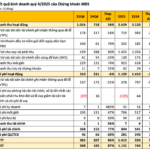

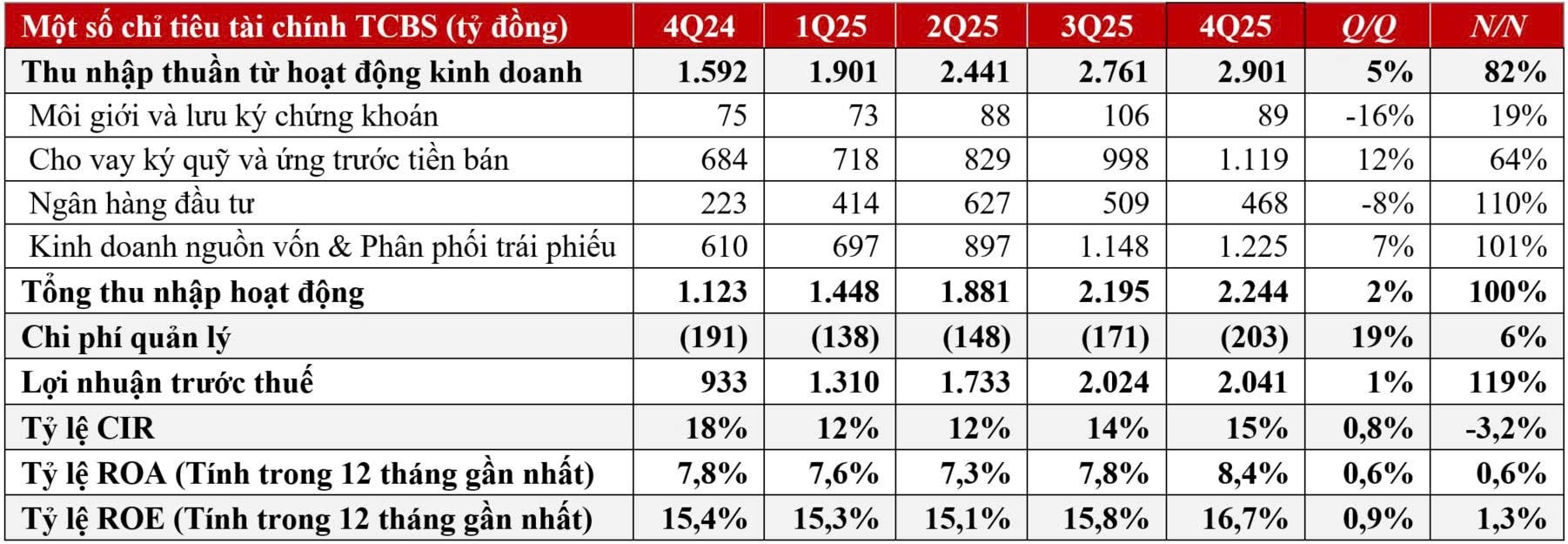

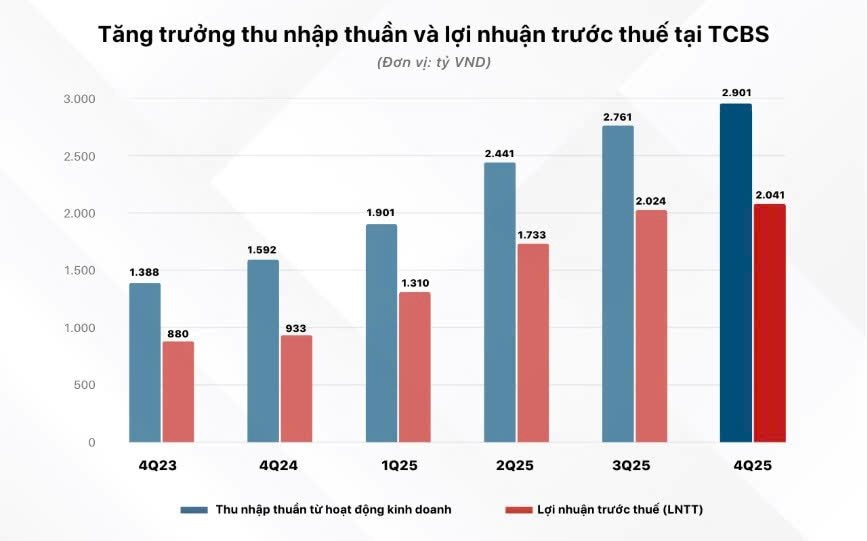

TCBS’s pre-tax profit in Q4/2025 continued to soar, reaching VND 2,041 billion, a nearly 120% increase compared to the same period last year. For the full year 2025, the company’s pre-tax profit hit a record high of VND 7,109 billion, achieving 123% of the annual plan and a nearly 50% increase compared to 2024.

Following a successful IPO and listing on the stock exchange in October 2025, TCBS solidified its position as the securities company with the largest equity capital in the market. It also maintained its leadership in capital efficiency, achieving the highest performance in the last 11 quarters, with a return on equity (ROE) of 16.7% and a return on assets (ROA) of 8.4%.

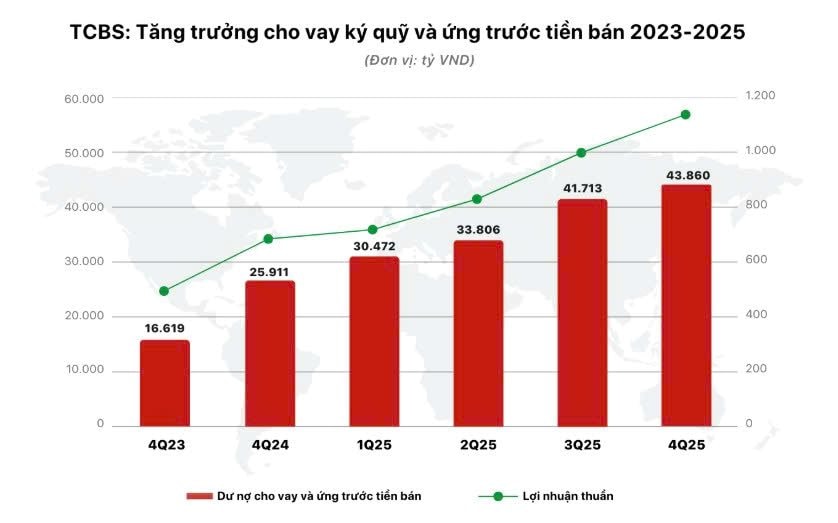

This remarkable performance was driven by all four core business segments: Stockbroking and custody services saw a significant surge, with a market share of 9.0% on the HOSE in Q4/2025. Margin lending and advance payment for stock sales continued to lead the market, with an outstanding balance of nearly VND 44,000 billion by the end of 2025.

Investment banking, bond distribution, and fund certificates maintained their leading positions, leveraging the comprehensive value chain within the Techcombank ecosystem.

These impressive figures reflect the effectiveness of the WealthTech model, which optimizes the ecosystem’s advantages and technological strengths, particularly through the flexible and extensive application of AI. TCBS delivers optimized and rapid services at reasonable costs, ensuring security and effective risk management. In 2025, TCBS was widely recognized domestically and internationally by prestigious organizations in technology and finance, earning awards such as “Best IPO” and “Most Innovative Use of Technology” from FinanceAsia, “Best Digital Wealth Management Experience” at the Triple A Digital Awards 2025, and many other distinguished accolades.

Outstanding 2025 business results

Stockbroking and Custody Services: Revenue from stockbroking and custody services in Q4/2025 reached VND 89 billion, a 19% increase compared to the same period last year. For the full year 2025, revenue totaled VND 356 billion, a 63% increase compared to 2024. The number of new trading customers surged by 64% compared to 2024. In Q4, the company expanded its market share on the HOSE to 9.0%, a 1.3% increase compared to the same period in 2024, and achieved a market share of 8.85% on the HNX, a 0.5% increase. This success was driven by the Zero-fee trading policy, transaction promotion programs, and stable, fast service quality. Additionally, leveraging its WealthTech strengths, TCBS successfully launched the KRX trading system, a new platform that comprehensively upgrades infrastructure and technology to handle up to 3 million orders per day and increases Gateway order submission speed to 15,000 orders per second.

In the warrant trading segment, TCBS issued over 24 warrant codes in 2025, with a total issuance value of over VND 350 billion, providing customers with diverse and optimal investment options.

Fund certificate distribution in Q4/2025 exceeded VND 4,500 billion, contributing to a full-year distribution of over VND 23,300 billion, a 24% increase compared to 2024. 2025 marked the launch and rapid growth of Fundmart, Vietnam’s leading smart fund certificate distribution platform, managing 30 investment funds from reputable asset management companies such as Techcom Capital, Dragon Capital, VinaCapital, SSI, VCB Capital, and UOB, accounting for nearly 50% of the total net asset value (NAV) of domestic funds.

Fundmart continuously introduced innovative features, notably the pioneering Buy Signal Testing feature in Q4/2025, attracting over 22,000 investors and achieving a monthly platform access rate of over 70,000 investors.

Margin Lending and Advance Payment for Stock Sales: In Q4/2025, interest income from margin lending and advance payment for stock sales reached VND 1,119 billion, a 12% increase compared to the record-breaking previous quarter and a 64% increase compared to the same period last year. For the full year 2025, total interest income from this segment reached VND 3,664 billion, contributing 37% to total net operating income and a 43% increase compared to 2024.

In 2025, following successful private placements and IPOs, TCBS maintained a loan-to-equity ratio of 0.99, significantly below the 2x ceiling set by the Securities Commission, leaving ample room for growth in the margin lending segment.

Investment Banking: The investment banking segment recorded net revenue of VND 468 billion in Q4/2025, a 110% increase compared to the same period last year. For the full year 2025, total revenue reached VND 2,018 billion, a 50% increase compared to 2024. Total bond issuance value in 2025 exceeded VND 85,000 billion, capturing a 38% market share and reaffirming TCBS’s leading position in the corporate bond market.

Capital Trading and Bond Distribution: Net revenue from capital trading and bond distribution in Q4/2025 reached VND 1,225 billion, a 101% increase compared to the same period last year. For the full year 2025, total revenue reached VND 3,966 billion, contributing 40% to total revenue and a 42% increase compared to the previous year.

In Q4/2025, TCBS distributed over VND 19,600 billion in corporate bonds to individual investors, a 32% increase compared to the previous quarter, contributing to a total distribution value of over VND 70,800 billion for the year. Additionally, the iConnect online bond trading system was widely used by investors, with a total transaction value of over VND 21,000 billion in 2025.

Financial Position: As of December 31, 2025, TCBS’s total assets reached over VND 80,632 billion, a 51% increase compared to the end of 2024. The primary growth drivers were margin lending and increased investment in financial assets to optimize capital.

In 2025, following successful private placements and IPOs, TCBS maintained its position as the market leader in equity capital, with a total debt-to-equity ratio of 0.77, well within safe limits.

The capital adequacy ratio (CAR) in Q4/2025 was 1.8 times higher than the minimum requirement of 260%, ensuring a safe buffer for growth and market fluctuations.

WealthTech Milestones in 2025

2025 marked another year of significant progress for TCBS in its WealthTech strategy, focusing on the flexible and in-depth application of financial technology and AI. Throughout the year, TCBS successfully implemented over 1,350 technology projects, demonstrating strong operational capabilities, high innovation speed, and rapid adaptation to market demands.

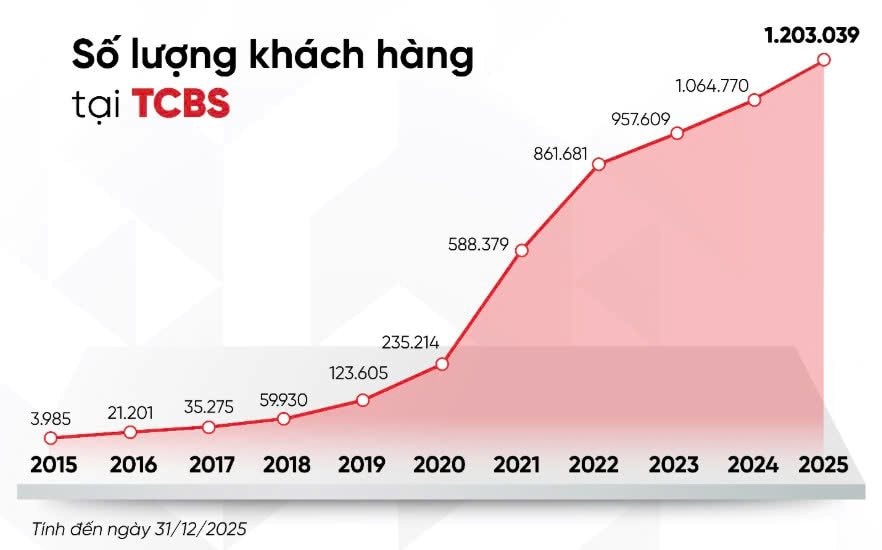

Information security capabilities were further validated through impressive international metrics: Microsoft Secure Score reached 83.24/100, and AWS Foundation Security Best Practices achieved 90/100. Meanwhile, the TCInvest system recorded over 138,000 new accounts in 2025, bringing the total number of individual customers to over 1.2 million, with an average of nearly 17 million monthly visits, reflecting investors’ strong loyalty to TCBS.

TCBS continued to make strides in applying artificial intelligence to enhance customer experience and internal operations. The TCInvest platform integrated AI-powered multilingual translation (English, Japanese, Korean, Chinese), marking a significant step in expanding services to international markets.

Additionally, TCBS introduced innovative AI products, notably AI Studio, which revolutionizes workflow automation (Agentic workflows), AI-driven automation, and AI agents. These are now being deployed across the company’s operational units. Automation and AI integration have saved TCBS thousands of operational hours, enabling business units to proactively leverage data for timely investment product development decisions. As a result, the cost-to-income ratio (CIR) in 2025 remained at 13.7%, a 0.5% decrease compared to 2024.

Starting in Q4/2025, TCBS began implementing AI Agentic Software Development to enhance system development efficiency, shorten product time-to-market, and improve the stability of digital platforms. This initiative establishes a robust technological foundation for scalable operations and sustainable customer experience enhancements in the long term.

TCBS’s technological innovation efforts in 2025 were recognized by 18 prestigious domestic and international awards in technology, finance, and wealth management.

TCBS Shatters Records with Over 7.1 Trillion VND in Profits for 2025

Technological Commercial Joint Stock Securities Company (TCBS – HOSE: TCX) has announced its Q4 and full-year 2025 financial results, revealing a pre-tax profit that surpasses the annual plan by 123%.

First Securities Firm Releases Q4/2025 Financial Report: Profit Surges Nearly 90% Year-on-Year, Margin Debt Cools Down

In 2025, the brokerage firm impressively surpassed its profit target by nearly 9% for the entire year.