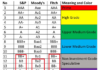

On January 14th, the VN-Index dipped by 8.74 points to 1,894.19, following its previous session’s breach of the 1,900 mark. While numerous privately held stocks experienced sharp declines, state-owned enterprises like BCM (Becamex), VNM (Vinamilk), BID (BIDV Bank), GVR (Vietnam Rubber Group), and PLX (Petrolimex) continued to attract significant investment.

Shifting Investment Trends

Analysts attribute this surge to Resolution 79/NQ-TW, recently issued by the Politburo, which outlines strategies for state-owned economic development. Veteran investors note the rarity of such a widespread and robust rally among blue-chip stocks.

Khánh Tuấn, an investor from Ho Chi Minh City, shared his experience: “I purchased BID shares in November 2025 at VND 38,000 per share. After two months of sideways movement, the stock suddenly surged, turning a 30% loss into a profit. Similarly, friends holding VCB (Vietcombank) and CTG (VietinBank) saw their portfolios shift from negative to positive in a short period.”

Market liquidity also soared, with daily trading volumes surpassing $1 billion. On January 14th alone, the HoSE recorded over VND 46 trillion in transactions, with total market liquidity nearing VND 50 trillion across all exchanges. This activity underscores the abundance of domestic capital ready to absorb profit-taking at higher price levels.

According to Võ Kim Phụng, Director of Analysis at BETA Securities, recent sessions highlight the accelerated performance of state-owned enterprises, particularly in banking, energy, and infrastructure. This phenomenon has been dubbed the “policy wave” by investors.

However, Phụng emphasizes that this shift reflects a deeper transformation in Vietnam’s stock market rather than a short-term reaction to new information. “Resolution 79 is not the starting point but a critical piece in a sustainable growth framework, where state-owned enterprises provide stability and strategic leadership, while the private sector drives innovation and growth. It complements Resolution 68/NQ-TW, which addresses challenges in the private sector,” he explained.

Investors are surprised by the unprecedented rally in state-owned stocks. Photo: LAM GIANG

Repositioning State-Owned Enterprises

Historically, state-owned stocks have underperformed due to low capital efficiency, subpar governance, and fiscal obligations. Resolution 79 marks a turning point by prioritizing efficiency, autonomy, and strategic roles for state-owned enterprises, rather than merely using them for macroeconomic stability.

Nguyễn Thanh Lâm, Director of Retail Analysis at Maybank Securities, views Resolution 79 as pivotal for Vietnam’s economic growth ambitions. “This is a long-term initiative. Restructuring state-owned enterprises will be a continuous and extensive process,” he stated.

Lâm notes that the initial surge in state-owned stocks is largely psychological. Tangible improvements in structure and operational efficiency will take time to reflect in financial results. “In 2026, the stock market benefits from high economic growth targets, potential FTSE upgrades, an 18% projected increase in listed company profits, reasonable valuations, and the potential return of foreign capital. The IPO pipeline for both private and state-owned firms is expected to be more vibrant post-Resolution 79,” he analyzed.

Huỳnh Anh Tuấn, CEO of VikkiBank Securities, believes the market has “repositioned” itself following Resolution 79. “With clarity in policy, the market will stabilize, and liquidity will increase. The resolution’s clear vision and high growth objectives have bolstered investor confidence. Notably, foreign investors have resumed net buying in recent sessions,” he observed.

Tuấn predicts that beyond targeted state-owned groups in energy, banking, and infrastructure, other stocks will also benefit from the influx of capital. “Markets are cyclical; no sector rises indefinitely. The energy sector, previously lagging, is now thriving due to strong earnings and Resolution 79 expectations, leading to a robust rally,” he added.

Tuấn also sees Resolution 79 as a catalyst for Vietnam’s market evolution from speculative to value-driven, with state-owned enterprises becoming quality benchmarks.

Võ Kim Phụng highlights a key difference in this rally compared to past policy-driven surges: the focus on profit structure changes. “Previously, state-owned stocks rose on expectations of foreign ownership caps, equitization, or divestment. Now, the market anticipates capital retention, reinvestment, and balance sheet optimization, especially in banking and infrastructure. If 2026-2027 sees profit growth alongside improved capital efficiency (ROE), revaluation is justified, and the uptrend could persist. Otherwise, the rally may soon diverge,” he cautioned.

Real Estate Continues to “Bottom Out”

While the market reaches new highs and state-owned, banking, and securities stocks surge, many real estate and construction investors remain in the red. Several stocks in this sector are still near their 2025 lows, with no clear recovery timeline.

However, MBS Securities’ 2026 residential real estate report suggests 2026-2027 could mark a new expansion cycle. Growth drivers include infrastructure investment, improved housing demand, regulatory easing, and increased supply. Despite rising interest rates, they remain low, and the bond market’s revival offers additional financing options.

MBS believes financially robust companies with ready land banks and swift execution will thrive in this cycle. “Most real estate stocks are priced below or near their five-year averages, while sales and cash flows are improving. These factors present opportunities for many real estate companies,” an MBS expert noted.

Experts highlight that foundational sectors like finance, energy, infrastructure, and digital security require substantial capital and long payback periods, making them unsuitable for private sector dominance. Resolution 79 is seen as a strategic move to enable state-owned enterprises to lead and create a foundation for private sector growth.

Khánh Hòa Books (KHX) Surges 40% on UPCoM Debut

On the morning of January 15, 2026, KHX shares of Khanh Hoa Publishing Joint Stock Company surged by the maximum limit of 40% at the opening of the first trading session, reaching 25,000 VND per share. This remarkable jump propelled the company’s market capitalization past the 125 billion VND milestone.

Vietstock Daily 15/01/2026: Turbulence at the Peak?

The VN-Index paused its upward momentum as intense volatility emerged near the new peak around the 1,900-point mark. With the Stochastic Oscillator reversing and signaling a sell in overbought territory, the index may require additional time to establish a new price equilibrium. The previous October 2025 high has been decisively breached, positioning it as a robust short-term support level.

Unveiling the Secret: The Trio of Islands Shaping Nha Trang’s All-in-One Urban Paradise

Nestled in the heart of the urban landscape, Charmora City stands as an exclusive “island” oasis, offering unparalleled privacy and security. Each of its three distinct islands—North, Central, and South—is meticulously designed with a unique purpose, seamlessly integrating the golden trifecta of Live, Work, and Play. This pioneering concept in Nha Trang caters to every need of residents and visitors alike, redefining modern living.