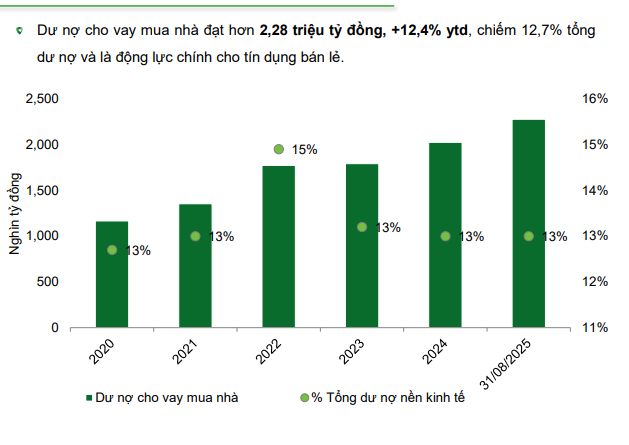

According to a recent report by VCBS, outstanding home loan debt reached over VND 2,280 trillion by the end of August 2025, marking a 12.4% increase since the beginning of the year. This accounts for 12.7% of the total outstanding debt in the economy. Analysts attribute this growth to the low-interest rate environment and high demand for both residential and investment properties. The housing loan sector began its recovery in Q3 2024, supported by an improved real estate supply and significant price fluctuations in prime locations, driven by major infrastructure project announcements that boosted investor interest.

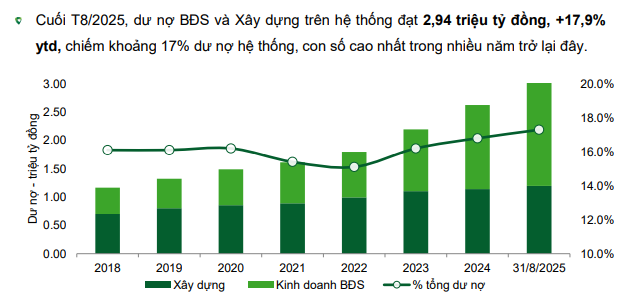

Meanwhile, real estate business credit also continued its robust growth. By the end of Q3 2025, outstanding credit for real estate business reached over VND 1,820 trillion, a 35% increase compared to the end of 2024, accounting for 10.1% of the total economic debt. Notably, credit growth was strongest among real estate developers (up 39.88% from 2024), surpassing individual borrowers (construction and renovation loans for sale). By the end of August 2025, total outstanding debt in real estate and construction reached VND 2,940 trillion, a 17.9% increase from the end of 2024, representing approximately 17% of the system’s total debt—the highest level in recent years.

By August 2025, total real estate-related credit (home loans + business loans) reached approximately VND 4,000 trillion, a 19% increase year-over-year, accounting for nearly 24% of the total economic debt.

“In recent periods, real estate capital has primarily flowed into business activities between developers and secondary buyers,” VCBS noted.

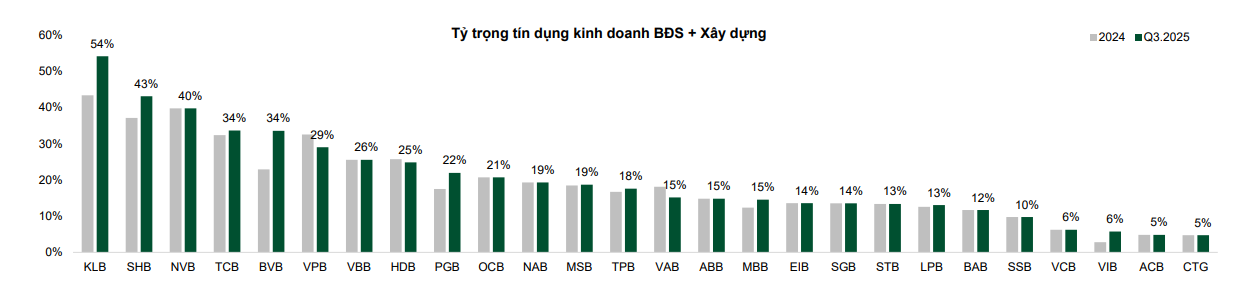

Amid weak demand for production, business, and consumer loans in the first half of the year, private banks with robust corporate ecosystems, such as Kienlongbank, SHB, NCB, and Techcombank, have aggressively expanded their real estate-related credit portfolios.

As of Q3 2025, KienlongBank leads the system with the highest proportion of real estate and construction credit, at approximately 54% of its total outstanding debt. SHB follows with around 43%, and NCB with 40%.

Other banks with significant exposure include Techcombank and BVBank, both at around 34%; VPBank at 29%; VietBank at 26%; and HDBank at 25%.

Banks with lower exposure include PGBank and OCB, at approximately 22% and 21%, respectively, while NAB, MSB, and TPBank range from 18% to 19%. In contrast, state-owned banks and retail-focused banks have significantly lower exposure, with Vietcombank and VIB at around 6%, and ACB and VietinBank at approximately 5%.

Looking ahead, VCBS anticipates continued strong credit flow into the real estate business sector, facilitating increased market supply. However, growth is expected to slow and become more selective compared to 2025, as the State Bank tightens control over risky sectors and prioritizes capital for production and business activities.

Latest Updates on Credit Growth Control

The State Bank has mandated that credit institutions strictly control credit growth in 2026 using a new formula, prioritizing lending for production and business activities while maintaining special oversight on real estate credit.

West Thang Long Opens to Traffic: Opportunities for Investors and Homebuyers?

West Thang Long Avenue (the section through Tu Liem) is nearing its final stages, poised to become a strategic transportation artery connecting Hanoi’s core with satellite cities. This milestone not only enhances regional connectivity but also catalyzes the local real estate market. Which key locations stand to benefit most from this transformative project?

Real Estate Experts at Batdongsan.com.vn: Prices Rise, But Bubble Risks Remain Low

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, elevated price levels have persisted over the past few years. However, the market is now focusing on residential properties that offer practical living solutions and generate cash flow, such as private homes and condominiums. This shift distinguishes the current phase from previous periods and suggests insufficient evidence to predict an imminent market bubble.