According to Vo Huynh Tuan Kiet, Director of Residential Real Estate at CBRE Vietnam, secondary market transaction prices for landed properties in Hanoi are higher than primary prices. This reflects the concentration of secondary transactions in central and near-central areas, where real demand remains strong.

Vo Huynh Tuan Kiet, Director of Residential Real Estate at CBRE Vietnam, shares insights at the Vietnam Real Estate Market Overview Press Conference Q4/2025.

In Q4/2025, the new supply of landed properties in Hanoi reached 654 units, with the majority coming from the Van Giang urban area (Hung Yen).

For the entire year of 2025, the total new supply recorded was over 3,800 units. Although this figure is 40% lower than in 2024, it remains a substantial annual launch volume for the Hanoi market.

Vo Huynh Tuan Kiet, Director of Residential Real Estate at CBRE Vietnam

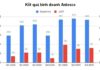

The market recorded stable liquidity in the final quarter, with 820 units sold. This figure brought the total transactions for 2025 to 5,852 units, exceeding the year’s new supply. The participation of foreign developers like CapitaLand in the low-rise segment has attracted significant buyer interest and intensified market competition.

The large supply in suburban areas has impacted average selling prices. As of the end of Q4/2025, the average primary price for landed properties was 187 million VND/m² (including construction, excluding VAT, maintenance fees, and pre-discounts). This price remained stable compared to Q3 but was 15% lower than the previous year, primarily due to the dominance of suburban primary inventory in 2025.

Mr. Kiet emphasized that the current supply is heavily concentrated in outlying areas, which has adjusted the overall market price by year-end.

In the secondary market, prices remained stable in Q4, averaging 201 million VND/m². Buyers are cautious due to rising interest rates and are weighing options against upcoming large-scale urban projects.

In 2026, the Hanoi landed property market is expected to welcome approximately 6,600 new units. The 2026 supply is anticipated to be diverse, including projects in both inner-city districts and suburban areas, from both domestic and foreign developers. The increasing presence of foreign developers is expected to drive primary market prices upward. Meanwhile, secondary market fluctuations will continue to correlate with interest rate movements, macroeconomic factors, and the progress of key infrastructure projects connecting the city center to satellite towns.

Over 1,500 Real Estate Experts and Industry Leaders to Attend VRES

The real estate market is evolving, with emerging opportunities yet increasing polarization. Vietnam Real Estate Summit – VRES 2025 is set to gather over 1,500 leaders and experts, offering a platform to share the latest investment strategies and trends.

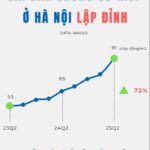

Hanoi Apartment Prices Double in Over 3 Years: Which Areas Are Seeing the Biggest Surge?

Apartment prices in Hanoi have seen remarkable growth in several key districts. Đống Đa leads the charge with a staggering 111% increase, reaching an average price of 86 million VND per square meter. Thanh Trì follows closely with a 119% surge to 59 million VND/m², while Gia Lâm and Bắc Từ Liêm also experienced significant jumps of 114% (64 million VND/m²) and 110% (84 million VND/m²), respectively.

“1,000 Affordable Apartments Sold Out in 5 Hours: Can Sunshine Group Cool Down Hanoi’s Real Estate Market?”

Recently, nearly 1,000 apartments at Sunshine Legend City were officially declared “sold out” after being distributed across various sales floors for unit matching. What sets this project apart is its starting price of just 50 million VND, which is 25% lower than comparable units in the surrounding area, attracting over 4,000 booking inquiries.