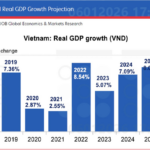

At a press conference on January 5th, 2026, Vietnam’s General Statistics Office (under the Ministry of Finance) announced that the country’s Gross Domestic Product (GDP) for 2025 had surged by an impressive 8.02% compared to the previous year. This remarkable growth rate has captured the attention of regional experts.

On January 10th, Free Malaysia Today published an article by Phar Kim Beng, a renowned ASEAN and international relations researcher. Beng highlighted that Vietnam’s ambitious 8.02% growth target for 2025 has become a focal point for economists across Asia.

According to Beng, this achievement is no accident. It’s the result of a calculated economic repositioning, transforming vulnerabilities into drivers of growth. Vietnam’s success is increasingly becoming a benchmark for developing economies in Southeast Asia.

Vietnam’s Remarkable Achievements

Beng attributes Vietnam’s 2025 success to four interconnected factors.

Firstly, exports remain a cornerstone of growth. Despite a 20% import tariff imposed by the US, Vietnam’s total export value reached approximately $475 billion, a 17% increase year-on-year. Notably, exports to the US hit a record high, generating a trade surplus despite tariffs and global economic headwinds.

Vietnam’s success is setting a new standard for developing economies in Southeast Asia. (Illustrative image)

This export boom spurred industrial production and retail sales to grow by over 9%, while inflation remained low at around 3%. Foreign direct investment also rose by nearly 9%, reflecting investor confidence in Vietnam’s manufacturing ecosystem.

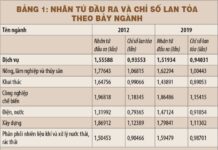

Secondly, Vietnam is emerging as a global manufacturing hub. Multinational corporations from South Korea, Japan, the US, and increasingly China, have established large-scale production facilities in Vietnam, focusing on electronics, textiles, and consumer goods. Regions like Bac Ninh have transformed from agricultural areas into industrial cities, driven by export corridors.

Thirdly, domestic demand, particularly household consumption and investment, continues to strongly support overall growth. While exports garner much attention, Vietnam’s domestic market is also expanding rapidly, fueled by rising incomes and a growing middle class.

Lastly, Vietnam’s strategic adaptability in trade and investment policies has helped it navigate external shocks. The country has countered tariff pressures by diversifying its export markets and products. Vietnam is actively pursuing new trade agreements to reduce reliance on any single market, while aiming for an ambitious average growth rate of 10% by 2030.

A Model for Southeast Asia

Phar Kim Beng believes Vietnam’s achievements are not only impressive but also demonstrate a broader truth: high growth rates are achievable in Southeast Asia when countries align structural advantages with global trends.

He argues that Vietnam’s 8% growth is not a ceiling but a new benchmark, showing that Southeast Asian economies can thrive by leveraging global trends and committing to reforms.

Vietnam’s experience offers valuable lessons for Indonesia, Southeast Asia’s largest economy and a G20 member, as it strives for higher development goals.

Indonesia possesses numerous advantages, including a large economy with a vast domestic market, significant contributions from manufacturing, services, natural resources, and the digital economy to its GDP. The country is also implementing policies to enhance its value chain, with strategies like deep processing of minerals such as nickel and copper yielding more sustainable results and reducing dependence on global commodity price fluctuations.

Indonesia’s aspiration to join the Organisation for Economic Co-operation and Development (OECD) reflects its commitment to governance reforms and global economic integration, potentially boosting investor confidence. Embracing higher institutional standards is expected to drive productivity, enhance policy predictability, and attract sustainable investment in high-value sectors.

Additionally, Indonesia’s demographic dividend, with its population peaking between 2030 and 2040, will significantly expand its labor force and domestic consumer base. These conditions suggest that Indonesia’s baseline growth prospects, estimated at around 5-5.5% for 2025-2026 by the World Bank and OECD, could be accelerated with the right policy mix and investor confidence.

UOB Revises Vietnam’s 2026 GDP Growth Forecast Upward

Fourth-quarter 2025 GDP growth hit its highest level since 2009, pushing full-year growth to 8%. This performance sets the stage for an upgraded 2026 growth forecast of 7.5%, despite lingering global trade risks.