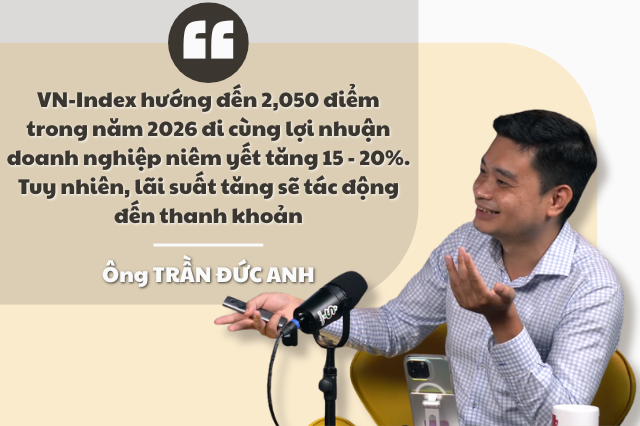

Scores are set to rise, but liquidity may decline.

Reflecting on the 2025 market, Mr. Tran Duc Anh, Director of Macroeconomics and Market Strategy at KB Securities Vietnam (KBSV), noted significant fluctuations shaped by four key factors: President Donald Trump’s retaliatory tax policies, widespread interest rate hikes by commercial banks late in the year, heavy net selling by foreign investors, and the outperformance of Vingroup stocks.

For 2026, Mr. Duc Anh forecasts that the VN-Index will continue its upward trajectory, targeting 2,050 points—a 15% increase from the 2025 peak. This projection is underpinned by expectations of 15–20% profit growth among listed companies.

However, KBSV experts caution that liquidity will be impacted by rising interest rates. As deposit rates, in particular, have bottomed out and are trending upward, a portion of capital may shift to savings, potentially reducing average market liquidity in 2026 compared to 2025.

On a positive note, foreign investors may return to net buying and more active trading. Yet, their contribution is expected to be limited due to their reduced trading share across the market, following three consecutive years of net selling, especially during 2024–2025.

Foreign capital is poised to return gradually.

Expanding on foreign investment trends, Mr. Duc Anh expressed surprise at the record net selling in 2025, given the market’s favorable conditions for foreign capital—a surging economy, robust profit growth among listed firms, and market upgrades.

In 2026, as exchange rate pressures ease due to higher interest rates and trade tensions subside, exports and FDI inflows are expected to maintain strong growth. Coupled with market upgrades, foreign investors are anticipated to trade more actively and gradually resume net buying, particularly around the September upgrade effective date, which will activate passive investment fund flows.

Additionally, Vietnam’s economic resilience and consistent corporate earnings growth will enhance the stock market’s appeal to foreign investors.

Public investment takes center stage.

A critical focus for Vietnam’s 2026 economy is boosting GDP growth to 10% or higher. With monetary policy nearing its limits and low interest rates difficult to sustain, growth will rely heavily on fiscal policy, particularly public investment.

KBSV analysts highlight that public investment is well-supported, with public debt at 35% of GDP and consistent budget surpluses in 2025 providing ample funding for major projects. The groundbreaking of over 200 large-scale projects on December 19, 2025, exemplifies this momentum.

Thus, public investment will dominate 2026 market themes, benefiting sectors like infrastructure, construction, materials, and real estate.

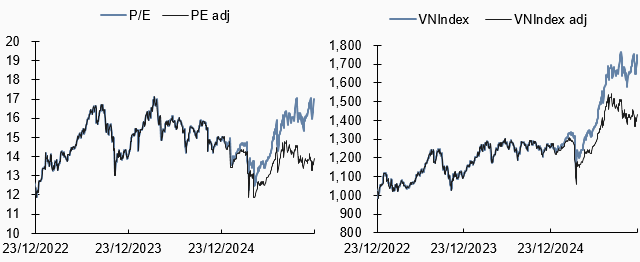

In terms of valuation, the market’s P/E ratio currently stands at 17 times (per Bloomberg data), near its three-year peak and no longer undervalued. Paradoxically, this figure is heavily skewed by Vingroup’s strong performance, notably VIC’s sevenfold increase pushing its P/E to 130 times, distorting the overall valuation.

Excluding this outlier—assuming Vingroup stocks rise only 15% (aligned with broader market gains and operational improvements)—the market P/E drops to 13.9 times, significantly below the three-year average of 14.6 times. This indicates that other stocks remain attractively priced, with many high-quality, large-cap shares trading near April tariff lows. Therefore, current valuations remain compelling.

|

Current valuations remain compelling.

Source: KBSV Research

|

With attractive valuations amid anticipated economic and corporate growth in 2026, Vietnam’s stock market outlook appears positive.

However, KBSV experts advise against expecting a dramatic surge in indices, given risks from rising interest rates, as seen in late 2025. Even modest increases of 0.5–1% could hinder market breakthroughs.

The IPO and listing wave is just beginning.

Following the vibrant IPO and listing activity in late 2025, including TCX, VPX, VCK, and earlier F88, Mr. Duc Anh believes this marks the start of a booming phase supported by multiple factors.

First, Vietnam’s stock market development, especially its upgrade, has bolstered confidence in equity fundraising, particularly as bank lending faces constraints in 2026 due to higher interest rates.

Second, policies streamlining IPOs and listings have made processes faster, smoother, and more cost-effective. These changes aim to encourage high-quality firms to go public, increasing market offerings, attracting foreign capital, and accelerating market upgrades to higher standards.

Lastly, policies promoting private sector growth, such as Resolution 68 by the Politburo, alongside broader economic initiatives, will enhance private enterprises’ growth potential, driving their need for capital market funding.

– 08:01 15/01/2026

Stock Market Poised for Significant Growth: TCBS CEO Highlights Attractive Investment Opportunities in 2026

As we step into 2026, a pivotal year marking the beginning of a new growth cycle, the Vietnamese stock market is poised to sustain its upward trajectory. This optimism is underpinned by a robust macroeconomic foundation, the resurgence of the private sector, and the anticipated profit growth of listed companies.

Textile Stocks Diverge as VN-Index Hits Record High

The VN-Index reached an all-time high in 2025, yet the textile and garment sector defied the trend, underperforming the broader market. This divergence was driven by the lingering impact of tariff shocks and prolonged cautious sentiment among investors.

Urgent Submission to Ho Chi Minh City People’s Council: Investment Plan for Thu Thiem 4 Bridge and Multiple Key Projects

The Vice Chairman of the Ho Chi Minh City People’s Committee has directed the Department of Finance to urgently review, consolidate, and draft a proposal for submission to the City People’s Council. This proposal seeks approval for the investment policy of the Thu Thiem 4 Bridge project, with the aim of presenting it at the nearest council session.

Top Bank and Securities Stocks Foreign Investors Heavily Purchased on January 12th

The trading session on January 12th witnessed a dramatic turn of events, with liquidity surging to over 40.7 trillion VND despite the heavy sell-off pressure on Vingroup stocks.