SCIC Investment One Member LLC has announced that it will not sell any Vinamilk shares (stock code: VNM) out of the 1.45 million shares registered for sale between December 10, 2025, and January 8, 2026, citing market volatility as the reason.

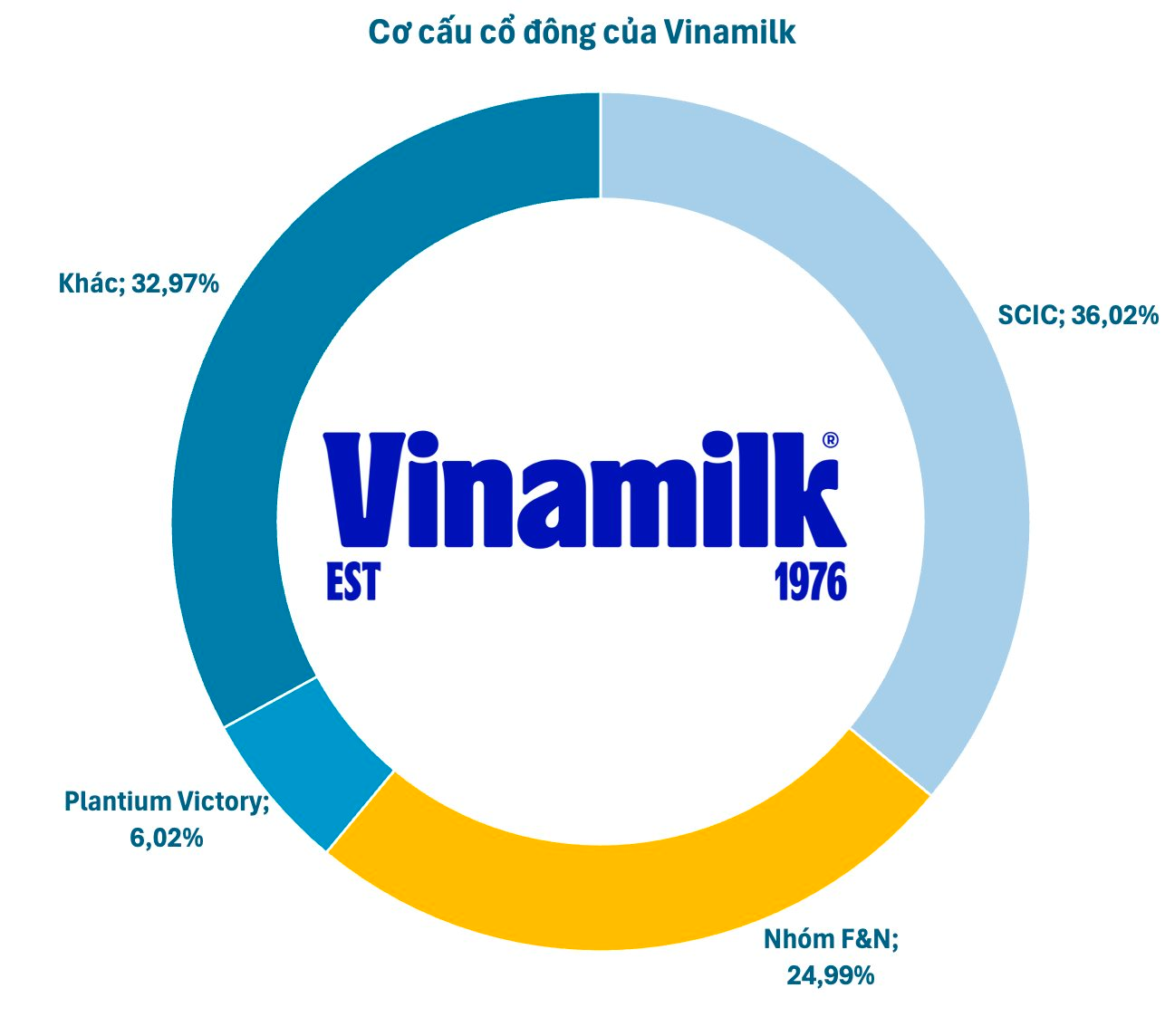

SCIC Investment is wholly owned by the State Capital Investment Corporation (SCIC). At Vinamilk, SCIC is the largest shareholder, holding nearly 752.5 million shares, equivalent to 36% of the company’s capital.

In a separate development, in December 2025, F&N Dairy Investments announced an agreement to acquire over 96 million Vinamilk shares, equivalent to 4.6% of the total shares, from JC&C (the parent company of Platinum Victory).

The transaction value is approximately 6,000 billion VND, or 228 million USD. Following this deal, Fraser & Neave (F&N)’s ownership in Vinamilk will increase to approximately 25%, making it the second-largest shareholder after SCIC.

Conversely, Platinum Victory’s stake in Vinamilk will decrease from 10.62% to 6.02%, and it will withdraw its capital representative from the Board of Directors. JC&C stated that this transaction aligns with its strategy of “building a focused investment portfolio to enhance shareholder value.”

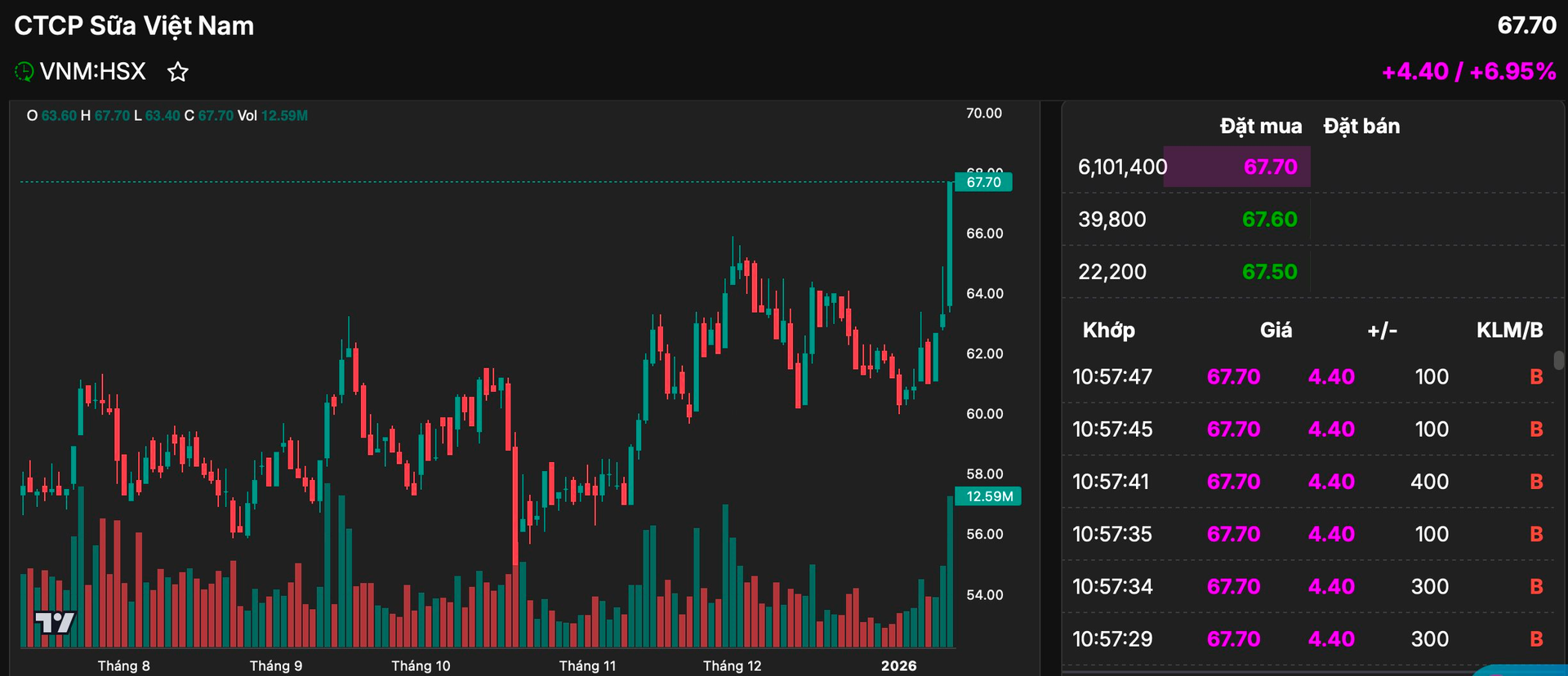

Immediately after the state shareholder announced its inability to divest, Vinamilk’s shares surged to the ceiling price with no sellers on January 13, reaching 67,700 VND per share, the highest since September 2023. The corresponding market capitalization exceeded 140,000 billion VND.

Looking ahead, a recent report by KBSV predicts that Vinamilk’s business performance in 2026 will significantly improve due to its new product lineup, which is highly competitive across all segments, from mid-range to premium. Additionally, the improvement in disposable income through new personal income tax regulations, along with the impact of tightened tax policies and the restructuring of distribution channels, is expected to yield positive prospects.

Thai Billionaire Acquires 96 Million Vinamilk Shares in 2-Minute, $260 Million Deal

On the morning of December 22nd, a blockbuster block trade of 96 million VNM shares, valued at over 6 trillion VND, was successfully executed. This transaction marks the final step in the previously announced capital transfer between two major foreign shareholders of Vinamilk.

The Silent Battle for Vinamilk Reaches Its Climax: Thai Billionaire Takes the Lead – Will the Historic Sabeco Takeover Saga Repeat?

The long-standing silent battle for control of Vinamilk has nearly concluded with the recent share transfer between F&N and JC&C, tipping the scales in favor of billionaire Charoen Sirivadhanabhakdi. This move not only marks the end of a protracted struggle but also ushers in a new era, as Thai investors have never concealed their ambitions to dominate the market.

Major Deal Involving Novaland and Vinamilk

Both NovaGroup and Diamond Properties are linked to Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors, who will receive nearly 164 million additional NVL shares. F&N Dairy Investments Pte. Ltd. will invest approximately VND 6.011 trillion to increase its stake in Vinamilk to 24.99% of the charter capital.

Thai Owner of Sabeco Plans to Invest Additional $260 Million to Significantly Boost Stake in Vinamilk

Through its subsidiary F&N, billionaire Charoen Sirivadhanabhakdi’s conglomerate has finalized a deal to acquire a 4.6% stake in Vinamilk, Vietnam’s leading dairy company, from Jardine Cycle & Carriage for approximately $228 million. This strategic move solidifies F&N’s position as the largest foreign shareholder in Vinamilk, further strengthening its foothold in the industry.