Real Estate Redefined: Prioritizing Quality of Life

Assoc. Prof. Dr. Ngô Trí Long, former Director of the Market and Price Research Institute (Ministry of Finance) and member of the Vietnam Financial Consulting Association (VFCA), observes a subtle yet significant shift in the investment mindset of Vietnam’s affluent class. While real estate remains a vital asset for wealth accumulation, the criteria for selection have evolved.

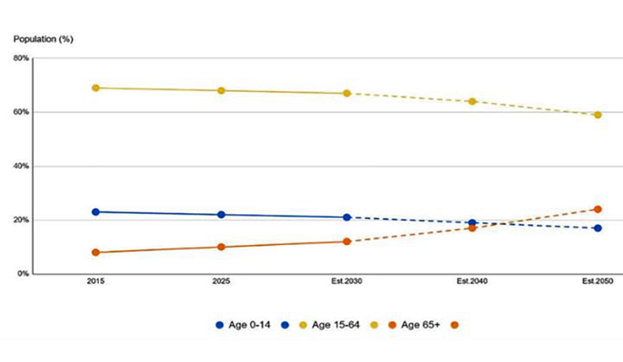

Citing March 2025 data from the General Statistics Office, Dr. Long highlights that by 2038, the proportion of individuals aged 60 and above may surpass 20%, marking Vietnam’s official transition into an aging population. This demographic shift directly impacts the middle and upper classes, who are at a “responsibility transition phase”: careers are stable, children are grown, but parents’ health begins to decline. Consequently, life’s focus shifts from “building” to “preserving.”

Vietnam’s Population by Age Group. Source: Savills Vietnam

|

“At this stage, financial security remains important, but the greater concern is losing control. This includes the helplessness when parents face medical emergencies, the pressure to make critical decisions during crises—from choosing care facilities to arranging caregivers and suitable recovery environments. Thus, real estate is no longer viewed as a purely financial asset but as a protective infrastructure for aging, ready to activate when needed,” explains Assoc. Prof. Dr. Ngô Trí Long.

An August 2025 survey by the United Nations Population Fund (UNFPA) reveals that over 80% of Vietnamese seniors prefer care within familiar environments, close to family, rather than traditional nursing homes. This underscores the demand for integrated living spaces combining healthcare, rehabilitation, and wellness, rather than separating “housing” from “services.”

Assoc. Prof. Dr. Ngô Trí Long

|

From a market perspective, Savills Vietnam’s November 2025 report identifies senior care real estate as a nascent yet high-potential segment. The market size is currently estimated at $2.3 billion and could expand to $3.6 billion by 2032, reflecting a compound annual growth rate of nearly 6%. However, supply remains limited, with fewer than 100 specialized senior care facilities nationwide.

Tokyu Retreat: Core Asset Logic with Hot Spring Therapy

As health-focused real estate emerges as a new asset class, Thera Home—a therapeutic apartment line within Tokyu Retreat (Thanh Thủy, Phú Thọ) developed by Onsen Fuji—stands out for its long-term wellness-centric approach. Tokyu Retreat comprises a 26-story Thera Home tower with 925 apartments, 312 low-rise villas, and integrated hot spring therapy amenities, forming a closed-loop ecosystem for living, therapy, and wellness, rather than a standalone residential or resort project.

The 26-story Tokyu Retreat tower in Thanh Thủy, Phú Thọ.

|

This approach is evident in the design, which centers living spaces around a therapeutic and rehabilitation ecosystem. Notably, Tokyu Retreat incorporates a 4-story Thera Healthcare Center within the 26-story tower, positioned as a premium senior care facility integrated into the living-therapy-wellness complex. Unlike standalone care facilities, this model enables seamless integration of specialized care into residents’ daily lives within the therapeutic apartments.

Residents have access to 24/7 health monitoring, personalized 1:1 care, physical therapy, tailored nutrition, and an emergency system directly linked to medical staff. Hot spring therapy is integrated into the complex, making natural recovery methods part of daily life rather than isolated services or short-term experiences.

A key differentiator lies in the standardized international operations. Thera Healthcare Center collaborates with Azurit Hansa (Germany), a leader in European senior care and rehabilitation, to ensure standardized care protocols and sustainable long-term operations—critical for the real value of health-focused real estate.

As asset accumulation strategies evolve, health-focused real estate reflects a shift in how Vietnam’s affluent approach assets. Unlike traditional homes suited only for healthy individuals, this asset type caters to a longer lifecycle, accommodating various health states. Its value lies not in occupancy but in its ability to provide care when needed, eliminating the need for emergency lifestyle adjustments.

From a family asset management perspective, health-focused real estate offers multifaceted value. Tangibly, it retains value and supports long-term accumulation. Strategically, it offers flexibility: rentable when not in use, convertible to care-focused living when needed. Deeper still, its “core asset” status stems from mitigating health risks and safeguarding quality of life for both present and future generations.

|

Hoàng Gia Group – Official Distributor of Tokyu Retreat Contact for in-depth consultation and exclusive offers: Hotline: 0338.691.988 / 0964.27.6868 Head Office: 9 Hùng Duệ Vương, Việt Trì Ward, Phú Thọ Province. |

Services

– 08:30 14/01/2026

Unmissable Expert Insights on the 2026 Real Estate Market

According to experts, the 2026 market will not favor incomplete projects, lack of transparency, or investors overly reliant on short-term leverage.