As we step into 2026, Vietnam’s stock market continues its high-spirited momentum. On January 13th, the VN-Index surged by 25.6 points, a 1.36% increase, reaching an all-time high of 1,902.93 points. This extends the peak-breaking streak that began in late 2025.

|

VN-Index Consistently Conquering New Milestones |

|

Source: VietstockFinance

|

This surge highlights the market’s robust growth momentum, building on the foundation laid in 2025, when the VN-Index reached historic highs in closing prices and widespread capital inflows. However, not all stock groups benefited equally from this trend.

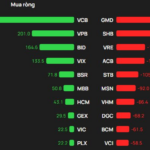

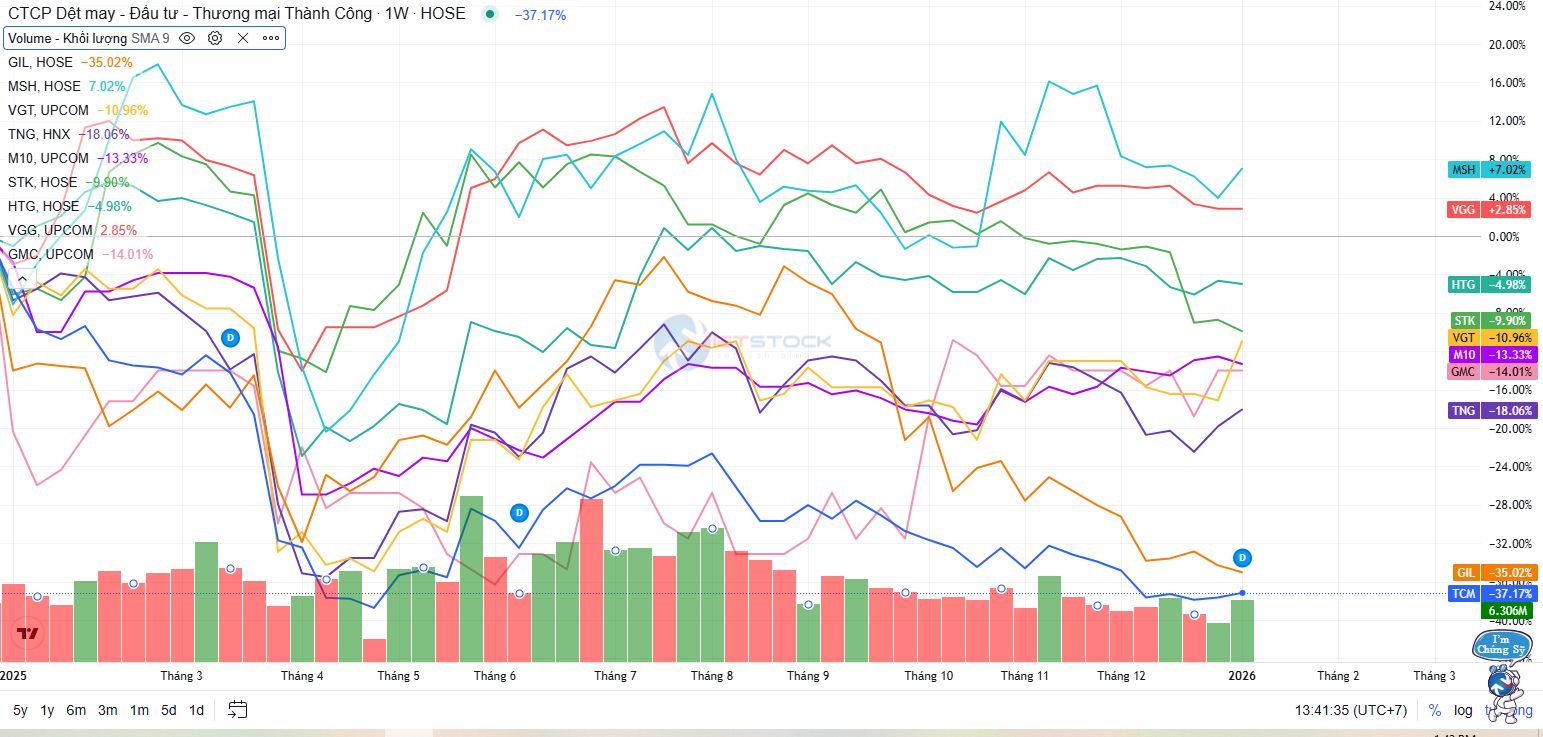

Looking back at 2025, the textile and garment stocks were among the most out-of-sync with the overall market. Despite maintaining their role as a key export pillar with an estimated turnover of $46 billion, a 5.6% increase from the previous year, these stocks largely remained outside the general uptrend, with most codes either decreasing or fluctuating within a narrow range.

This disparity is evident in the industry’s overall performance. While the VN-Index rose nearly 41% in 2025, the fashion and textile index increased by only 9.69%, reflecting a significant shift in market expectations for the sector’s prospects.

Source: VietstockFinance

|

The Tariff Shock

Over time, the textile index moved relatively in sync with the VN-Index in the first quarter of 2025. However, from April, the trajectories of the two indices began to diverge, with the gap widening towards the end of the year, even as the overall market accelerated.

The direct cause was the U.S. tariff shock in early April 2025. This immediately triggered a widespread sell-off in stocks heavily reliant on exports. A 90-day tax deferral only created a brief rebound as businesses rushed to ship goods to “avoid taxes,” while market confidence remained largely unrecovered.

When the official 20% tax was implemented in August, the pressure returned, and most stocks continued to weaken until the end of the year. The shock, therefore, was not only short-term but left a lasting “scar” in how the market evaluates the textile industry’s prospects.

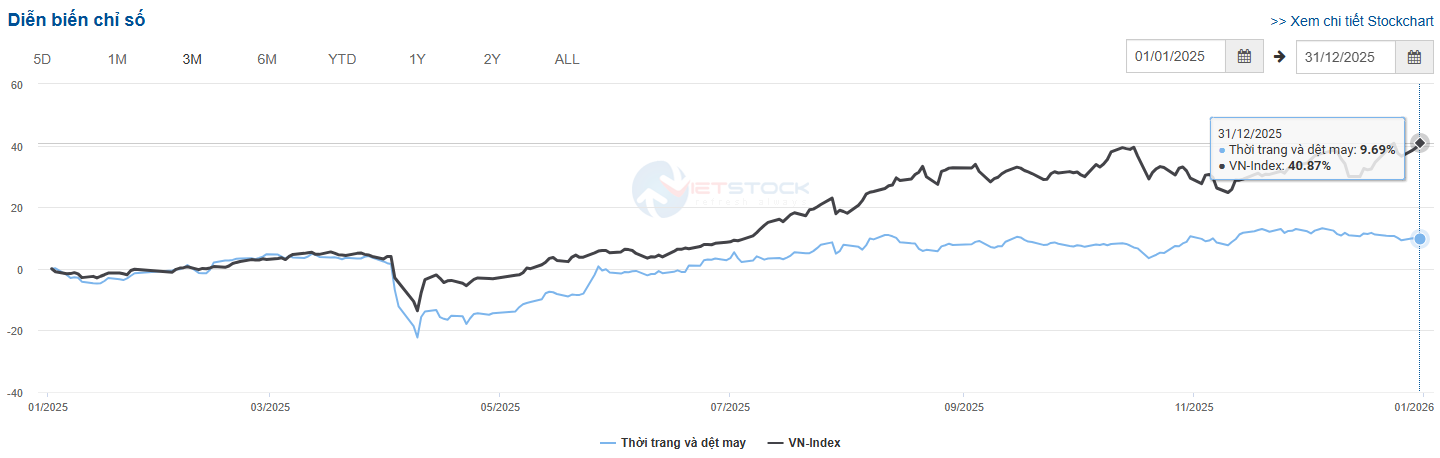

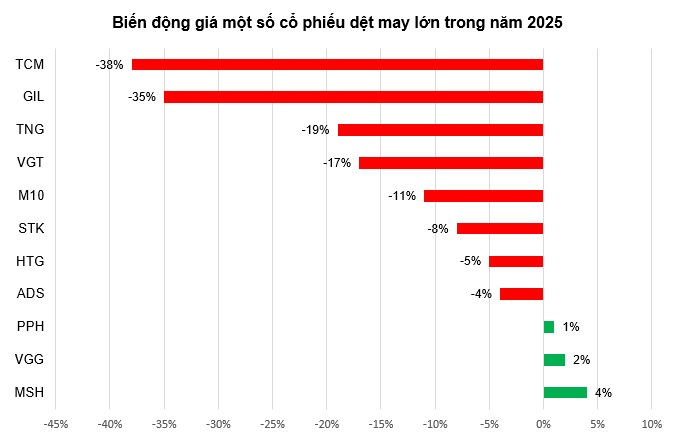

A Picture of Polarization: More Declines, Fewer Gains, and Sideways Movement Dominating

The impact of the tariff shock was industry-wide, evident in the price movements of 50 listed textile stocks. According to VietstockFinance data, by the end of 2025, 25 codes, half of those surveyed, had decreased in value. Of these, 14% plummeted by over 20%, and 12% fell between 10-20%.

Conversely, 23 codes increased, but only 13 surpassed the industry average. Notably, the largest group, equivalent to 48% of the codes, moved sideways, fluctuating between -10% and +10%. This structure reflects a market lacking momentum, with capital standing aside and a wait-and-see attitude prevailing among most stocks.

Source: VietstockFinance, author’s compilation

|

Price movements of representative textile codes in 2025 – Source: VietstockFinance

|

Shrinking Capitalization, Leading Enterprises Also Losing Steam

Negative price movements led to a contraction in market capitalization. By the end of 2025, the total capitalization of the 50 surveyed textile stocks fell below 35,000 billion VND, a 3% decrease from the previous year. This signals the market’s cautious medium-term outlook for the industry, rather than just a temporary reaction to information shocks.

Even leading enterprises were not immune to this trend. Shares of Thanh Cong Textile Garment Investment Trading JSC (HOSE: TCM) lost 38% of their value in the year, with capitalization dropping by 32%. The tariff shock pushed TCM‘s market price to a 5-year low, with only a brief recovery before adjusting again.

Similarly, Binh Thanh Import Export Production and Business JSC (Gilimex, HOSE: GIL) shares fell by 35% over the year, amid the company’s prolonged dispute with Amazon and a net loss of over 100 billion VND in 9 months. GIL‘s price movements highlight the fragility of textile stocks in the face of both macro risks and internal issues.

Source: VietstockFinance, author’s compilation

|

A notable paradox in 2025 was the disconnect between business results and stock performance. Many industry leaders reported high revenues and profits, yet their stock prices still declined.

TNG Investment and Trading JSC (HNX: TNG) is a prime example, with its stock falling 19% in the year despite estimated revenues of 8,696 billion VND, the highest in the company’s history. Similarly, Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT) saw a 19% drop in stock price and a 17% decline in capitalization, while pre-tax profits reached 1,350 billion VND, the second-highest ever.

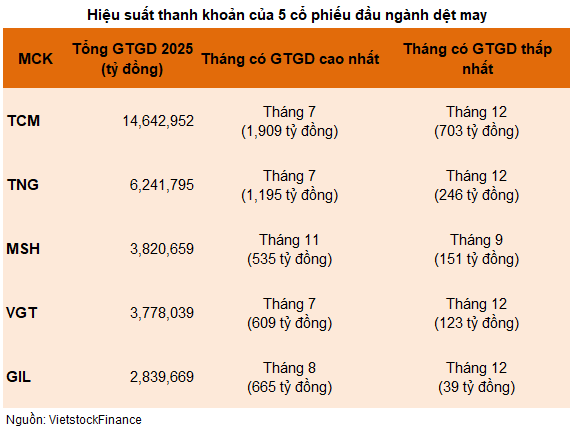

Highly Concentrated Capital Flows, Peaking in July-August

The liquidity of the textile industry in 2025 showed extremely concentrated capital flows rather than widespread distribution. The top 5 leading codes—TCM, TNG, VGT, GIL, and MSH—recorded a total trading value of over 31,213 billion VND, accounting for 92.3% of the industry’s total trading value.

|

Even within the leading group, polarization was evident. TCM emerged as the absolute leader, accounting for about 43% of the industry’s total trading value, with over 14,642 billion VND traded in the year. TCM‘s liquidity was even larger than the combined trading value of TNG and VGT.

Interestingly, liquidity did not surge immediately after the April tariff shock but peaked in mid-year. Capital inflows into the textile industry increased sharply in July and August, reaching approximately 5,126 billion VND and 4,451 billion VND, respectively—the highest levels of the year. Most leading stocks saw liquidity peak during these two months.

|

However, from August, when the 20% tax took effect, textile stock prices collectively reversed and failed to recover by year-end. Liquidity also declined significantly. In December alone, the industry’s total trading value hit a low of just 1,490 billion VND, reflecting prolonged caution and the withdrawal of speculative capital.

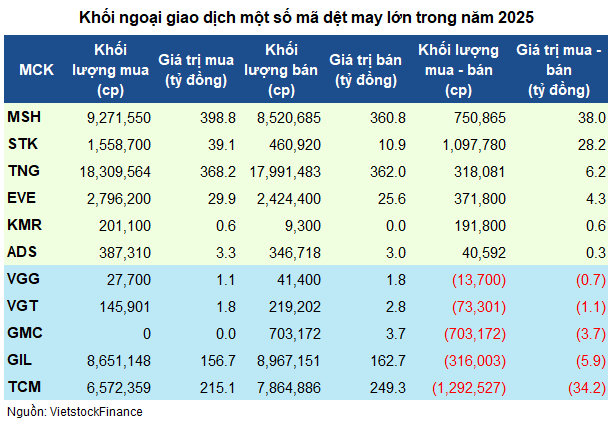

From the perspective of foreign capital, the picture was not very supportive. Amid foreign investors’ record net selling of over 121,000 billion VND across the market in 2025, the net buying value of less than 31 billion VND in the textile group was too small to make an impact.

This capital was concentrated in a few individual codes like MSH (+38 billion VND) and STK (+28.2 billion VND), while net selling pressure persisted in key stocks like TCM (-34.2 billion VND). This further underscores the reality that the textile industry still lacks sufficient and sustained capital to lead the trend.

|

2026 – Testing the Resilience of Textile Stocks

Overall, 2025 was a challenging year for textile stocks. The tariff shock acted as a catalyst, but the limited recovery highlights deeper issues related to order prospects, competitive advantages, and the global policy environment. The market awaits clearer signals to restore confidence.

According to the 2026 textile industry outlook report by Asean Securities (Aseansc), the industry is recommended for medium-term monitoring as positive factors and risks continue to coexist. In the long term, the global textile market is projected to exceed $3,500 billion by 2035, offering Vietnam opportunities to increase its export market share, particularly in CPTPP and EU markets.

The trend of supply chain shifts away from China remains a crucial support, along with advantages in geographical location, political stability, and improved logistics infrastructure. FDI inflows into supporting industries are expected to increase to meet rules of origin in FTAs, thereby enhancing localization rates and added value.

However, the recovery prospects for 2026 are unlikely to be linear. Labor cost pressures, tariff risks in major markets, green transition requirements, and raw material supply instability remain significant headwinds. In this context, 2026 is likely to be a period testing the adaptability and restructuring capabilities of individual enterprises rather than a collective breakthrough for the entire industry.

– 19:00 14/01/2026

Foreign Block Reverses to Sell on VN-Index Record Day, Contrasting with Over 500 Billion VND Inflow into a Banking Stock

In today’s sell-off, GMD topped the list of stocks heavily offloaded by foreign investors, recording a net outflow of approximately VND 252 billion.