International Financial Center: A Boost for the Office Market

At the Vietnam Real Estate Market Outlook 2026 event on January 13th, Mr. Lê Trọng Hiếu, Senior Director and Head of Leasing at CBRE Vietnam, revealed that in 2025, Ho Chi Minh City (HCMC) will welcome approximately 80,000 sqm of new office supply, while absorption is expected to reach only around 40,000 sqm. Notably, the vacancy rate in Grade A offices has risen to about 18%.

The total office supply in the expanded region following the merger (HCMC, Binh Duong, and Ba Ria – Vung Tau) is estimated at 800,000 sqm, with over 90% concentrated in HCMC.

Mr. Lê Trọng Hiếu – Senior Director, Head of Leasing at CBRE Vietnam

|

In Hanoi, net absorption is more positive, reaching approximately 78,000 sqm, while new supply is around 53,000 sqm. Demand continues to come from technology, professional services, insurance, and multinational corporations, reflecting the expansion trend of foreign businesses in Vietnam.

However, a CBRE survey shows that besides rental prices (accounting for about 65% of priority), tenants are increasingly concerned about operational quality, amenities, ESG standards, building monitoring capabilities, and user experience. Mr. Hieu believes these will be key competitive criteria in the 2026-2028 period.

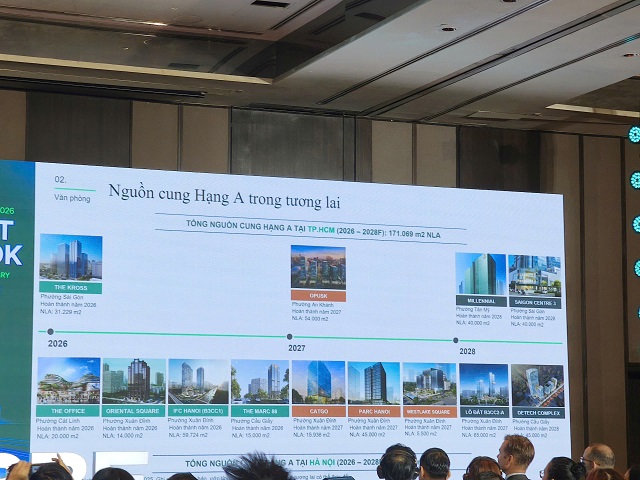

One of the major drivers expected to boost the office market in the 2026-2030 period is the plan to establish an International Financial Center in HCMC. CBRE estimates that this area alone could add nearly 1 million sqm of office space in the coming years, as many developers accelerate project preparations.

New Grade A office projects in HCMC during the 2026-2028 period

|

Discussed incentives include tax exemptions, land use extensions up to 70 years, and investment encouragement policies. Simultaneously, the trend of forming office clusters outside the CBD (Central Business District) is growing to reduce pressure on the city center and optimize costs for businesses.

Transportation infrastructure continues to play a crucial supporting role. The acceleration of metro line 2, connecting major urban axes, along with transportation projects expected to complete in 2027-2028, is anticipated to improve accessibility to new office areas. In Hanoi, approximately 300,000 sqm of new supply is in the preparation stage, mostly in conveniently connected locations.

The increase in high-quality supply also pressures existing buildings to upgrade and renovate to maintain competitiveness in amenities, operational standards, and brand image.

Projected office supply to continue rising in the 2026-2028 period. Photo: Thượng Ngọc

|

Industrial Land Slows Down, Pre-Built Factories Surge

In the industrial real estate sector, Mr. Hieu described the 2025 market as a “rollercoaster,” with a volatile macro environment, increased licensing procedures, and construction costs. Industrial land absorption in 2025 was lower than in 2024, dropping by 24% in the North and 39% in the South. Land rental prices, already high at 140-200 USD/sqm, leave limited room for further increases in 2026-2027.

In contrast, the pre-built factory and warehouse segment saw positive results. In 2025, absorption of pre-built factories reached approximately 700,000 sqm, while new supply was only around 300,000 sqm, pushing occupancy rates to a very high level of about 95%. Demand came from logistics companies, electronics manufacturers, regional producers, and major warehouse operators.

Large-scale infrastructure projects such as Long Thanh Airport, highway systems, ring roads, and the national logistics network are laying the foundation for a new growth cycle in industrial real estate. CBRE forecasts that in the 2026-2027 period, Vietnam could introduce about 1,000 hectares of industrial land and approximately 1.1 million sqm of factories and warehouses; by 2028, this could expand by another 900 hectares.

Additionally, integrated logistics industrial parks, eco-industrial parks, and flexible factory models are emerging trends, aimed at optimizing costs, reducing emissions, and enhancing supply chain efficiency.

Overall, in 2026, the market will shift its focus from quantity expansion to quality enhancement. For offices, competition will revolve around connectivity, green standards, building management technology, and tenant experience. For industrial real estate, while industrial land prices may stabilize, the factory-warehouse and integrated logistics segments are expected to continue growing, driven by infrastructure and production-trade capital.

In this context, investors and developers will need longer-term strategies, focusing on product adaptability, operational management, and sustainable value creation rather than relying on short-term price cycles.

– 07:00 14/01/2026

The Shifting Investment Mindset of Vietnam’s Affluent Class

As Vietnam enters an aging phase, the demand for long-term healthcare is no longer a distant concern. In this context, healthcare real estate—particularly projects integrated with therapeutic hot mineral springs—is emerging as a new “core asset” among Vietnam’s affluent. It not only accumulates value but also serves as essential infrastructure to safeguard the quality of life for families.

The An Heritage Signs Strategic Partnership with Four Diamonds Alliance and Crystal Bay

On the morning of January 8, 2026, as part of the Four Diamonds Alliance launch ceremony, The An Heritage officially sealed a strategic partnership with Vietnam’s leading real estate alliance and operator, Crystal Bay.

Social Housing to Propel the Real Estate Market in 2026

By 2026, an anticipated 160,000 social housing units will be added to the market. This substantial supply not only enhances housing accessibility for residents but also plays a crucial role in stabilizing the real estate market.