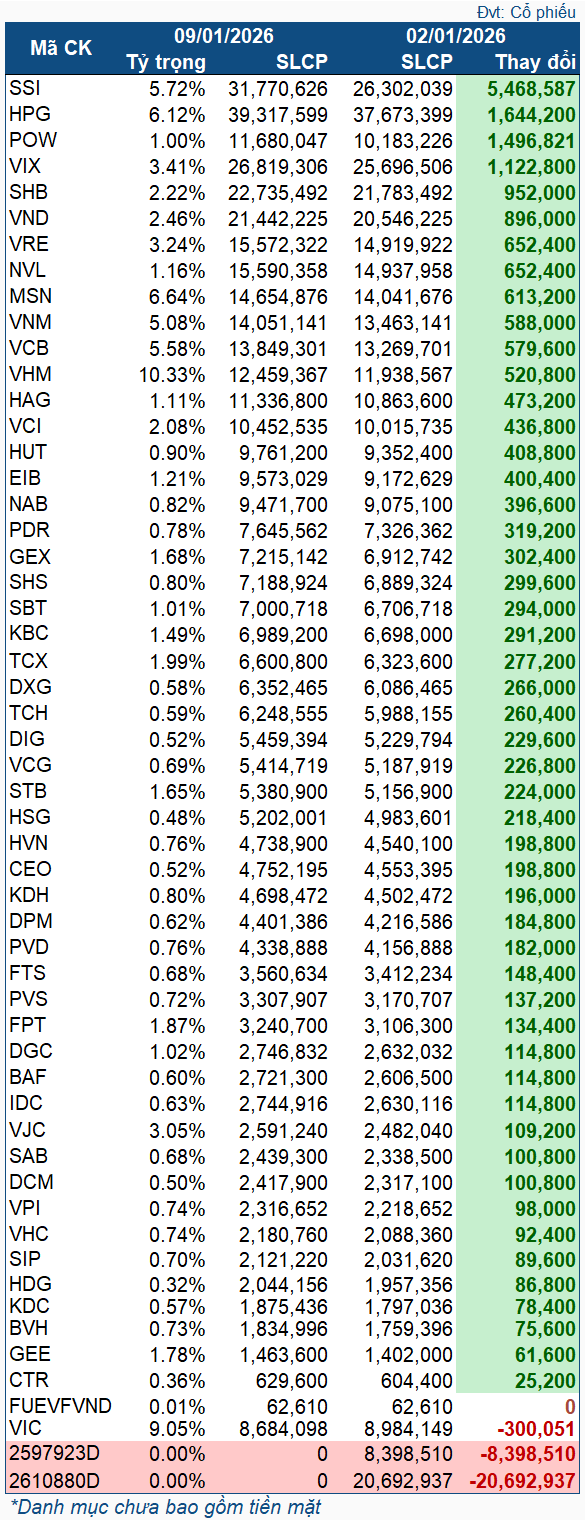

During the first week of the year, VNM ETF recorded net purchases across all stocks in its portfolio. The most significant increase was in SSI, with over 5.46 million shares. A substantial portion of this increase stemmed from the exercise of stock purchase rights at a 5:1 ratio (2,610,880D). However, based on the number of rights exercised and the actual increase in shares, the Fund also net purchased approximately 1.33 million shares during the week.

Similarly, POW saw an addition of nearly 1.5 million shares, primarily from a rights issue offered to existing shareholders at a 12% ratio (100 rights to purchase 12 new shares). After accounting for the shares acquired through this rights issue, POW was net purchased by around 490,000 shares.

Excluding the two stocks that increased due to rights exercises, the primary focus of net purchases for the week was HPG, with over 1.64 million shares. This was followed by financial sector stocks, including VIX (over 1.12 million shares), SHB (952,000 shares), and VND (896,000 shares).

Conversely, VIC was the only stock to experience net selling, with a reduction of over 300,000 shares.

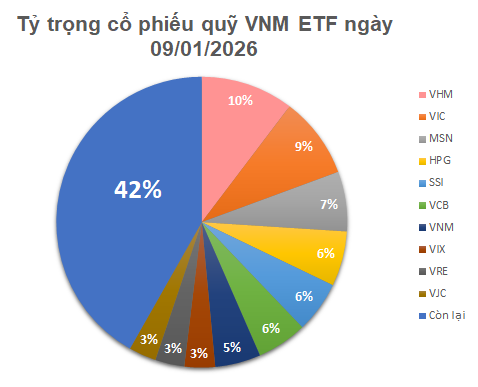

As of January 9th, the total asset value of VNM ETF reached 643 million USD, a notable increase from 605 million USD on January 2nd. The assets are primarily allocated across 52 stocks and 1 fund unit. There was a shift in the top holdings, with VHM taking the lead at 10.33%. Following closely are VIC (9.05%), MSN (6.64%), HPG (6.12%), and SSI (5.72%).

– 13:08 14/01/2026

Latest Updates on Credit Growth Control

The State Bank has mandated that credit institutions strictly control credit growth in 2026 using a new formula, prioritizing lending for production and business activities while maintaining special oversight on real estate credit.

VN-Index Officially Surpasses the 1,800-Point Milestone

The first trading week of the new year saw the VN-Index officially surpassing the 1,800-point milestone on January 6th, followed by a series of new highs. Despite an unexpected correction on January 8th and a capital outflow from the real estate sector in the subsequent session, the index continued its upward trajectory, closing the week at a new peak of 1,867 points.