Newly Released Q4/2025 Financial Reports from Leading Businesses

In the banking sector, KienLongBank (KLB) reported a 124% surge in Q4 profits, reaching 786 billion VND. For the full year, the bank surpassed 2.323 trillion VND, a 109% increase compared to 2024.

Mekong Fisheries (AAM) announced Q4/2025 results with a pre-tax loss of 483 million VND, an improvement from the 1.5 billion VND loss in Q4/2024. Full-year 2025 pre-tax profit reached 3.7 billion VND, a significant turnaround from the 6 billion VND loss in 2024.

VIX Securities (VIX) achieved a remarkable Q4/2025 pre-tax profit of 1.601 trillion VND, nearly 12 times higher than the 134 billion VND in Q4/2024 (1,098% growth). Full-year 2025 profit reached 6.717 trillion VND, a 724% increase year-over-year.

TCBS Securities (TCX) recorded a Q4/2025 pre-tax profit of 2.041 trillion VND, up 119% from Q4/2024. Full-year 2025 profit reached 7.109 trillion VND, a 48% increase.

Similarly, MBS Securities (MBS) reported a strong Q4 with a pre-tax profit of 385 billion VND, up 86% from Q4/2024. Full-year 2025 profit reached 1.415 trillion VND, a 52% growth.

In the pharmaceutical sector, Agimexpharm (AGP) posted a Q4 profit of 20 billion VND, up 11% year-over-year. Full-year pre-tax profit reached 66 billion VND, a 9% increase.

In energy, Nước Trong Hydropower (NTH) reported a Q4 profit of 20 billion VND, up 15% from Q4/2024. Full-year 2025 profit reached 73 billion VND, a 34% growth.

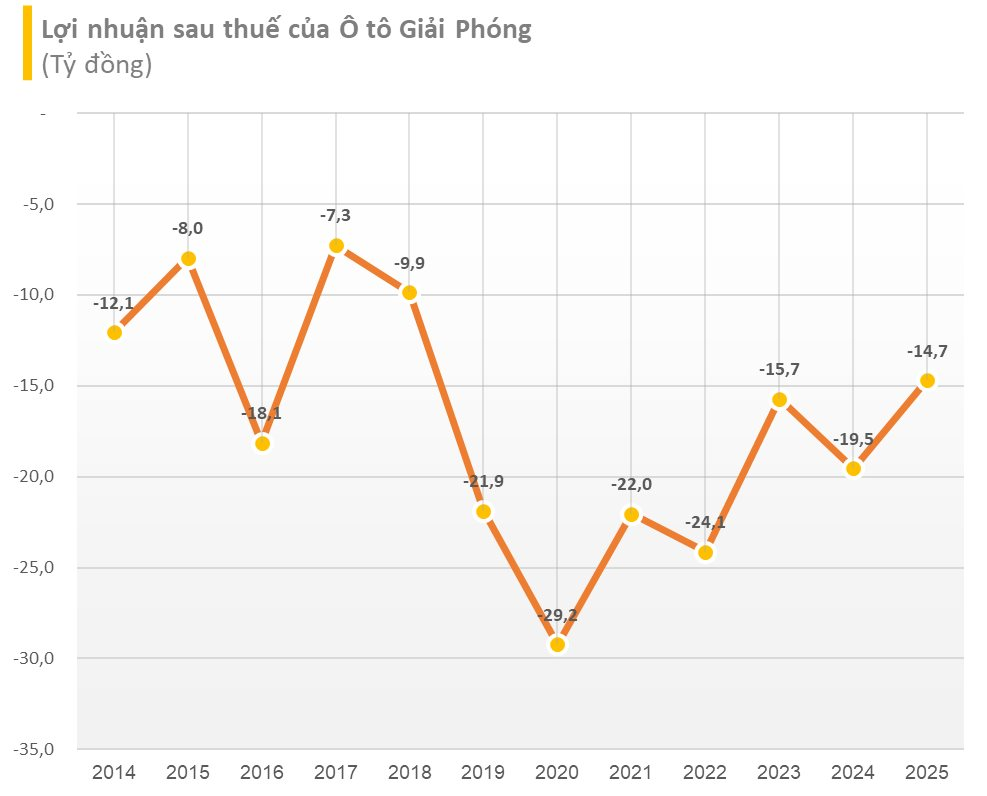

In contrast, Giải Phóng Automobile (GGG) continues to struggle despite strong revenue growth. Q4/2025 saw a loss of 4 billion VND (compared to a 5 billion VND loss in Q4/2024). Full-year 2025 pre-tax loss reached 15 billion VND, marking the 15th consecutive year of losses.

Previously, several companies and banks had estimated their 2025 performance.

Nam Á Bank (Nam A Bank) estimated a 2025 pre-tax profit of 5.254 trillion VND, a 15.6% increase from 2024.

An Bình Bank (ABBank) reported a 2025 pre-tax profit of 3.522 trillion VND, 4.7 times higher than 2024 and nearly 200% of the annual plan.

Sacombank announced a 2025 consolidated pre-tax profit of 7.628 trillion VND, 52% of the target set by the shareholders’ meeting. This result was primarily due to a significant increase in credit risk provisions, totaling over 11.3 trillion VND for the year.

At the 2025 Party Committee and Business Conference, Vietcombank leaders stated that 2025 pre-tax profit increased by over 7% compared to 2024, as approved by the State Bank. With a 2024 consolidated pre-tax profit of over 42.2 trillion VND, Vietcombank’s 2025 profit is estimated to exceed 45 trillion VND, a historic high.

Bình Sơn Refinery (BSR) estimated a revenue of 142.298 trillion VND and a pre-tax profit of 4.541 trillion VND, exceeding the annual plan by 2% and 262%, respectively.

PV GAS (GAS) reported an estimated revenue of 134 trillion VND, up 27% from 2024, and a pre-tax profit of 14.5 trillion VND.

PV Drilling (PVD) expects a revenue of approximately 10.5 trillion VND, up 10% year-over-year. Pre-tax and after-tax profits are estimated at 1.1 trillion VND and 830 billion VND, respectively, growing by 17% and 19%.

PV Power (POW) estimated a consolidated revenue of over 35 trillion VND, up 10% year-over-year. Pre-tax profit is expected to exceed 2.5 trillion VND, a more than 80% increase.

Petrosetco (PET) reported an estimated consolidated revenue of 20.6 trillion VND, 101% of the annual plan and up 8% from 2024. Pre-tax profit reached 402 billion VND, 132% of the plan and up 42% year-over-year; after-tax profit reached 322 billion VND, 32% above the target.

In the textile industry, Vinatex (VGT) CEO Cao Hữu Hiếu stated that 2025 consolidated revenue is estimated at 18.89 trillion VND, 103% of the plan, and consolidated profit at 1.355 trillion VND (second-highest in history after 2021), 149% of the plan.

TNG Investment and Trading (TNG) estimated a 2025 revenue of 8.696 trillion VND, up 14% year-over-year, setting a new record.

In fisheries, Sao Ta Food (FMC) estimated a consolidated revenue of 300.53 million USD, up 19.8% year-over-year, with profit expected to meet the 420 billion VND target (specific figures not disclosed).

In real estate, Taseco Land (TAL) estimated a 2025 revenue of 3.824 trillion VND (2.3 times higher than 2024) and an after-tax profit of over 615 billion VND, exceeding the plan by 15%.

Vietnam Rubber Group (GVR) reported an estimated consolidated revenue of 32.007 trillion VND, 3% above the plan and up 11.4% year-over-year. Consolidated pre-tax profit reached 6.929 trillion VND, 118.6% of the plan and up 23.6% from 2024. Estimated tax contributions reached 4.35 trillion VND, 3.1% above the plan.

New Year’s Delight: VN-Index Surpasses 1900 Points for the First Time

The CEO of TCBS attributes the driving force behind Vietnam’s stock market momentum to a combination of robust macroeconomic growth and the solid fundamentals of Vietnamese enterprises.

Top Bank and Securities Stocks Foreign Investors Heavily Purchased on January 12th

The trading session on January 12th witnessed a dramatic turn of events, with liquidity surging to over 40.7 trillion VND despite the heavy sell-off pressure on Vingroup stocks.