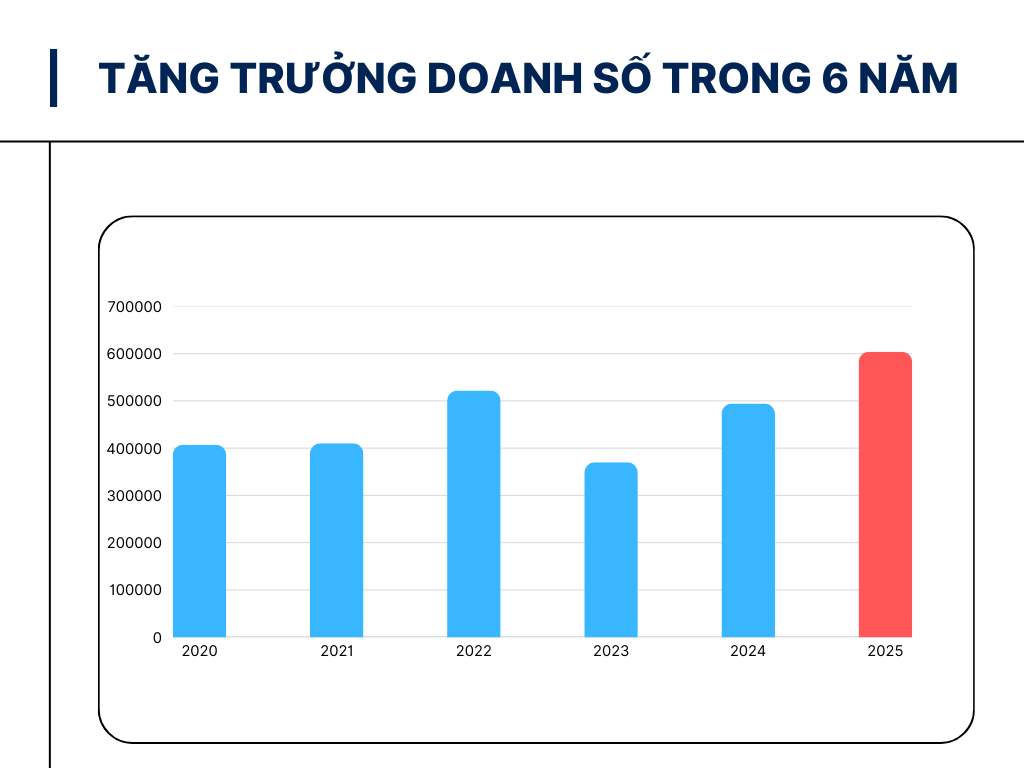

Vietnam’s automotive market experienced a booming year in 2025, with impressive growth figures from manufacturers and importers. According to aggregated data from the Vietnam Automobile Manufacturers’ Association (VAMA), VinFast, and Hyundai Thanh Cong (excluding Chinese brands), total vehicle sales nationwide reached 604,134 units, a 22.22% increase compared to 2024 (494,300 units).

This result officially broke the previous sales record set in 2022 (522,143 units). Surging consumer demand and supportive policies have fueled significant growth in the automotive industry.

Vietnam’s automotive market sets an unprecedented record.

Within the overall sales structure, VAMA members contributed the largest volume, with 375,736 units sold, a 10.5% increase from 2024, capturing 62.2% of the market share. This includes major brands like Toyota, Ford, Mitsubishi, Honda, and other passenger and commercial vehicle manufacturers.

Meanwhile, VinFast made a significant mark by delivering a record-breaking 175,099 electric vehicles in 2025, securing a 29% market share. The Vietnamese brand maintained consistent growth throughout the year, significantly contributing to the market’s overall size. Hyundai Thanh Cong also recorded sales of 53,229 units, holding an 8.8% market share.

VinFast, owned by billionaire Pham Nhat Vuong, is the top-selling brand in the market.

The diverse supply of both domestically assembled and fully imported vehicles has provided consumers with a wide range of options tailored to their financial capabilities.

The sale of over 600,000 vehicles underscores the vast consumer potential in Vietnam. The market has grown not only in quantity but also in quality and technology across product lines.

Continuous updates of new models and adjustments in sales policies have encouraged buyers to make quicker decisions. These figures also reflect the positive economic recovery and the gradual improvement in workers’ incomes.

The 2025 sales results have established a solid foundation for the future development plans of automotive brands. The intense competition between traditional gasoline brands and emerging electric vehicle manufacturers is driving dynamic market growth.

With the current growth momentum, Vietnam’s automotive industry is projected to maintain its position as one of the largest markets in Southeast Asia.

Omoda & Jaecoo Aim for 10,000 Sales in Vietnam by 2026: From Factory Construction to New Model Launches, What Are the Challenges Ahead?

Omoda & Jaecoo are poised to enter Vietnam’s automotive market with targeted strategies. However, as newcomers under the Chery Group umbrella, they face intense competition from established brands that currently dominate market share.