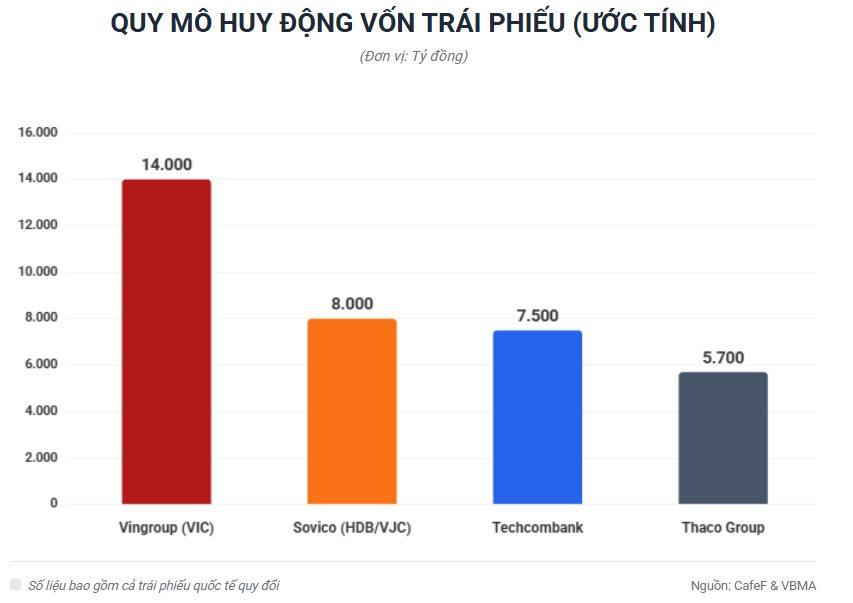

The year-end financial market peak witnessed a notable capital mobilization effort from Vingroup (stock code: VIC), owned by billionaire Pham Nhat Vuong. In terms of total scale (including converted value), this group leads the bond market with an estimated figure of over

VND 14,000 billion.

Domestically, the company successfully issued the VIC12511 bond series with a total value of VND 1,000 billion. The highlight of this issuance was the announced interest rate of up to 12% per annum—one of the highest in the market at present. The bond has a 36-month term, maturing in 2028, and is secured for debt restructuring purposes.

Simultaneously, Vingroup made a significant mark in the international capital market by completing the issuance of USD 325 million in bonds (code VICD2328002). At the current market exchange rate (approximately VND 26,269 per USD), this bond series has a converted value of over VND 8,500 billion.

Specifically, Vingroup issued 1,625 bonds with a face value of USD 200,000 per bond through an agency method. The bonds have a 5-year term, maturing on December 16, 2030, and are listed on the Vienna Stock Exchange (Austria). Notably, the bonds are linked to the option to receive existing Vinpearl shares (code VPL) owned by Vingroup.

In another development within the ecosystem, Vinhomes (VHM) has also approved a bond issuance plan with a maximum total value of VND 4,500 billion, a 3-year term, and a combined interest rate.

Sovico Ecosystem: Vietjet and HDBank Raise Nearly VND 8,000 Billion, International Capital via Green Bonds

The ecosystem associated with billionaire Nguyen Thi Phuong Thao recorded the most vibrant activity, with an estimated converted total value of approximately

VND 8,000 billion.

In the domestic market, HDBank (HDB) and Vietjet (VJC) collectively mobilized VND 6,650 billion. Vietjet completed two issuances totaling VND 2,000 billion with an interest rate of up to 10% per annum for the first four periods. HDBank conducted seven issuances, raising VND 4,650 billion with lower interest rates (6.4% – 7.5%).

Notably, in the international market, HDBank recently completed the second phase of its Green Bond Program, valued at USD 50 million (equivalent to over VND 1,300 billion). The investors involved were the Dutch Entrepreneurial Development Bank (FMO) and the British International Investment (BII).

These are non-convertible, unsecured, and uncollateralized bonds with a 3-year term. The raised capital will be used to finance green projects, estimated to reduce 102,000 tons of CO2 over 10 years.

Thaco Ecosystem: VND 5,700 Billion in Fresh Capital

Not to be outdone, the ecosystem of billionaire Tran Ba Duong also recorded a large-scale capital mobilization just before the new year. In a short period, Truong Hai Group (Thaco) successfully raised VND 2,000 billion through a 60-month bond issuance (maturing in 2030). The issuance interest rate was 8.5% per annum, significantly lower than the real estate sector average, with issuance guarantees and collateral.

Simultaneously, two member units—Thiso International Trading and Services JSC and Dai Quang Minh Real Estate Investment JSC—completed their billion-dong issuances. Specifically, Thiso raised VND 2,200 billion with a 36-month term and an 8% per annum interest rate for the first period. Meanwhile, Dai Quang Minh raised VND 1,500 billion with a higher interest rate of 9.75% per annum.

Thus, during this peak period, companies associated with billionaire Tran Ba Duong are estimated to have collectively raised VND 5,700 billion through bond channels.

Techcombank and Financial Group: Actual and Planned Mobilization Reaches VND 7,500 Billion

Within the ecosystem of billionaire Ho Hung Anh, actual data shows a strong participation from the parent bank rather than just the securities company member’s plans.

Specifically, during this period, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) quietly completed three private bond issuances (codes TCB12524, TCB12525, and TCB12526) with a total value of up to VND 4,500 billion. These bonds have a 3-year term, with issuance interest rates ranging from 6.5% to 7.2% per annum—a competitive rate compared to the market average.

Alongside this actual capital, according to VBMA’s December report, the member unit Technocom Securities (TCBS) has also approved a plan to issue private bonds in six phases with a maximum expected total value of VND 3,000 billion. Thus, the total mobilization scale (actual and planned) of this group is estimated at VND 7,500 billion.

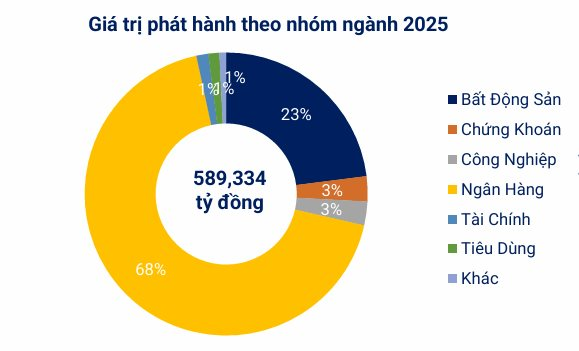

Market Outlook for 2025: Scale Reaches Nearly VND 590,000 Billion

Broadly, data from the Vietnam Bond Market Association (VBMA) shows that the corporate bond market in 2025 has seen an impressive recovery in scale. Cumulatively for the year, the total issuance value reached approximately VND 589,334 billion (with private issuances nearing VND 535,000 billion and public issuances exceeding VND 54,000 billion).

In December 2025 alone, the market recorded 62 private issuances with a value of over VND 58,600 billion and 6 public issuances worth nearly VND 3,800 billion. The real estate sector still dominates in terms of issuance volume.

Conversely, early bond repurchases showed signs of slowing down. In December 2025, companies repurchased VND 35,820 billion, a 15% decrease year-on-year. The maturity pressure in 2026 remains significant, with an estimated value of over VND 206,000 billion, requiring companies to maintain new capital mobilization to ensure liquidity and debt restructuring.

Anticipating the 14th National Party Congress: Selecting the Right ‘Breakthrough of Breakthroughs’ to Elevate the Nation’s Stature

The 14th National Party Congress convenes amidst profound global shifts, as Vietnam stands poised on the brink of a transformative era of robust development. Scholars and intellectuals alike anticipate the Congress to chart the right strategic priorities, fostering genuine breakthroughs in institutional frameworks, growth models, enterprise development, and high-quality human resources. Such advancements are expected to propel the nation onto a trajectory of rapid, sustainable progress.

Unveiling the Season 1 Champion of “A.I Battle” – Winner of a $1 Million Prize from Techcombank

At the grand finale, Techcombank awarded a prestigious international AI study abroad scholarship valued at up to $1 million to the winning team, Converged, for securing the First Prize.