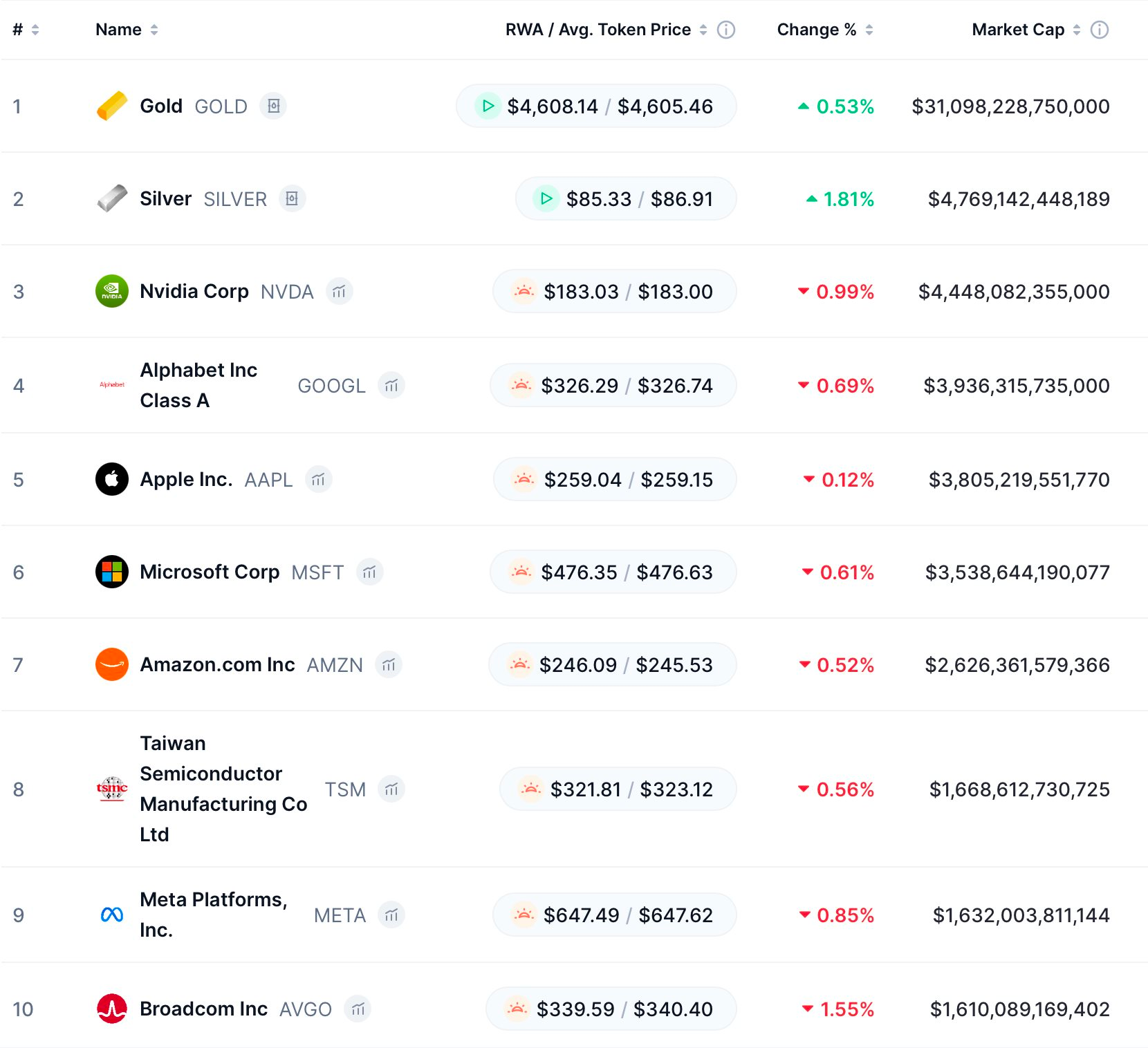

The global silver frenzy shows no signs of cooling, surging 150% in 2025. On January 12th, silver prices spiked 7%, breaching $85/oz and setting a new record. This meteoric rise propelled its market capitalization above $4.7 trillion (CoinMarketCap estimate), surpassing tech giants like NVIDIA, Google, and Apple to become the world’s second most valuable asset, trailing only gold.

Silver’s ascent was fueled by a US federal criminal probe into Fed Chair Jerome Powell, raising concerns about the central bank’s independence. Geopolitical tensions escalated as protests in Iran heightened conflict risks. Markets also factored in potential US rate cuts after December’s weaker-than-expected jobs report. Traders anticipate two Fed cuts this year, despite expectations of policy hold later this month.

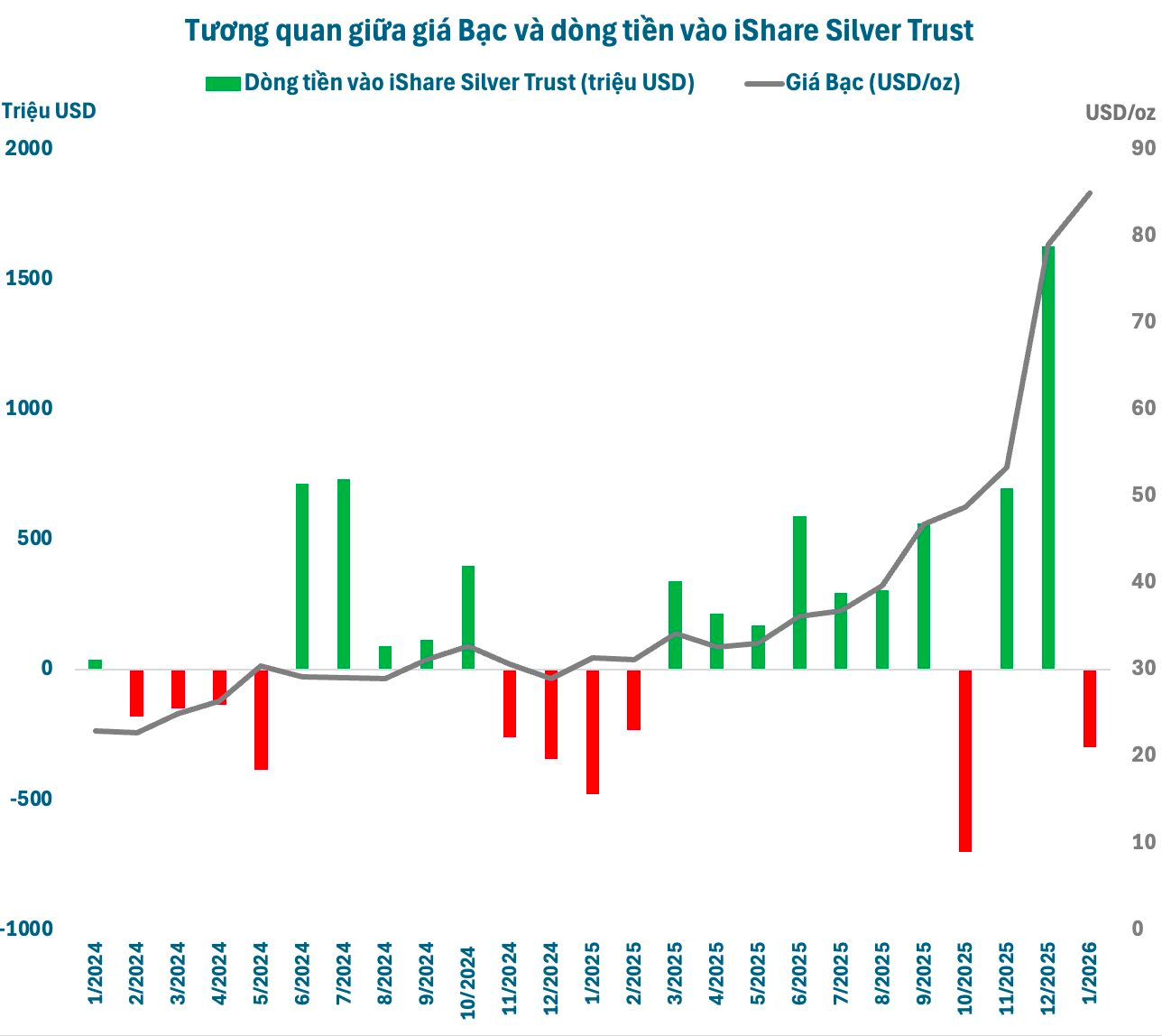

Institutional buying added momentum, with BlackRock’s iShares Silver Trust (SLV) deploying over $500 million in recent days, narrowing year-to-date outflows to under $400 million. In 2025, SLV invested $3.4 billion in silver.

Bank of America’s Michael Widmer highlights silver’s appeal for risk-seeking investors, with historical peaks at $135–$309/oz. The current gold/silver ratio below 60 suggests silver’s outperformance potential, echoing 2011’s $135 high (ratio: 32) and 1980’s $309 peak (ratio: 14).

Fundamentally, silver faces its fifth consecutive supply deficit as industrial demand outstrips mined output. Limited supply—largely a byproduct of base metal mining—constrains expansion, while solar energy and electronics drive robust physical demand. IEA PVPS reports global solar capacity exceeded 2,260 GW in 2024, up 29% year-over-year, sustaining high input demand. Scarcity amplifies silver’s sensitivity to supply chain disruptions.

Silver Prices Extend Rally on January 13th

Silver prices today remain steadfast at elevated levels, both domestically and globally, reflecting sustained market resilience and investor confidence.