No More Uniform Price Increases Across Segments and Regions

Speaking with reporters, Mr. Nguyễn Anh Quê, Chairman of G6 Group, shared that the real estate market in the 2026-2030 period, particularly in 2026, faces numerous opportunities alongside significant risks.

According to Mr. Quê, the current phase marks the beginning of a new cycle. The government continues to view real estate as a vital sector for economic growth, and investment procedures are becoming more streamlined, thereby increasing supply and easing market demand.

Additionally, credit limits remain substantial, at least 14% or higher, and interest rates are maintained at moderate levels. While “cheap money” is no longer available as it was in 2024-2025, interest rates will not soar as high as in 2010-2011 or 2022-2023.

However, the Chairman of G6 Group highlights that these opportunities come with challenges. Supply is projected to be enormous, with some experts suggesting it could be 30-50 times greater than previous periods.

In reality, many subdivided areas and “ghost towns” have emerged since 2008 and are expected to become more apparent by 2027, as oversupply outpaces absorption.

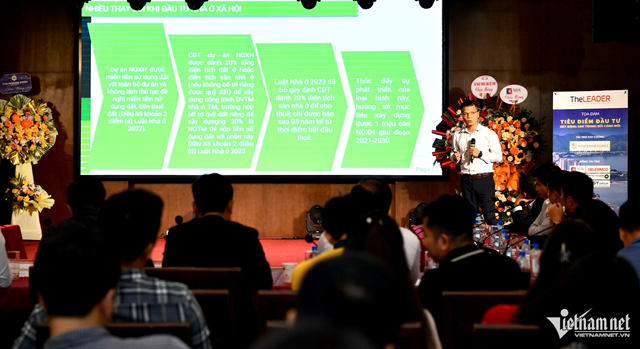

Experts believe the upcoming real estate cycle will differ from previous ones, requiring investors to carefully sift through opportunities. Photo: Hoàng Hà |

Furthermore, risks associated with corporate bonds and non-performing loans remain high. Uncertainties in import-export dynamics, exchange rates, gold prices, and raw material costs also pose significant challenges to the real estate market.

Mr. Quê predicts that the upcoming real estate market will differ from previous cycles. Unlike earlier periods where prices rose uniformly across all segments and regions, future increases will be highly differentiated. Only areas with unique narratives will likely see price growth.

“The market will not witness uniform price increases across land plots, apartments, or resort properties as in previous cycles,” he emphasized.

For instance, Phú Quốc, which is preparing for the 2027 APEC event, is experiencing policy shifts that create more favorable conditions. With prices remaining stagnant over the past seven years, this area is expected to rebound.

Similarly, regions along high-speed rail routes are anticipated to see price increases. Major urban developments, deep-water ports, and large industrial zones will also positively impact land and property prices.

Meanwhile, Ms. Giang Huỳnh, Director of Research & Consulting at Savills HCMC, notes that Vietnam’s real estate market is undergoing a restructuring phase to prepare for a new growth cycle.

“Entering 2026, the real estate market will not experience a uniform recovery. Instead, macroeconomic factors, monetary policies, and new legal frameworks will collectively reshape the market, favoring a more cautious and selective approach with clear differentiation between segments and regions,” Ms. Giang Huỳnh stated.

She predicts that the next growth cycle for the real estate market will likely become evident between 2026 and 2027.

Key Considerations for Investors

Analyzing various segments, Mr. Nguyễn Anh Quê believes apartment prices in provincial areas will continue to rise due to increasing material costs and growing housing demand.

“However, in Hanoi and HCMC, apartment prices may decline. This is because prices in these cities have skyrocketed, while ample social housing supply will exert downward pressure,” the G6 Group leader explained.

Regarding land plots, he notes that areas with previous sharp price increases, such as Hanoi’s outskirts, will struggle to rise further. Conversely, the outskirts of HCMC, particularly Bình Dương and Bà Rịa – Vũng Tàu, are expected to see price growth.

For resort properties, areas attracting tourism and investment, even for properties with 50-70 year usage rights, may still see price increases. Conversely, locations failing to attract tourism, despite having clear legal titles, infrastructure, and planning, will likely face price reductions.

“2026 marks the acceleration of a new real estate cycle, but it occurs amidst global and domestic economic and political uncertainties. A single piece of news could shift the market. However, opportunities exist within challenges—the key is to sift through them carefully,” he stressed.

Mr. Quê also advises investors to exercise caution regarding liquidity, actual demand, and capital flow. Comparing property prices with surrounding areas and assessing investment potential relative to living and exploitation capabilities is essential. Legal clarity is paramount; investments should focus on properties with clear land titles.

Similarly, Ms. Giang Huỳnh emphasizes that in this new context, investors must prioritize asset quality, legal compliance, and practical exploitation potential over short-term expectations.

Nguyễn Lê

– 05:45 15/01/2026

Ho Chi Minh City’s Landed Property Prices Plummet by Nearly Half as Developers Ramp Up Discounts

JLL reports that the primary market price for landed homes stands at $8,033 per square meter (over 211 million VND per square meter), reflecting a sharp decline of 48.5% quarter-on-quarter and 52.6% year-on-year. This significant drop is primarily attributed to the introduction of competitively priced units from the Vinhomes Green Paradise project in Can Gio.

Chairman of Hoa Binh Construction Group Le Viet Hai: Real Estate Must Develop Steadily to Prevent Ecosystem Disruptions and Ensure Continuous Employment for Businesses

At the forum “Real Estate Market Outlook 2026 – Momentum for a New Growth Cycle,” organized by Construction Newspaper, many opinions suggested that the market is poised to enter a new growth cycle.