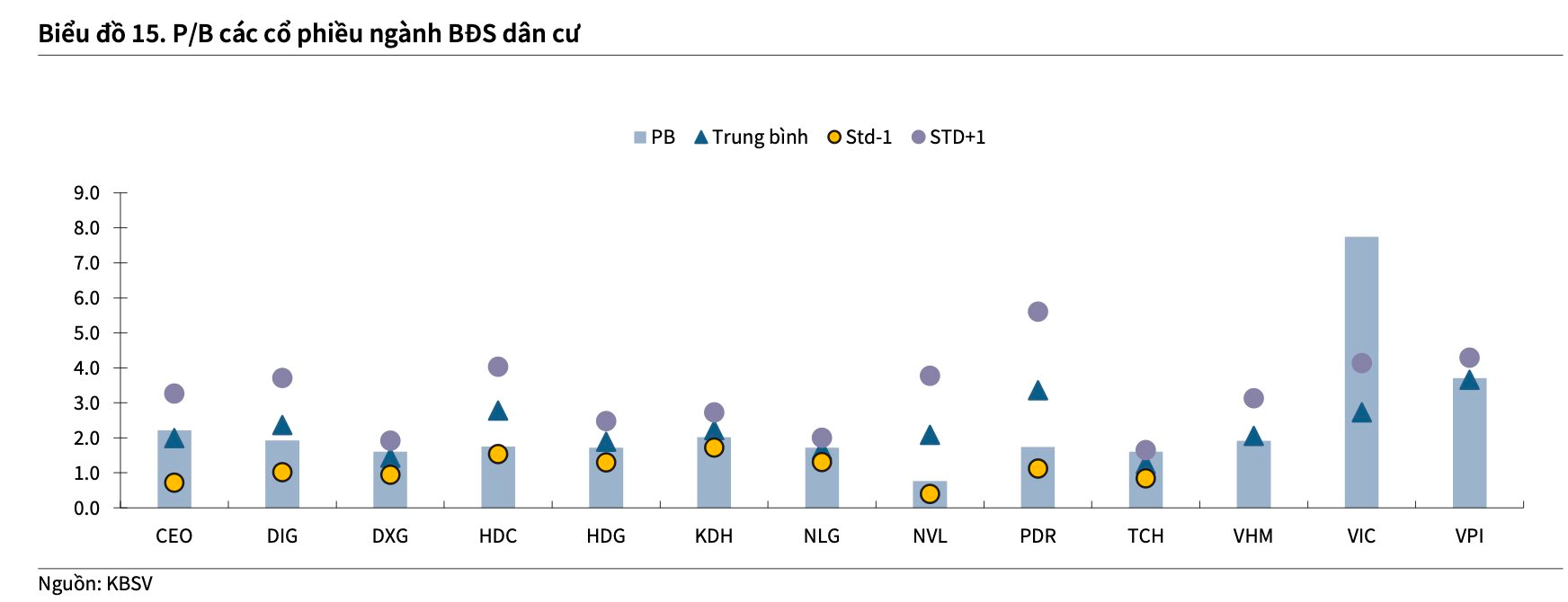

According to a recent report by KBSV, most real estate companies are currently trading at a significantly lower average P/B ratio compared to the five-year average.

With an anticipated improvement in supply from 2026, KBSV expects real estate companies’ business results to grow positively, driven by three key factors: legal unblocking and market mechanism improvement, increased investment in transportation infrastructure, and low-interest rates to support economic growth.

As a result, real estate stocks are considered to have recovery potential in the medium to long term. Investors may prioritize companies with large clean land banks, complete legal frameworks, strong project execution capabilities, and safe financial structures. KBSV highlights KDH and NLG as notable investment opportunities.

KBSV positively assesses the real estate sector’s potential following various legal unblocking solutions, including Resolution 171/2024/QH15, Decree 75/2025/NĐ-CP, Resolution 206/2025/QH15, and the draft regulation on mechanisms and policies to address difficulties in implementing the Land Law.

The positive easing measures following a period of tightening are expected to continue into 2026. This should improve market supply as more projects are approved, procedures are streamlined, and legally stalled projects can resume and relaunch.

Alongside legal unblocking, increased investment in transportation infrastructure remains a key driver for the real estate market. In 2026, alongside ongoing road projects, major initiatives like the North-South high-speed railway and ring roads in Hanoi and Ho Chi Minh City will contribute to a synchronized transportation network, enhancing the value of surrounding areas and supporting property prices. The trend of anticipating infrastructure development in emerging areas continues, helping establish asset value early.

The shift of real estate development to suburban areas is becoming more pronounced due to rising inner-city property prices, limited land availability, and improved connectivity. KBSV predicts that demand will continue to move outward, supporting the development of TOD (Transit-Oriented Development) urban models and boosting absorption rates in suburban projects in 2026.

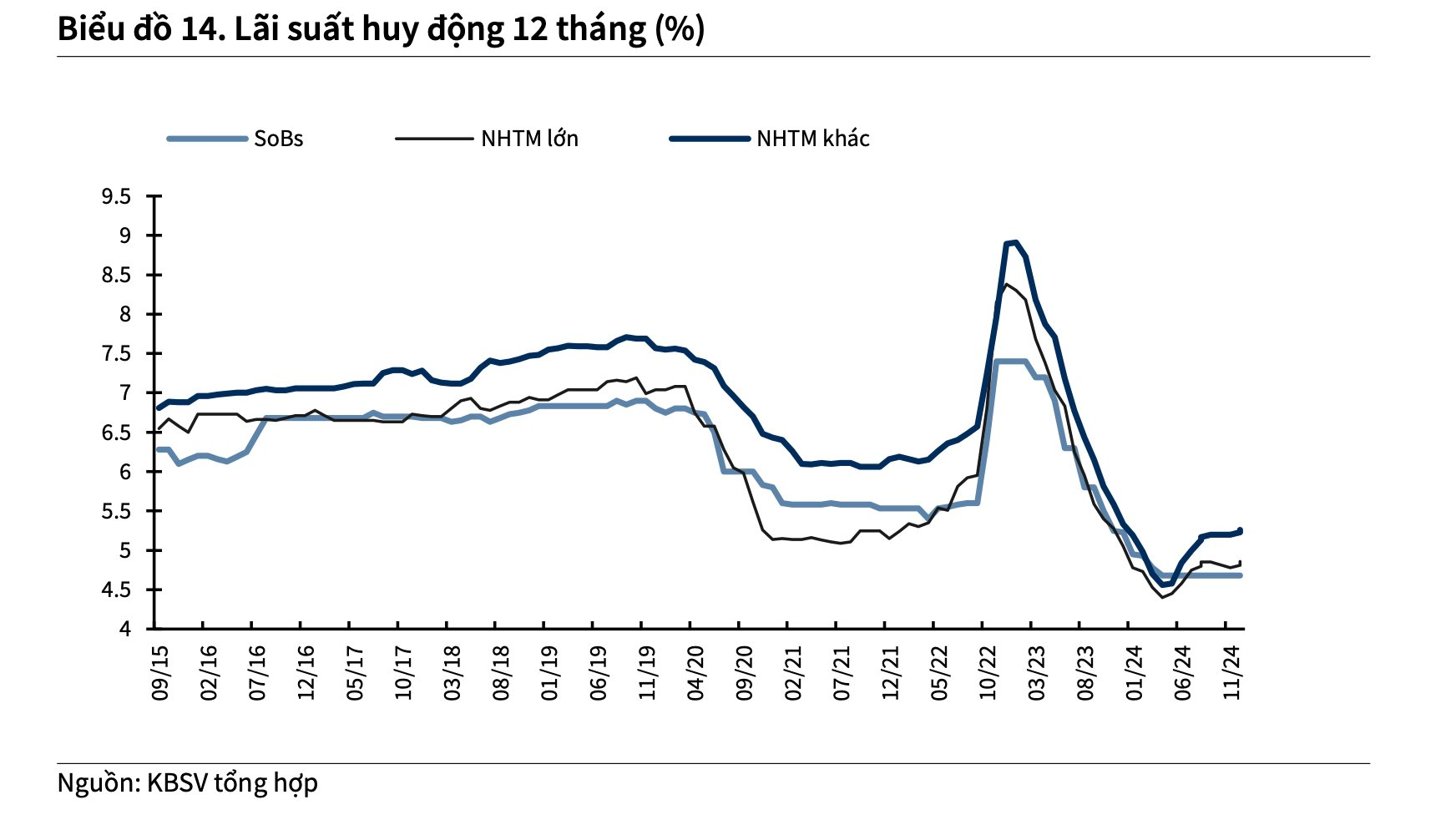

Regarding interest rates, mortgage lending rates have increased by 100–150 basis points but remain lower than in 2020–2021. KBSV forecasts a potential increase of 50–100 basis points in 2026, though rates are likely to stabilize around this level to prioritize economic growth, thereby continuing to support the real estate market.

LA Home: Bridging Northern Markets, Leading Infrastructure in Ho Chi Minh City’s Western District

On January 8, 2026, Hanoi witnessed the unveiling and orientation training event for the LA Home Eco-Urban Area Project – Northern Region, themed “LA Home: The Epicenter of Flow – Riding the 2026 Infrastructure Wave.”

The New Interest Rate Cycle: Who Holds the Advantage in the Stock Market?

In 2026, Vietnam’s financial market is witnessing a new reality: the era of low interest rates is gradually coming to an end. As capital costs rise, securities companies with strong capital potential, unique ecosystems, and the ability to mobilize foreign capital, such as VPBankS (VPX), are emerging as the “leaders” driving the competitive race.

What Are the Concerns When Loan Interest Rates Rise?

As interest rates on deposits rise, lending rates across banks are also establishing a new baseline. According to experts, interest rates are unlikely to reverse and surge significantly in 2026, as the State Bank remains committed to maintaining stability to support economic growth.